CITY OF

HUNTINGTON BEACH

California

Popular Annual Financial Report

For The Year Ended

June 30, 20ʮ2

CITY OF HUNTINGTON BEACH, CALIFORNIA

ELECTED OFFICIALS

2

REPORT CONTENTS

CITY PROFILE……………… 5 CAPITAL ASSETS……………….. 10

GOVERNMENTAL FUNDS……. 15-17

LOCAL ECONOMY………… 6 INVESTMENT PORTFOLIO……. 11 BUSINESS-TYPE FUNDS……… 18

COVID-19 RECOVERY…….. 7 STATEMENT OF NET POSITION 12 EXPLANATION OF

ACCOUNTING TERMS………

19

CITY HIGHLIGHTS………… 8 STATEMENT OF ACTIVITIES -

EXPENSES………………………

13

CITY DEBT………………….. 9 STATEMENT OF ACTIVITIES -

REVENUES………………………..

14

Mayor Mayor Pro Tem Council Member Council Member Council Member

Tony Strickland Gracey Van Der Mark Rhonda Bolton Pat Burns Dan Kalmick

Council Member Council Member City Attorney City Treasurer City Clerk

Casey Mckeon Natalie Moser Michael Gates Alisa Backstrom Robin Estanislau

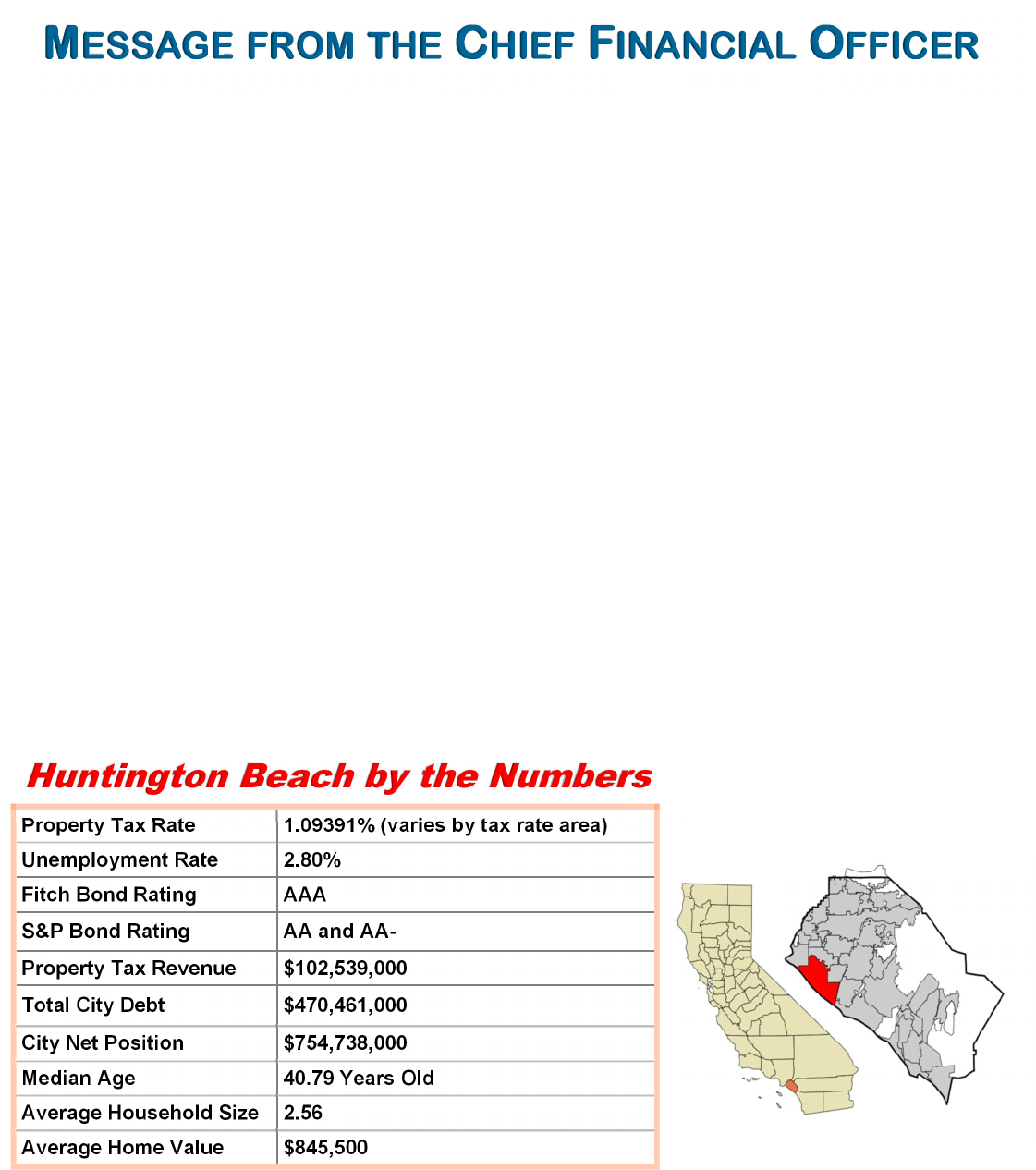

Property Tax Rate 1.09391% (varies by tax rate area)

Unemployment Rate 2.80%

Fitch Bond Rating AAA

S&P Bond Rating AA and AA-

Property Tax Revenue $102,539,000

Total City Debt $470,461,000

City Net Position $754,738,000

Median Age 40.79 Years Old

Average Household Size 2.56

Average Home Value $845,500

MESSAGE FROM THE CHIEF FINANCIAL OFFICER

Dear Reader:

I am pleased to share with you the City of Huntington Beach (City) Popular Annual Financial Report (PAFR) for

the year ended June 30, 2022. The PAFR, also referred to as the “Citizens’ Report”, summarizes the complex

financial information reported in the City’s Annual Comprehensive Financial Report (ACFR) into a simplified,

easy to read format. This report provides an overview of the City’s financial position, including sources of revenues

and expenditures. In addition to key financial data, the PAFR also includes information regarding our local

economy, the City’s ongoing response and recovery efforts to the coronavirus (COVID-19) pandemic and

important City highlights.

In spite of the challenges brought on by the pandemic, our community has shown tremendous resilience and the

City has continued its commitment to maintain high service levels to its residents, businesses and visitors. My hope

is that this year’s PAFR reflects our prudent and effective use of your tax dollars as to continue providing a safe

environment for our businesses and citizens to thrive.

I would like to take this opportunity, on behalf of the City of Huntington Beach, to thank the citizens of this City

for their ongoing commitment and dedication. It has been challenging to navigate the ever-changing landscape of

our daily lives, but I have seen the resilience of our community and have hope that the challenges that we faced in

the prior fiscal year have not only made us stronger, but have also brought us closer together.

I would also like to thank the City Council, City Manager, and City Departments. Under their tremendous

leadership and support, I consistently witness the excellence and hard work displayed by each member of the City’s

team. Together, we strive to fulfill our duty “To serve exceptionally, inspiring pride in our Huntington Beach

community through a fanatical focus on excellence by being active caretakers of our unique, people-focused

Huntington Beach culture,” especially when times are hard. I am confident that Huntington Beach will continue to

be one of the greatest cities in which to work, live and play.

Sunny Han, CPA

Acting Chief Financial Officer

Huntington Beach by the Numbers

3

POPULAR ANNUAL FINANCIAL REPORT

This report provides an overview of the City’s financial position, including sources of revenues and expenditures, as

well as economic information about the community. The PAFR of the City of Huntington Beach is published to

increase public awareness about the City’s financial condition. It is our goal that this report is easy to understand.

The PAFR summarizes the financial activities of the City of Huntington Beach’s governmental and proprietary

funds and draws its information from the Fiscal Year 2021/22 ACFR. The ACFR was prepared in conformance

with generally accepted accounting principles (GAAP) and includes financial statements audited by Davis Farr

LLP, Certified Public Accountants. The City received an unmodified (or clean) opinion that the financial statements

present fairly, in all material respects, the respective financial position of the governmental activities, the business-

type activities, each major fund, and the aggregate remaining fund information of the City. The amounts within the

ACFR were arrived at by employing accrual and modified accrual basis accounting techniques as prescribed by the

Governmental Accounting Standards Board (GASB).

Government-wide data on pages 12-14 is presented similarly to a consolidated financial statement for a private

business (accrual basis). Governmental funds financial information on pages 15-17 is presented under standard gov-

ernmental accounting rules (modified accrual basis). Modified accrual accounting is a governmental accounting

method based on revenues being recognized in the period when they become available and measurable (known).

This PAFR is unaudited and is presented on a non-GAAP basis. The differences between the GAAP basis presenta-

tion in the ACFR and the non-GAAP presentation in the PAFR are as follows: the use of prescribed accounting

methods and financial statement formats; the presentation of segregated funds; and the disclosure of all material

financial and non-financial matters in notes to the financial statements. Individuals who desire to review the audited

GAAP-based, full disclosure financial statements should refer to the City’s ACFR, which is available on the City’s

website at https://www.huntingtonbeachca.gov/government/departments/finance/budget.cfm, or by contacting the

Finance Department at 2000 Main Street, Huntington Beach, California, 92648, by phone at (714) 536-5630, or by

e-mail at tvi@surfcity-hb.org.

4

ABOUT HUNTINGTON BEACH

5

CITY PROFILE

The City of Huntington Beach is home to a thriving beach community, located on the Orange County coast, 35

miles south of Los Angeles and 90 miles north of San Diego. With a population of 197,437 residents, it is known as

Surf City due to its abundance of beaches; the year-round sunny, warm Mediterranean climate; and its casual

lifestyle. With over 10 miles of coastline and iconic pier spanning 1,850 feet in length - one of the longest piers on

the West Coast - Huntington Beach plays host to millions of visitors annually. In addition to its internationally

recognized beaches, Huntington Beach is recognized as a prime location to live, work and play, ranking #1 in the

nation for “Quality of City Services” and #21 for “Best-Run City in America” by WalletHub (June 2022).

Huntington Beach was also ranked #1 in the state and #5 in the nation for “Best City for People with Disabilities”

by WalletHub (September 2022).

Huntington Beach attracts numerous national events

including the Van’s U.S. Open Surfing, Surf City USA

Marathon, and, the Great Pacific Airshow. The City

also hosts a variety of other exciting events for fami-

lies and visitors such as the annual Concours d’Ele-

gance, SoCal Corgi Beach Day, Cherry Blossom Festi-

val, Civil War Days, and, of course, the City’s most

iconic event—the Fourth of July Fireworks Show and

Parade. The 2022 4th of July festivities commenced

with a downtown block party on Main Street. It was a

fun-filled evening with food, drinks, and live music

featuring The Ramsey Brothers & Redneck Rodeo. In

September 2022, the International Surfing Association

(ISA) World Surfing Games made an impressive re-

turn to Huntington Beach for the first time since 2006.

The winning men’s and women’s National Teams

were allocated one Olympic slot for their respective

country.

Founded in the late 1880s, Huntington Beach was incor-

porated as a Charter City in 1909. Huntington Beach has

a Council/Manager form of government wherein seven

City Council members are elected to four-year terms, and

the Mayor is filled on a rotating basis from the incumbent

Council Members. The City Attorney, City Clerk and

City Treasurer positions are also elected and serve four-

year terms. The City of Huntington Beach is a full-service

city including police, fire, public works, and other key

functional departments with a dedicated and talented team

of over 900 full-time equivalent employees.

Demographically, the City benefits from higher education

levels, median incomes, and home values as compared

with the State. The City boasts an annual median house-

hold income of $91,318, 51% higher than the United

States, 28% higher than the State of California, and 6%

higher than Orange County.

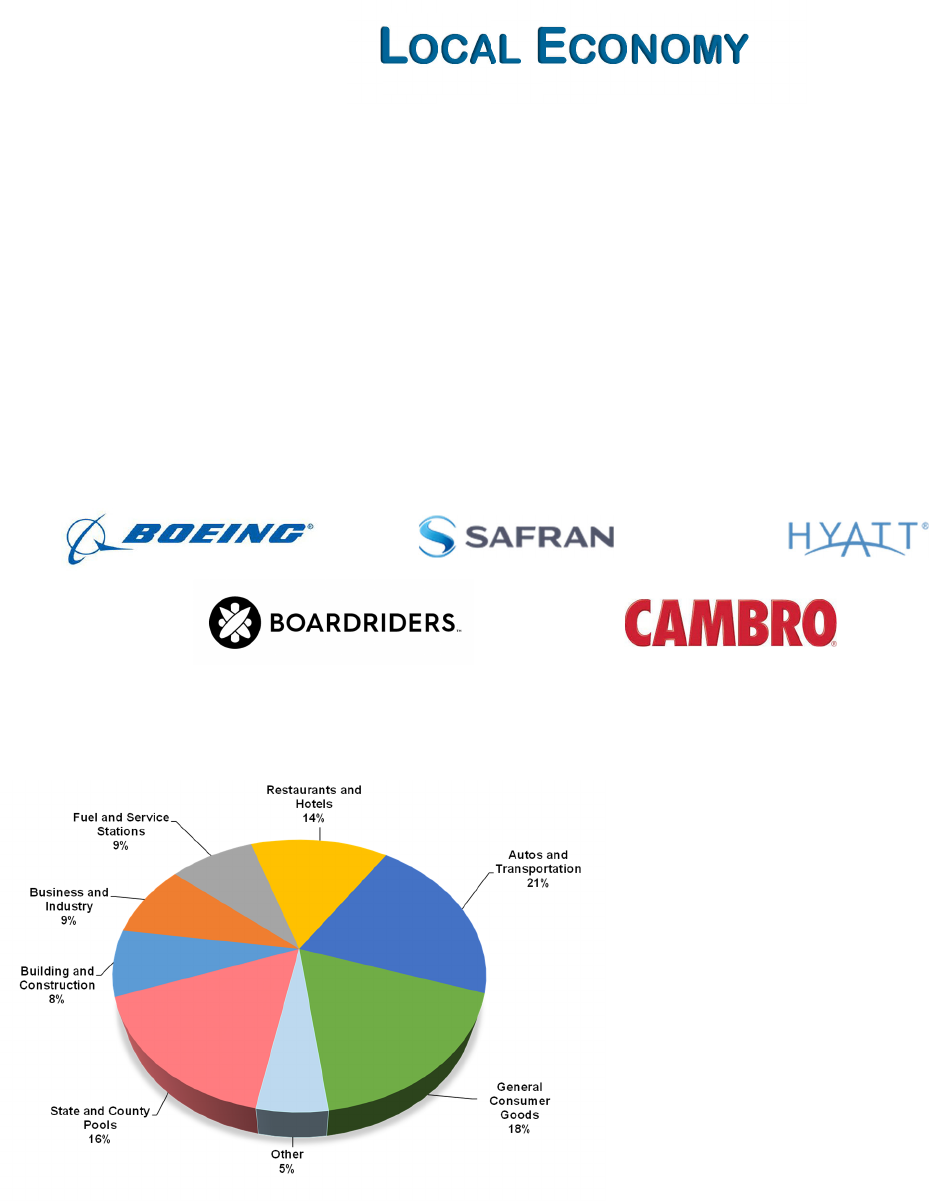

LOCAL ECONOMY

6

Huntington Beach is one of the leading commercial and industrial centers in Southern California. As the fourth

largest city in Orange County, and the 23rd largest in California in terms of population. With the easing of the

restrictions put in place as a result of the COVID-19 pandemic, the City’s economy has seen much improvement

with the unemployment rate decreasing from 4.7 percent to 2.8 percent. The City’s labor force continues to be

positioned to maintain the City’s strong tax base.

Huntington Beach has numerous demographic factors in its favor:

Personal median incomes greater than State and County averages

A stable property tax base

A diversified sales tax base

The Huntington Beach business community is well-diversified with no single industry or business dominating

the local economy. Local businesses include aerospace and high technology, petroleum, manufacturing,

computer hardware and software, financial and business services, hotel and tourism, and large-scale retailers.

The top five principal employers in the City are Boeing, Safran Cabin Inc., Hyatt Regency Huntington Beach,

Boardriders Wholesale LLC, and Cambro Manufacturing.

After more than two years of contending with the

pandemic, the economy is showing continuing

signs of recovery as evidenced by the major

decline in COVID-19 cases and expansion of the

nation’s economy to 93 percent of pre-pandemic

levels. While global tensions and supply chain

shortages remain prevalent, the City is

experiencing sustained increases to its major

revenue sources, such as Sales Tax and Transient

Occupancy Tax, through remarkable

improvements to the local economy. However,

continuing volatility in the financial and equity

markets, along with the rapidly changing

economic picture and the length and continuing

impacts of the COVID-19 pandemic, add a layer

of uncertainty to the City’s financial projections.

CITY OF HUNTINGTON BEACH

Composition of Sales Tax Revenue

Fiscal Year 2021/22

COVID-19 RECOVERY

7

As of June 15, 2021, the Governor terminated the executive orders that put into place the Stay at Home Order. The

City has experienced an overall positive economic impact from the easing of COVID-19 restrictions. Although the

economy is showing signs of recovery, there are many in the community that still require assistance. Listed below

are a few of the programs put in place by the City to assist the community with the prevailing challenges of the

COVID-19 pandemic.

Navigation Center

Addressing homelessness is a top priority for the City of Huntington Beach, which means taking action to

ensure that solutions are established to assist those in the community in need of housing. The City engaged in an

extensive site selection process to build a navigation center to temporarily shelter the homeless in our community.

After an expansive search and comprehensive community outreach, the 174-bed shelter located at 17642 Beach

Boulevard was identified to best address the needs of the homeless population. The Navigation Center opened its

doors on December 2020, operated by Mercy House. The Center can accommodate homeless adults including their

animals and will provide access to vital services that will help them on the path towards housing security. Each

potential resident will be screened and upon admission to the Center, will receive clean clothes, prepared meals,

access to laundry facilities, private restrooms and 24-hour security. Resources for healthcare, dental and behavioral

services will also be made available. In addition, Mercy House staff will assist with finding employment, permanent

housing, and assistance to overcome substance abuse addictions, should it apply. The goal of the Center is to provide

opportunities and resources to permanently transition their residents to a more stable and secure way of living and

off the streets.

For more information please visit their website here : https://www.hbhomelesssolutions.com

Be Well OC

Be Well OC is Orange County’s first mobile mental health response program. This mobile response team, launched

in September 2021, is composed of two crisis counselors who drive to your location and provide in-community

assessment and stabilization services. The teams are well-trained and experienced in providing appropriate

information, referrals, transportation to services and additional follow-up support and case management to help

address mental health related situations. Be Well OC assists with many non-emergency and non-medical situations,

including welfare checks, public assistance and homelessness, in collaboration with the Huntington Beach

Homeless Task Force.

The City of Huntington Beach continues to thrive together through the motto “OneHB,” which reflects the City’s

commitment to facing the unprecedented challenges created by the COVID-19 pandemic guided by the following

principles: One Team, One Focus, and One Goal to ensure HB continually improves its standing as a premier

coastal community measured through the health of our organization, infrastructure and community.

8

CITY HIGHLIGHTS

Citywide Mobility Plan

The City has adopted policies and built infrastructure to help people shift from driving alone to walking, biking,

utilizing transit, and carpooling. The Mobility Implementation Plan will help us more aggressively advance

these goals and will need to adhere to criteria set forth

in the City’s existing and ongoing plans. The Plan will

ensure a diverse set of travel options that meet the ac-

cess and mobility needs for people of all ages and abil-

ities, based in transportation justice and the idea that

infrastructure should equally and equitably address the

needs of all people. The Plan will provide clarity and

specific, practical direction for strategies that support

diverse transportation options and technological inno-

vations, such as micromobility devices, electric vehi-

cles, and autonomous vehicles, while ensuring that

these changes do not adversely impact progress to-

wards other City commitments related to safety, equity,

vehicular traffic congestion, and GHG emissions.

Oak View Streetscape Improvements and Community

Center and Library Plans

The City is working collaboratively with the Ocean

View School District and the general community to pre-

pare a master plan to redevelop the Community Center

and adjacent Oak View Park, as well as expand and

modernize Oak View Library to better meet the needs of

this neighborhood. The City has been awarded a $5 mil-

lion grant from the California Department of Transpor-

tation to add beautification elements, trees, and art in

public spaces, as well as remove litter and debris to en-

hance spaces for walking and recreation.

Comprehensive 311 System

The City is in the pre-planning stages of developing and implementing a robust, citywide 311 System to central-

ize all community requests, inquiries, information resources and engagements in one platform. This “one-stop-

shop” will address non-emergency inquiries and requests for services. Establishing this one portal has the poten-

tial to improve our community’s customer service experience and improve operational efficiencies, in keeping

with the City’s ongoing commitment to timely and efficient responsiveness.

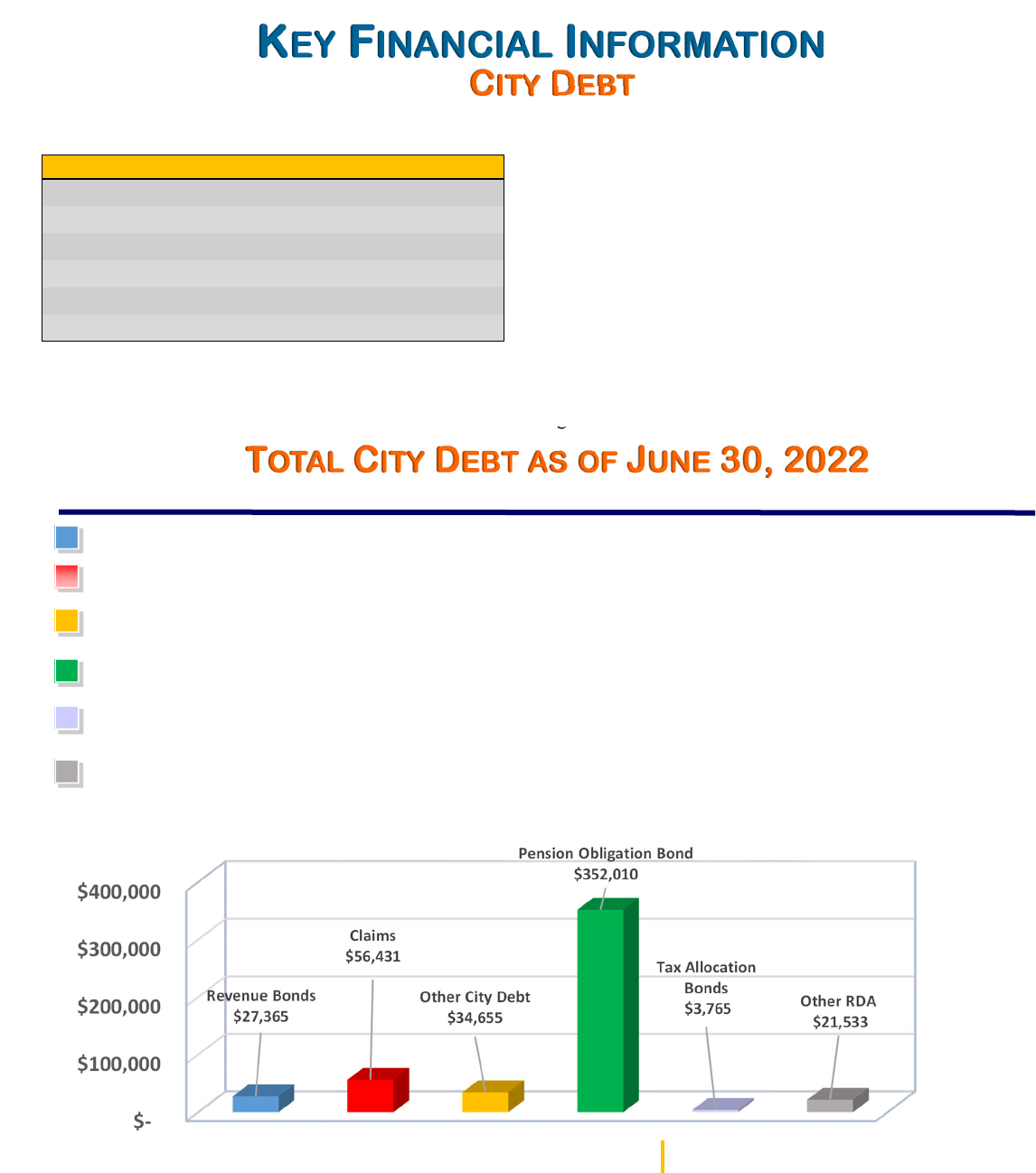

CITY DEBT

The City of Huntington Beach is legally restricted to

issuing general obligation bonds to 12 percent of its

assessed valuation. Since the City has no general obligation

bonds outstanding, the limit does not apply. The chart on

the left shows the latest ratings as determined by Fitch and

Standard & Poor’s as of June 30, 2022. The City continues

to maintain strong credit ratings on all of its other debt

issues which signals a relatively low risk of default and the

benefits of reduced interest rates and borrowing costs.

Most notably, in February 2022, Fitch Ratings reaffirmed

the City’s AAA Implied General Obligation Bond rating.

The high ranking puts the City in an elite group of cities

not only in California, but in the entire country, with AAA

ratings.

TOTAL CITY DEBT AS OF JUNE 30, 2022

(In Thousands)

Revenue Bonds – Long-term bond issues used to finance civic improvements. The bonds are repaid from revenues

generated from the lease on the buildings that were improved.

Claims Payable– Workers’ Compensation and Liability Insurance claims made to the City.

9

Other City Debt – Miscellaneous long-term debts that include loans, leases, pollution remediation liabilities, and compen-

sated absences.

Pension Obligation Bond – Debt used to pay the City’s CalPERS unfunded pension liability.

Tax Allocation Bonds – Debt used for the former Redevelopment Agency’s project improvements. This debt is repaid by

property tax revenues from the former Redevelopment Agency.

KEY FINANCIAL INFORMATION

Other Redevelopment Successor Agency Debt – Primarily loans taken by the former Redevelopment Agency.

RDA Successor Agency Debt

City Debt

Debt Instrument Fitch S & P

1999 Tax AllocaƟon Refunding Bonds

AA AA-

2002 Tax AllocaƟon Refunding Bonds

N/A AA-

2014 Lease Revenue Bonds, Series A

AA+ AA

2020(a) Lease Revenue Bonds

AA+ AA

2020(b) Lease Revenue Bonds

AA+ AA

2021 Pension ObligaƟon Bonds

AA+ AA+

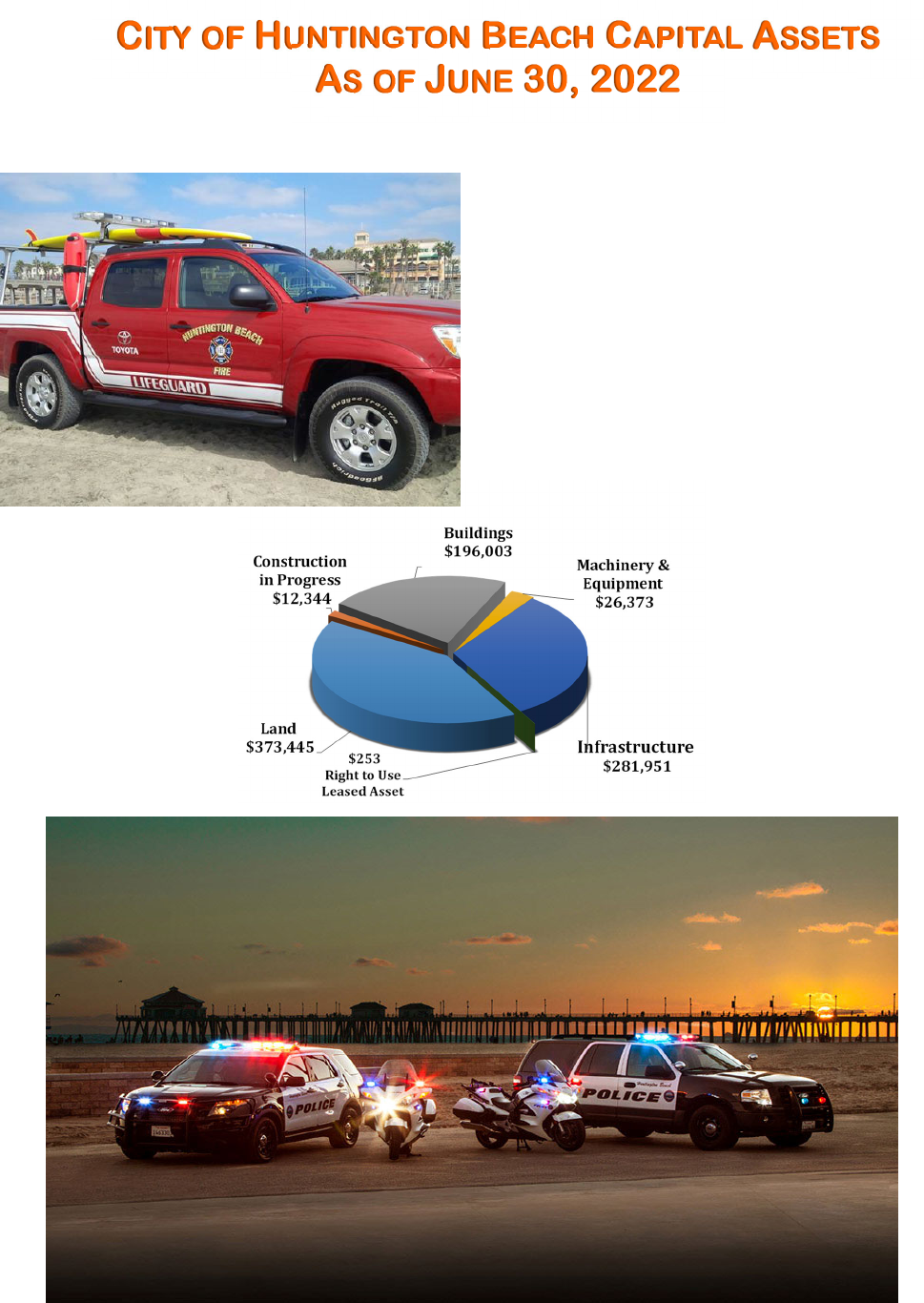

CITY OF HUNTINGTON BEACH CAPITAL ASSETS

AS OF JUNE 30, 2022

(In Thousands)

As of June 30, 2022, the City’s total capital assets

balance is $890,369. This total amount is comprised of

Infrastructure, Land, Construction in Progress, Building,

Machinery and Equipment, and Right to Use Leased

Asset as displayed in the chart below. The amounts

shown are net of depreciation.

Depreciation is the reduction in the value of an asset

with the passage of time. In the financial statements for

the entire government, or for the government’s business

-like activities, the City records depreciation on the

straight-line method (equal annual amounts) over the

estimated useful life of the assets.

10

INVESTMENT PORTFOLIO

* Security is callable, but classified above according to original maturity date.

11

The City’s cash and investment practices and policies as of June 30, 2022, are based upon State law and prudent

investor rules. Totals also include investments for the Supplemental Pension Retirement Trust Fund. The primary

goals of these investment practices and policies are:

To protect principal and maintain liquidity to meet expected operating expenses;

To ensure compliance with all Federal, State, and local laws governing the investment of public funds under the

control of the City Treasurer; and

Achieve a reasonable rate of return within the parameters of prudent risk management while minimizing the

potential for capital losses arising from market changes or issuer default.

MARKET VALUE OF THE CITY’S CASH AND INVESTMENTS

AS OF JUNE 30, 2022

(In Thousands)

INVESTMENTS: Fair Value Less than 1 1 to 3 3 to 5 More than 5 Total

US Treasuries 74,943$ 2,975$ 47,848$ 24,120$ -$ 74,943$

US Agency Securities* 140,790 35,962 51,389 53,439 - 140,790

Mutual Funds 58,101 58,101 - - - 58,101

Commercial Paper 4,967 4,967 - - - 4,967

Money Market Funds 2,007 2,007 - - - 2,007

Medium Term Notes - IADB 33,552 5,965 13,831 13,756 - 33,552

Corporate Bonds 26,063 7,992 18,071 - - 26,063

Local Agency Investment Fund 28,417 28,417 - - - 28,417

Orange County Investment Pool 10,447 10,447 - - - 10,447

California Asset Mgmt Program 2,776 2,776 - - - 2,776

PARS Pension Rate Stabilization Program 12,427 12,427 - - - 12,427

Total Investments 394,490$ 172,036$ 131,139$ 91,315$ -$

394,490

Total Deposits 26,011

Total Deposits and Investments

420,501$

Investment Maturities (In Years)

12

See page 19 for an explanation of accounting terms.

CITY FINANCIALS

STATEMENT OF NET POSITION

The following financial summary is based upon a condensed view of the City’s assets and liabilities for all funds

as of June 30, 2022 and June 30, 2021.

Total Current and Other Assets increased by $54,397,000 for governmental activities primarily due to the increase

in cash and receivables balances related to increased property, sales tax revenues, and transient occupancy tax. A

majority of the increase is due to the implementation of new GASB Statement No. 87, Leases. Under This State-

ment, the lessor of a lease contract is required to recognize a lease receivable and a deferred inflow of resources.

The decrease in current and other assets of $15,210,000 for business-type activities is primarily due to a reduced

cash balance in the Water Master Plan fund due to ongoing large capital project costs in Fiscal Year 2021/22, in-

cluding water main replacements and the City’s share of slip-lining the OC-44 imported water transmission line.

Deferred Outflows and Deferred Inflows decr eased by 93 per cent and increased by 656 percent, respective-

ly. The changes in deferred outflows is mainly due to deferral of pension contributions made subsequent to the

measurement date, including the unfunded liability payment to CalPERS totaling $362,430,000 made from pro-

ceeds of the Pension Obligation Bond. The changes in deferred inflows is related to the actuarially determined

amortization of changes in assumptions, and differences between expected and actual experience used to deter-

mine the City’s net pension liability. The actuarially determined amortization difference also increased Net Pen-

sion Asset and Net Other Postemployment Benefits Asset.

Total Current and Other Liabilities increased by 37 percent due to normal fluctuations in the accounts payable and

payroll cycle. For governmental activities, the majority of the $22,449,000 increase is related to the second

tranche of American Rescue Plan Act Funds received in June 2022 that was recorded as unearned revenue.

Total Long-Term Obligations for gover nmental activities decr eased by 47 per cent primarily due to the City

issuing a $363,645,000 Pension Obligation Bond in prior year and also due to CalPERS reporting a preliminary

21.3% net return on investments for Fiscal Year 2020/21 resulting in a Net Pension Asset for the first time.

Total Restricted Net Position increased by 2 percent largely due to the change in restricted net position in the Pen-

sion Liability Fund due to revenues set aside from the voter-approved property tax override dedicated to the pay-

ment of pension costs.

Total U nre s tri cte d N e t Po s iti o n decreased for business-type activities by 13 percent due to the City having Net

Pension and Other Postemployment Benefit Assets in Fiscal Year 2021/22. Unrestricted net position for govern-

mental activities increased by $51,721,000.

CITY OF HUNTINGTON BEACH STATEMENT OF NET POSITION

AS OF JUNE 30, 2022 AND JUNE 30, 2021

(In Thousands)

2022 2021 Change 2022 2021 Change 2022 2021 Change

Assets

Current and Other Assets 331,062$ 276,665$ 20% 82,651$ 97,861$ -16% 413,713$ 374,526$ 10%

Non-Current Assets 106,219 - N/A 8,658 - N/A 114,877 - N/A

Capital Assets 746,371 737,256 1% 143,998 142,469 1% 890,369 879,725 1%

Total Assets

1,183,652 1,013,921 17% 235,307 240,330 -2% 1,418,959 1,254,251 13%

Deferred Outflows of Resources

28,739 393,130 -93% 2,151 25,937 -92% 30,890 419,067 -93%

Liabilities

Current and Other Liabilities 57,250 34,751 65% 6,133 11,599 -47% 63,383 46,350 37%

Long-Term Obligations 461,797 864,784 -47% 23,816 51,137 -53% 485,613 915,921 -47%

Total Liabilities

519,047 899,535 -42% 29,949 62,736 -52% 548,996 962,271 -43%

Deferred Inflows of Resources

136,033 17,716 668% 10,082 1,601 530% 146,115 19,317 656%

Net Position

Net Investment in Capital Assets 712,289 699,204 2% 143,998 142,469 1% 856,287 841,673 2%

Restricted 68,460 65,755 4% 19,309 20,332 -5% 87,769 86,087 2%

Unrestricted (223,438) (275,159) 19% 34,120 39,129 -13% (189,318) (236,030) 20%

Total Net Position

557,311$ 489,800$ 14% 197,427$ 201,930$ -2% 754,738$ 691,730$ 9%

Governmental Activities Business-Type Activities Total Primary Government

13

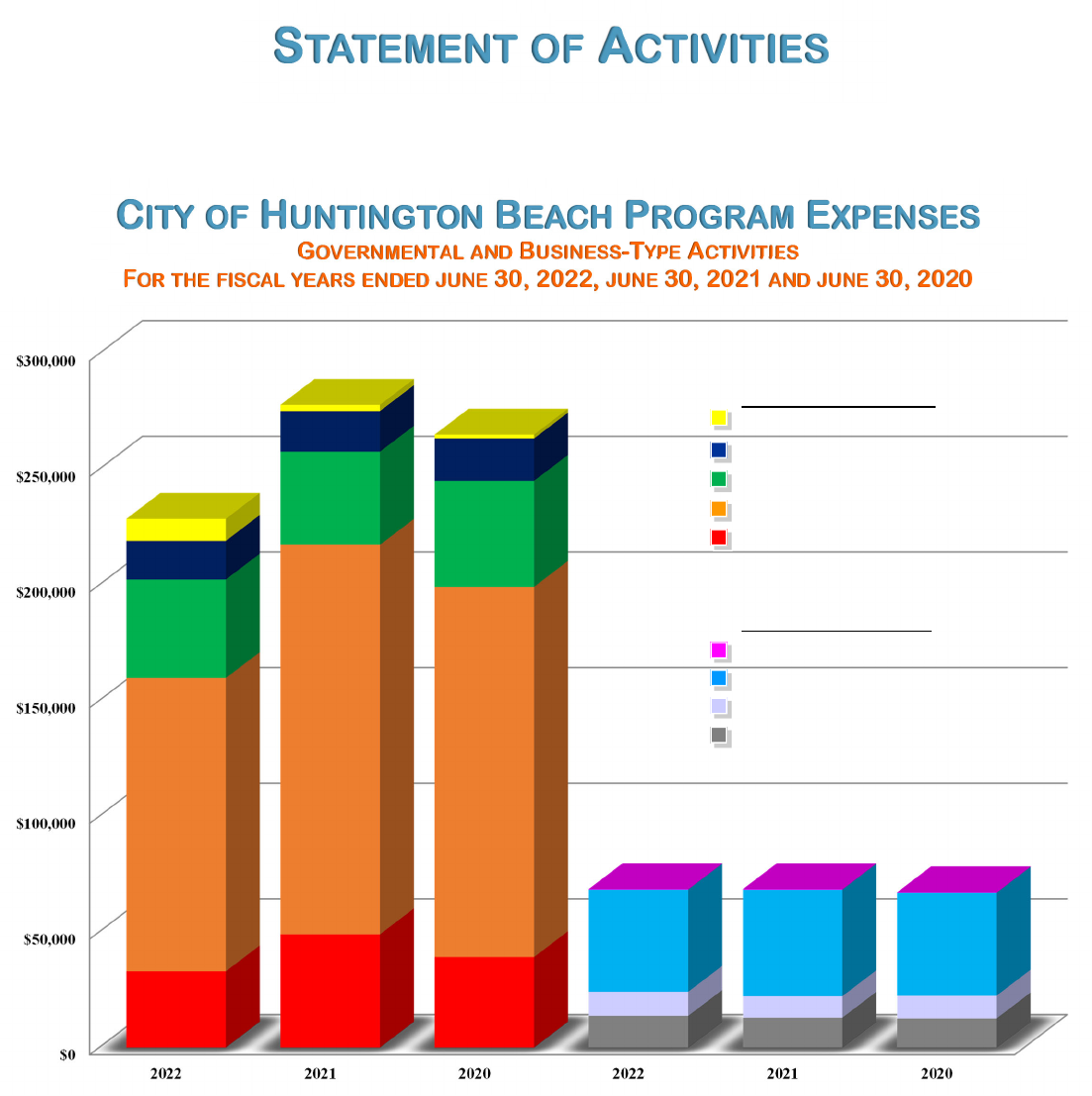

Governmental expenses decreased by $49,257,000 or 17.7 percent. The bulk of the expenditure decrease is related

to prior year’s $363,645,000 issuance of Pension Obligation Bonds to refinance 85 percent of the City’s unfunded

pension liability with CalPERS.

STATEMENT OF ACTIVITIES

The following graphs show Revenues and Expenses for Governmental and Business-type activities as they relate to the

program category in which the funds were collected or expended.

Governmental activities include the General Fund,

Debt Service Funds, Capital Projects Funds, and Special Revenue Funds. Business-type activities include the Water

Fund, Sewer Fund, Refuse Fund, and Hazmat Fund.

CITY OF HUNTINGTON BEACH PROGRAM EXPENSES

GOVERNMENTAL AND BUSINESS-TYPE ACTIVITIES

FOR THE FISCAL YEARS ENDED JUNE 30, 2022, JUNE 30, 2021 AND JUNE 30, 2020

(In Thousands)

G˘˟ˎ˛˗˖ˎ˗˝ˊ˕

Interest on Long Term Debt

Community Services & Library

Public Works

Public Safety

General Government

B˞˜˒˗ˎ˜˜-Tˢ˙ˎ

Hazmat

Water

Sewer

Refuse

$265,040

$277,884

$68,515

$68,546

$265,040

$67,135

$228,627

14

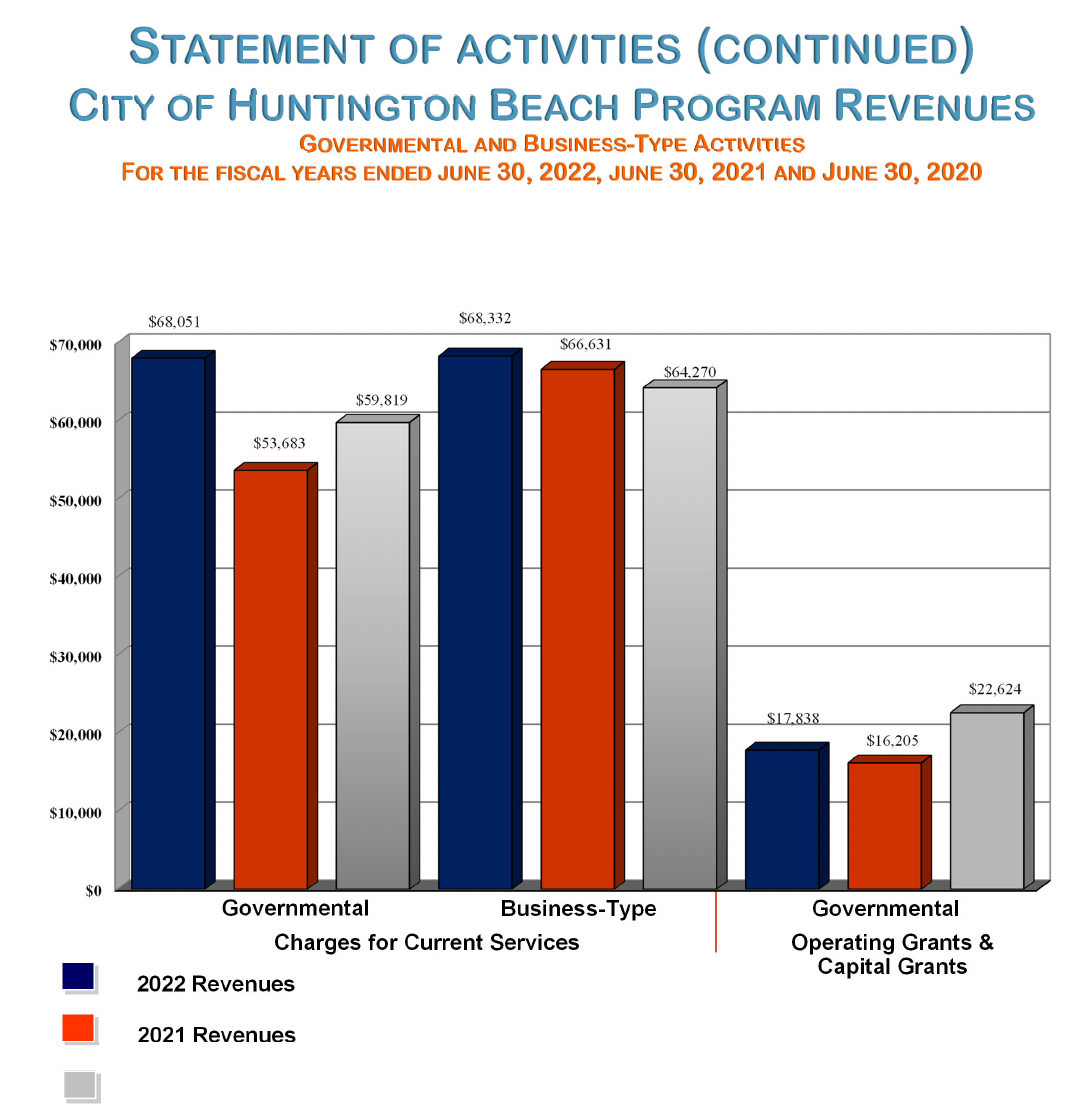

CITY OF HUNTINGTON BEACH PROGRAM REVENUES

GOVERNMENTAL AND BUSINESS-TYPE ACTIVITIES

FOR THE FISCAL YEARS ENDED JUNE 30, 2022, JUNE 30, 2021 AND JUNE 30, 2020

(In Thousands)

Charges for Current Services incr eased $14,368,000 or 26.8 per cent. The easing of COVID-19 restrictions has

allowed the City to provide services at full capacity. The City saw revenue increases across the board, with the most

significant increases from Community Development, Community Services, and Fire.

Operating Grants and Capital Grants increased by $1,633,000 or 10.1 per cent, pr imar ily due to an increase in

grant funds received by Community Development, Police, and Public Works. Police and Public Works had increases

in Office of Traffic Safety grants and Highway Bridge Replacement and Rehabilitation grants, respectively.

STATEMENT OF ACTIVITIES (CONTINUED)

Governmental

Business-Type Governmental

Charges for Current Services Operating Grants &

Capital Grants

2021 Revenues

2022 Revenues

2020 Revenues

Definition of Program Revenues: Revenues that der ive directly fr om the pr ogr am itself, such as user fees and

charges, which reduce the cost of the function to be financed from the government’s general revenues.

15

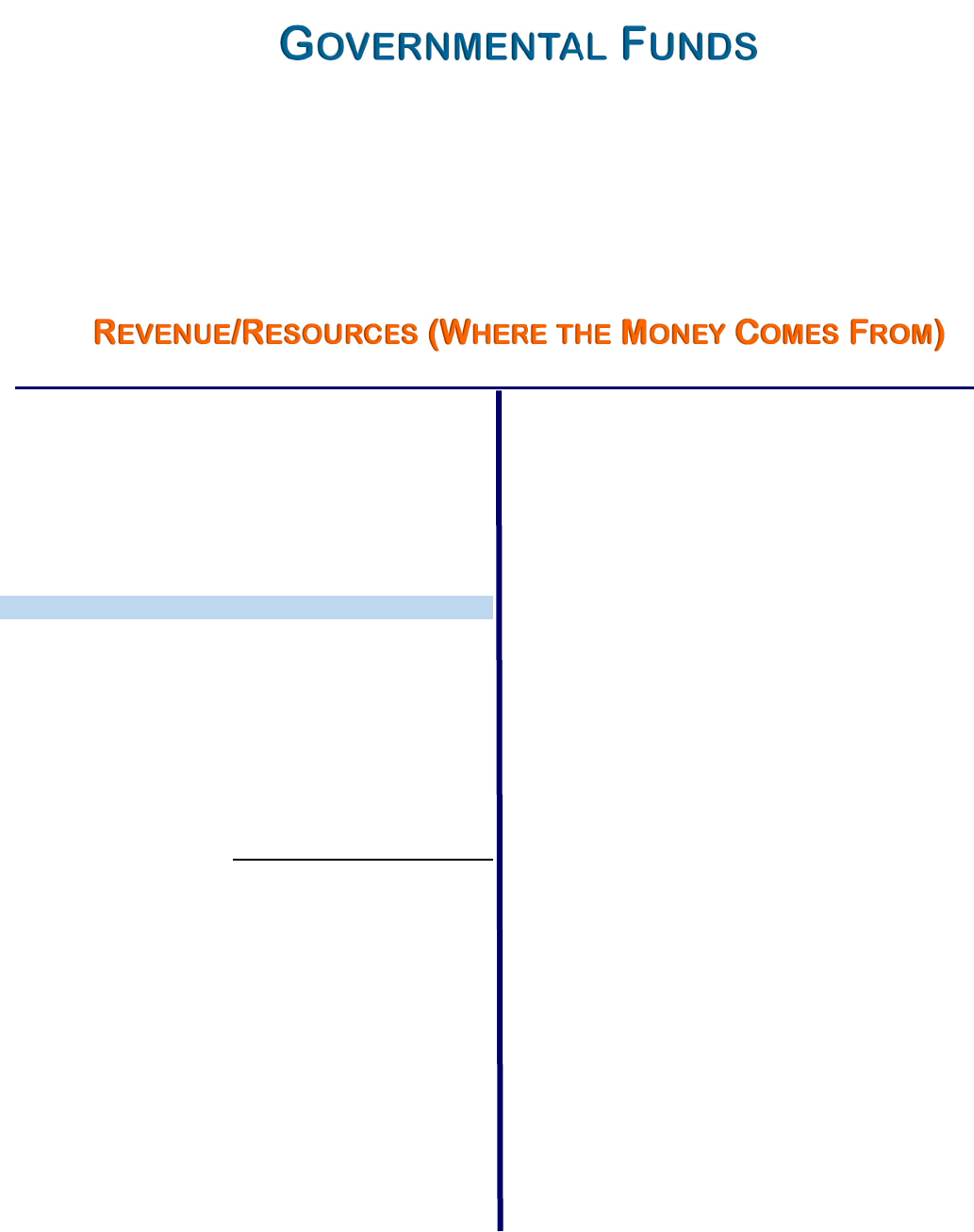

GOVERNMENTAL FUNDS

The largest source of operating revenues for the City is

Property taxes. Pr oper ty taxes ar e levies collected

from property within the City based on assessed value

and tax rate.

Sales taxes ar e imposed on r etail tr ansactions and

are collected and administered by the State. Huntington

Beach receives 1.0% of the total taxable sales

generated within the City.

A Utility tax of 5 percent is imposed on consumers of

electricity, gas, water, and cable television services and

4.9 percent for telephone services within the City.

The City maintains 26 individual governmental funds. Governmental funds are used to account for tax-supported ac-

tivities such as: public safety, public works, general government, and community-related services. The major govern-

mental funds are the General Fund, Grants Special Revenue Fund, the Low-Moderate Income Housing Asset Fund

(LMIHAF) Capital Projects Fund and Pension Liability Debt Service Fund.

The “other taxes” category is comprised of the

following:

• Franchise fees – negotiated fee revenue received from

local utilities.

Transient occupancy tax – imposed on lodging

facilities such as hotels and motels. The City’s tax rate

is set at 10 percent.

Licenses and permits represent revenues generated

from a variety of activities, such as business licenses and

building-related permits.

Revenue from fines and forfeitures are generated from

various sources, such as court and traffic fines, parking

violations, and library fines.

Revenue from the use of money and property includes

interest on City investments, leases, parking fees, and

concessions.

Revenue from other agencies is primarily reimbursements

from Federal, State, and County sources.

Charges for current services are revenues collected for

services rendered to the public such as recreational

classes.

Other revenues are revenues that do not fall into

designated categories, such as refunds, donations or other

financing sources.

C˒˝ˢ ˘ˏ H˞˗˝˒˗ː˝˘˗ Bˎˊˌˑ

S˝ˊ˝ˎ˖ˎ˗ ˝ ˘ˏ Rˎ˟ˎ˗˞ˎ˜

G˘˟ˎ˛˗˖ˎ˗˝ˊ˕ F˞˗ˍ˜

F˘˛ Tˑˎ F˒˜ˌˊ˕ Yˎˊ˛˜ E˗ˍˎˍ J˞˗ˎ 30, 2022

ˊ˗ˍ J˞˗ˎ 30, 2021

(In Thousands)

REVENUE/RESOURCES (WHERE THE MONEY COMES FROM)

The City received $308,413,000 from various funding sources for the fiscal year ended June 30, 2022.

Debt Service Funds are used to account for the r e-

ceipts for and payment of general long-term debt.

Capital Projects Funds ar e used to account for and

report financial resources for capital outlays.

The General Fund accounts for activity not required to

be accounted for in another fund.

Special Revenue Funds are used to account for and

report the proceeds of specific revenue sources.

REVENUE BY SOURCE 2022 2021

Property Taxes 102,539$ 99,958$

Sales Taxes 57,652 51,162

Utility Taxes 19,528 18,374

Other Taxes 33,720 25,745

Licenses and Permits 9,596 8,213

Fines and Forfeitures 5,144 4,619

Use of Money and Property 14,365 19,163

Other Agencies 13,060 29,836

Charges for Services 49,902 25,389

Other 2,907 2,039

Total

308,413$ 284,498$

16

Governmental Fund Revenues increased by $23.9 million or 8.4 percent from the prior fiscal year. The following

details the significant changes from the prior fiscal year:

Property Taxes incr eased by $2.6 million or 2.6 per cent, due to the housing market boom leading to

accelerated growth in assessed

valuations.

Other Revenues incr eased by $868,000

or 42.6 percent. The increase can be

attributed to positive economic impacts

from loosening public health orders,

reopening of businesses and increase in

visitors to the City’s beaches and

downtown businesses.

Licenses and Permits incr eased by $1.4

million or 16.8 percent primarily due to

an increase in permits issued and

development projects.

Other Taxes increased by $8 million or

31 percent predominantly due to an

increase in residents paying their Utilities

Franchise Tax.

Fines and Forfeitures incr eased

$525,000 or 11.4 percent predominantly

due to an increase in parking fee rates.

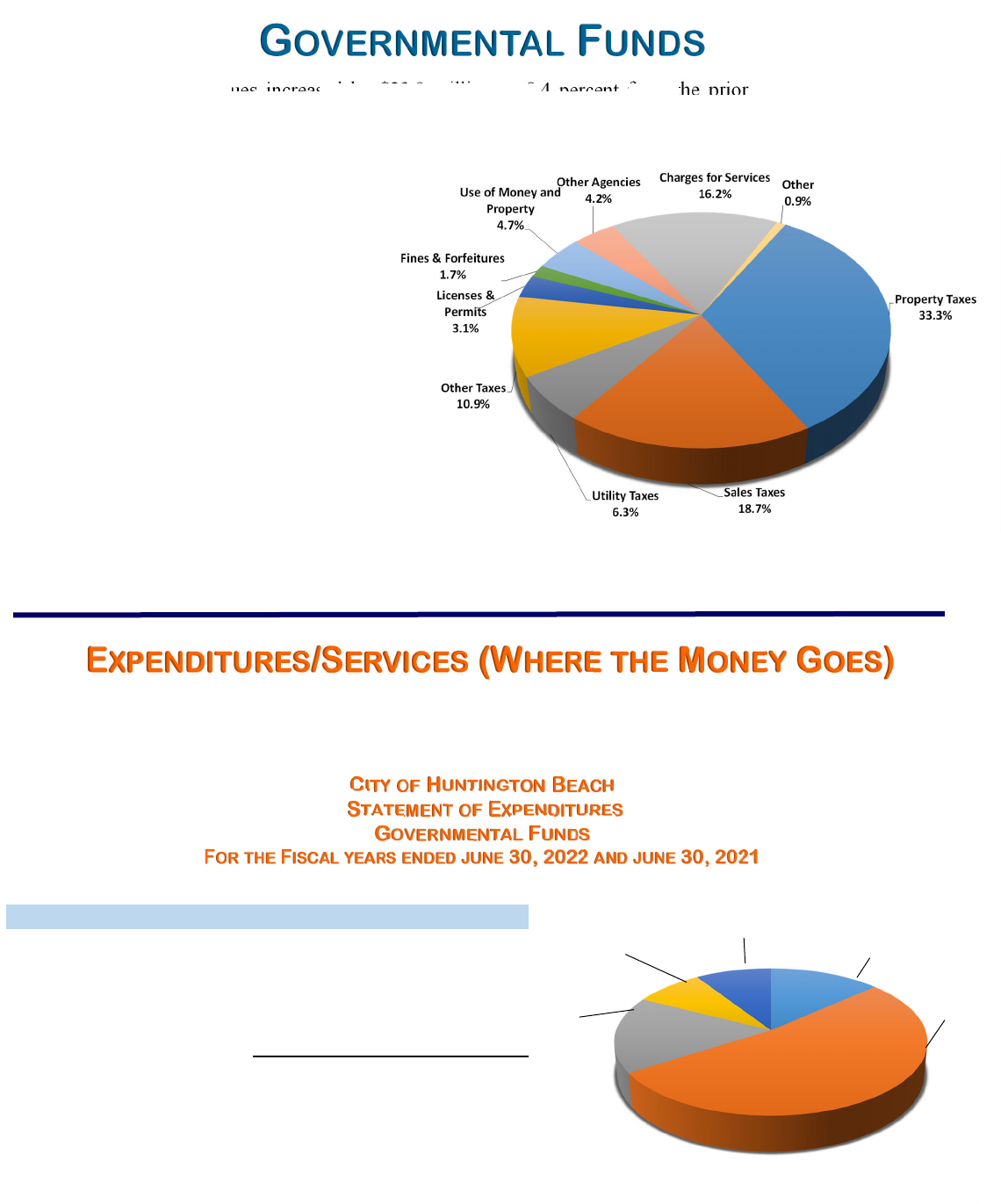

GOVERNMENTAL FUNDS

EXPENDITURES/SERVICES (WHERE THE MONEY GOES)

The City incurs expenditures to meet the diverse needs of the community. As a full service city, Huntington Beach pro-

vides fire and police services, as well as recreational and cultural opportunities. For the period July 1, 2021 to June 30,

2022, the total expenditures incurred by the City were $298,835,000 (excluding transfers and other financing sources).

CITY OF HUNTINGTON BEACH

STATEMENT OF EXPENDITURES

GOVERNMENTAL FUNDS

FOR THE FISCAL YEARS ENDED JUNE 30, 2022 AND JUNE 30, 2021

(In Thousands)

Community and

Library Services

8.3%

Debt Service 9.1%

General

Government

13.3%

Public

Works

16.8%

Public Safety

52.5%

Expenditures decreased by $318.3 million or 51.6 percent primarily due to the City refinancing 85 percent of its

CalPERS unfunded accrued pension liability with the issuance of a Pension Obligation Bond in the prior year.

EXPENDITURES 2022 2021

General Government 39,849$ 102,860$

Public Safety 156,856 382,164

Public Works 50,158 88,007

Parks, Recreation, & Library 24,755 39,163

Debt Service 27,217 4,920

Total

298,835$ 617,114$

17

GOVERNMENTAL FUNDS

General Government expenditures are those in-

curred by the administrative function, including the

City Council, City Manager, City Attorney, City Clerk,

City Treasurer, Finance, Human Resources, Communi-

ty Development, and Information Services.

Public Safety expenditur es r eflect the costs associ-

ated with providing police, fire, and marine safety

services to residents, businesses, and visitors.

Public Works expenditures are those related to the

design, construction, maintenance, and operation of

public facilities and infrastructure within the City.

Community and Library Services expenditures are

those incurred by the City to enrich the quality of life in

Huntington Beach through recreational and cultural

activities, as well as to support the educational and in-

formational needs of residents and visitors.

Debt service expenditures are used to retire the

City’s debt.

Governmental Fund Expenditures decreased by $318

million or 51.6 percent from the prior fiscal year, which

is primarily due to the issuance of a Pension Obligation

Bond to refinance 85 percent of the City’s unfunded

accrued liability with CalPERS in the prior year.

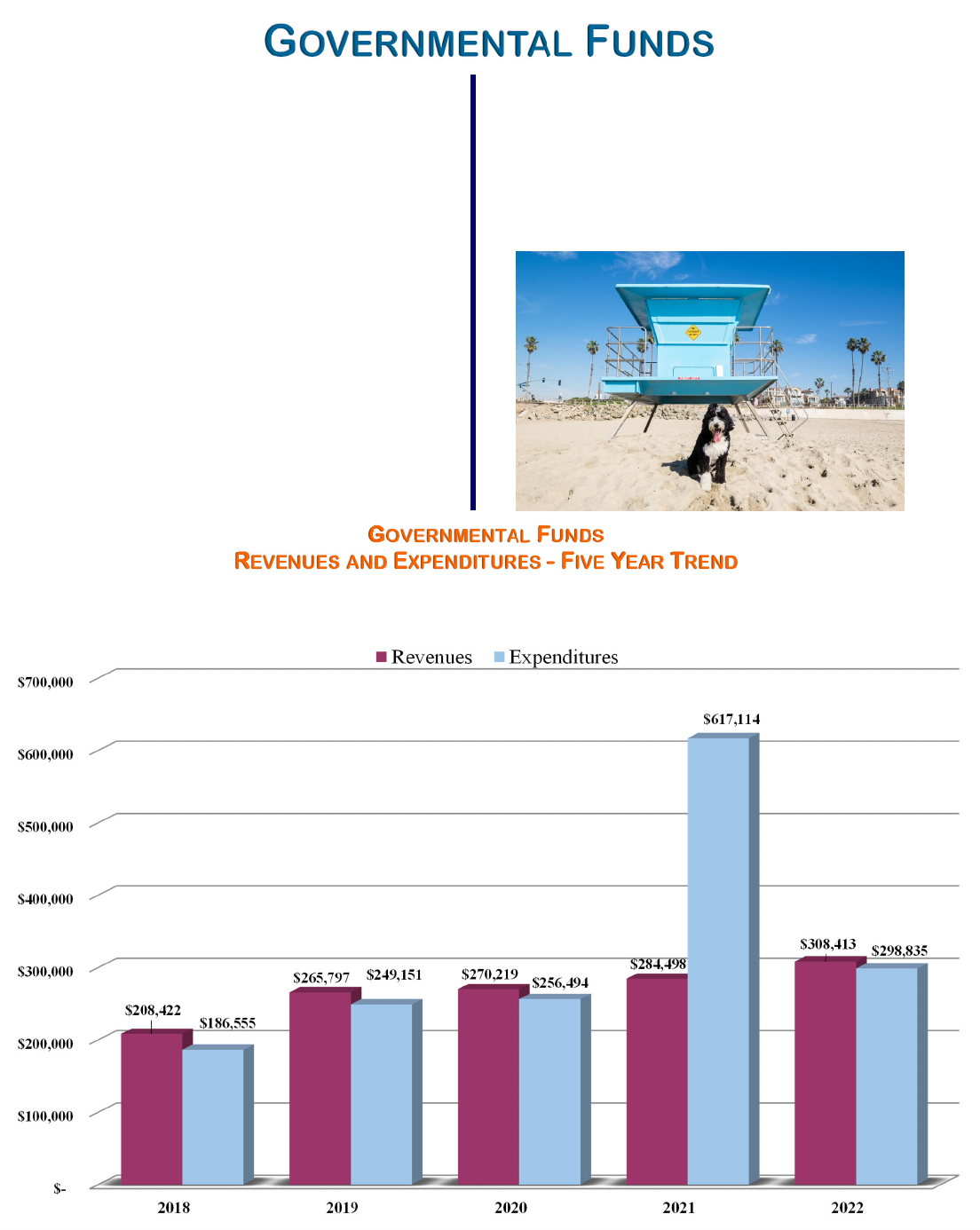

GOVERNMENTAL FUNDS

REVENUES AND EXPENDITURES - FIVE YEAR TREND

(In Thousands)

18

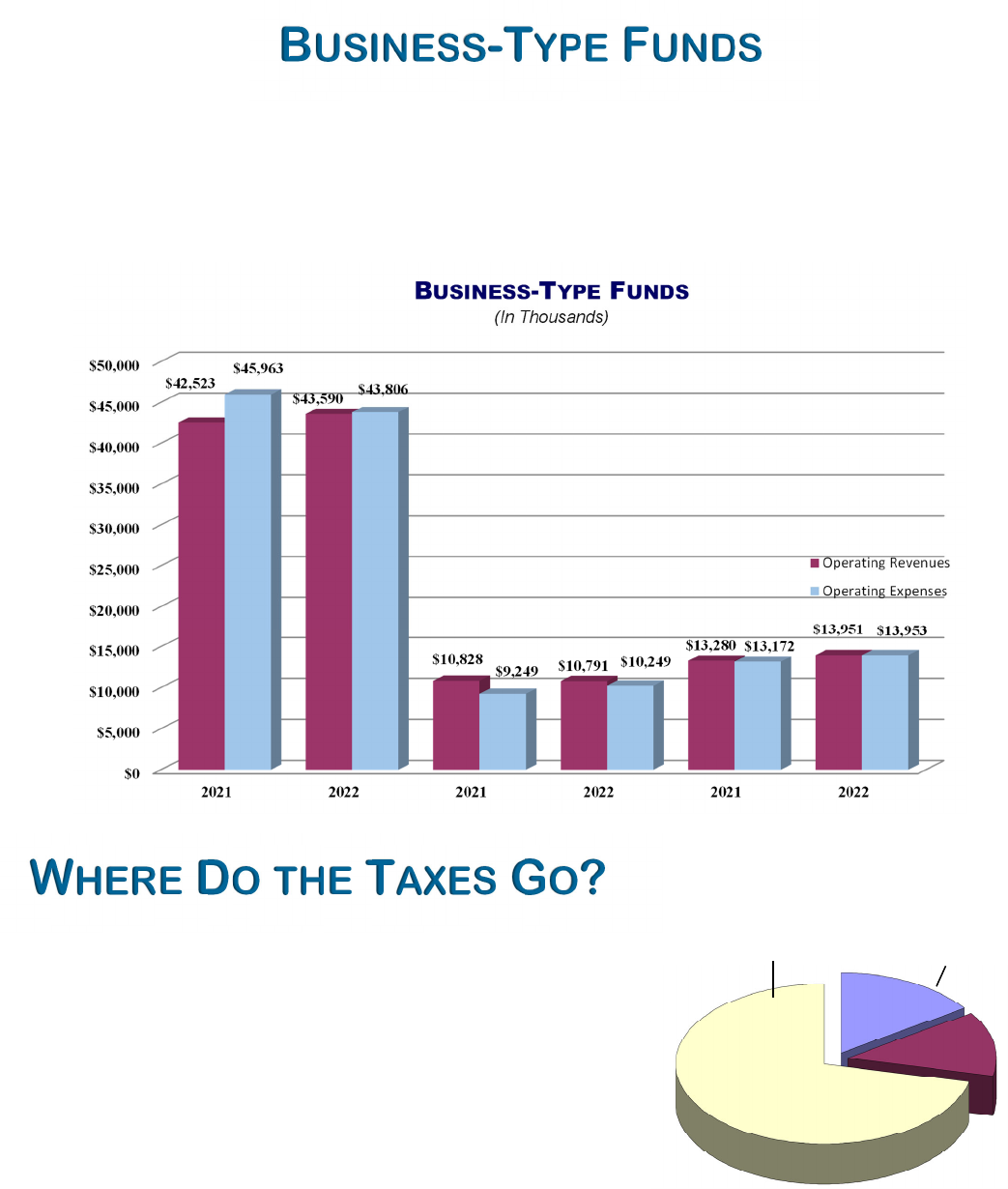

WHERE DO THE TAXES GO?

The largest source of revenue for the

City of Huntington Beach is property

taxes. Personal property in California is subject to a basic levy equal to

one percent of assessed value. The California Constitution, after

passage of Proposition 13 in 1978, fixed valuations of real property at

1975 levels, with a maximum adjustment of two percent per year based

on inflation. When a change of ownership or new construction occurs,

the property is reassessed to its current value.

The basic levy is allocated to county governments, school districts,

cities, and special districts. Additional levies require two-thirds

approval by voters and are allocated directly to the specific

government.

The chart above shows how each dollar paid in property tax in the City of Huntington Beach is distributed to

local school districts, County operations, and the City’s General Fund.

City General

Fund $0.16

County

$0.13

Education

$0.71

BUSINESS-TYPE FUNDS

Business-type funds are used to report any activity for which a fee is charged to users for goods or services, similar to

private business. Over time, these funds generate enough revenue to cover the costs of their operating expenses. The

City maintained four business-type funds as of June 30, 2022.

P˛˘˙ˎ˛˝ˢ Tˊˡˎ˜

The Water Fund accounts for water sales to customers

and costs incurred to maintain its infrastructure.

The Sewer Service Fund accounts for user fees charged to

residents and businesses for sewer services.

The Refuse Fund accounts for the activities of the City’s

refuse collection program.

The Hazmat Service Fund accounts for user fees charged

for the City’s hazardous materials program.

Water

Sewer Refuse & Hazmat

EXPLANATION OF ACCOUNTING TERMS

19

Current and Other Assets – Assets that one can

reasonably expect to convert to cash, sell, or

consume within one year.

Capital Assets – The City’s long-term investments

in land, buildings, equipment, improvements,

infrastructure, and construction in progress. The

City uses these capital assets to provide services

to citizens; consequently, these assets are not

available for future spending.

Net Investment in Capital Assets – This

represents the City’s investment in its capital

assets less accumulated depreciation and any

outstanding debt attributable to the acquisition,

construction, or improvement of these assets. It

should be noted that the resources needed to

repay this debt must be provided by other sources,

since the capital assets themselves cannot be

used to liquidate these liabilities.

Deferred Outflows of Resources – Represents a

consumption of net assets that is applicable to a

future reporting period.

Deferred Inflows of Resources – Represents an

acquisition of net assets that is applicable to a

future reporting period.

Current and Other Liabilities – These are

primarily debts that can be paid off in one year or

less. This includes accounts payable, accrued

payroll and accrued interest payable.

Long-Term Obligations – Represents mainly

debt obligations of the City. The proceeds from

these various debt issues are typically used to

finance large project costs such as building

construction and renovations, major equipment

purchases, and roadway construction.

Net Position - This represents the City’s total

assets and deferred outflows of resources less the

total liabilities and deferred inflows of resources.

Restricted Net Position – Resources whose use

is subject to externally imposed restrictions. The

City has resources set aside for debt service,

public works projects, and community services

programs as established by the City Council.

Unrestricted Net Position – These are resources

that are accessible to the City to provide services

to the residents of Huntington Beach if there were

no additional revenues or resources available.

AWARD

The Government Finance Officers Association of the

United States and Canada (GFOA) has given an Award for

Outstanding Achievement in Popular Annual Financial

Reporting to the City of Huntington Beach for its Popular

Annual Financial Report for the Fiscal Year Ended June

30, 2021. The Award for Outstanding Achievement in

Popular Annual Financial Reporting is a prestigious

national award recognizing conformance with the highest

standards for preparation of state and local government

popular reports.

In order to receive an Award for Outstanding Achievement

in Popular Annual Financial Reporting, a government unit

must publish a Popular Annual Financial Report, whose

contents conform to program standards of creativity,

presentation, understandability, and reader appeal.

An Award for Outstanding Achievement in Popular Annual

Financial Reporting is valid for a period of one year only.

The City of Huntington Beach has received a Popular

Award for the last sixteen consecutive years (Fiscal Years

ended 2006-2021). We believe our current report continues

to conform to the Popular Annual Financial Reporting

requirements.

City of Huntington Beach

2000 Main Street

Huntington Beach, CA 92648

(714) 536-5630

www.huntingtonbeachca.gov