1

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

T

HE

E

NERGY

AND

R

ESOURCES

I

NSTITUTE

Creating Innovative Solutions for a Sustainable Future

MOVING TOWARDS A LOW-CARBON

TRANSPORT FUTURE

Increasing Rail Share in

Freight Transport in India

Working Paper – Fly Ash

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

MOVING TOWARDS A LOW-CARBON

TRANSPORT FUTURE

Working Paper – Fly Ash

THE ENERGY AND

R

ESOURCES INSTITUTE

Creating Innovative Solutions for a Sustainable Future

Increasing Rail Share in

Freight Transport in India

3

4

WORKING REPORT – FLY ASH

© The Energy and Resources Institute 2019

T E R I. 2019

Increasing Rail Share in Freight Transport in India : Working Paper – Fly Ash

New Delhi: The Energy and Resources Institute.

Project Report No. 2016UD05

About Shakti: Shakti Sustainable Energy Foundation works to strengthen the energy security of India by aiding the

design and implementation of policies that support energy efficiency, renewable energy and sustainable mobility.

Disclaimer: The views/analysis expressed in this report/document do not necessarily reflect the views of Shakti

Sustainable Energy Foundation. The Foundation also does not guarantee the accuracy of any data included in this

publication nor does it accept any responsibility for the consequences of its use.

For more information

Project Monitoring Cell

T E R I Tel. 2468 2100 or 2468 2111

IHC Complex, Lodhi Road Fax 2468 2144 or 2468 2145

New Delhi – 110 003 Web www.teriin.org

India India+91•Delhi(0)11

5

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

TABLE OF CONTENTS

Working Paper – Fly Ash 9

Background 9

Aim of the Study 9

Objectives 9

Policies for Fly Ash Transport in India 9

CPCB Guidelines for Transportation of Fly Ash in India 9

MoEF&CC Guidelines towards Utilization of Fly Ash in India 10

Fly Ash Transportation 11

Fly Ash Generation & Utilization 12

Scenario of Fly Ash Production in India 12

State wise Scenario of Fly Ash Production in India 14

Plant wise Scenario of Fly Ash Production in India 16

Mode of Utilization of Fly Ash 19

Scenario of Fly Ash Transport in Indian Railways 20

OriginDestination(O-D)Analysis 21

Rake Composition 22

Fly Ash Transport in Cement Industry 24

Opportunity of fly ash transport by Rail 28

Estimation of Costs and Benefits involved in Transporting Fly Ash 34

Issues 41

Issues with Indian Railways 41

Issues with NTPC 41

Issues with Cement Plants 42

Recommendations 42

Bibliography 43

6

WORKING REPORT – FLY ASH

LIST OF FIGURES

Figure 1: Process showing Handling and Storage of Fly Ash 11

Figure 2: Photograph showing Fly Ash Loading Silos and Road Bulkers 12

Figure 3: Scenario of Fly Ash Generation in India 13

Figure 4: Scenario of Fly Ash Utilization in India 13

Figure 5: An Overall Scenario of Fly Ash Production in India 13

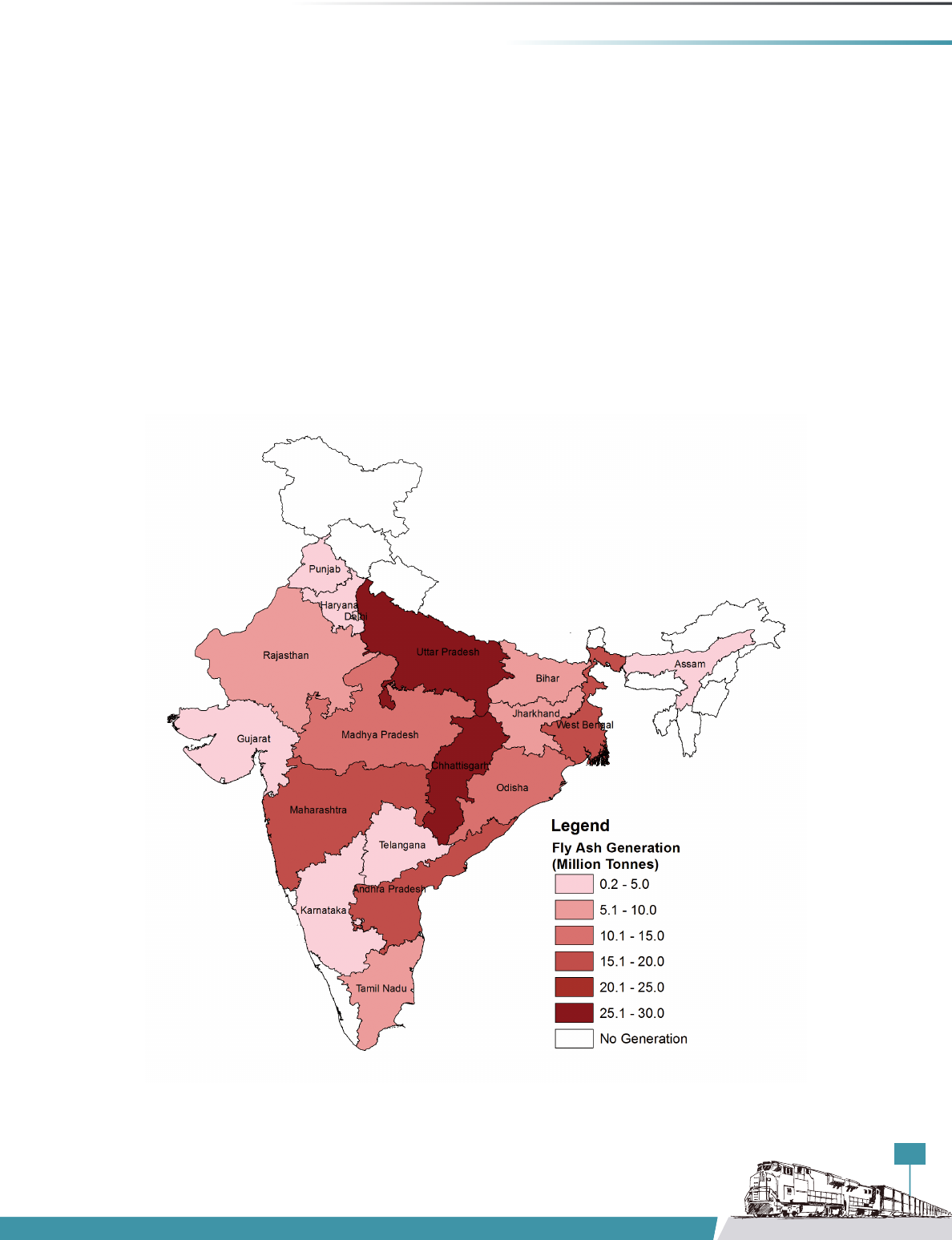

Figure6: StatewiseScenarioofFlyAshProductioninIndia(2016-17) 15

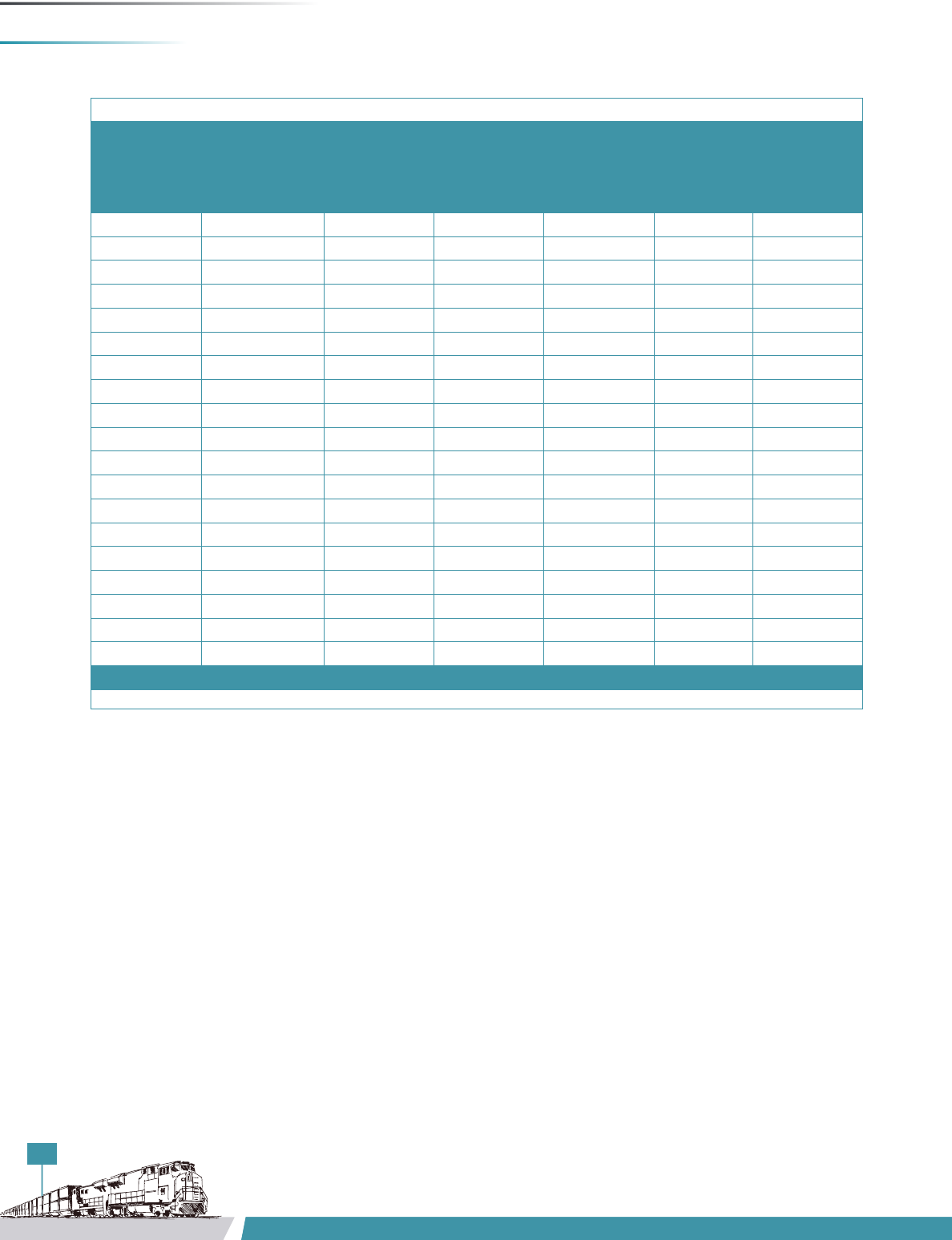

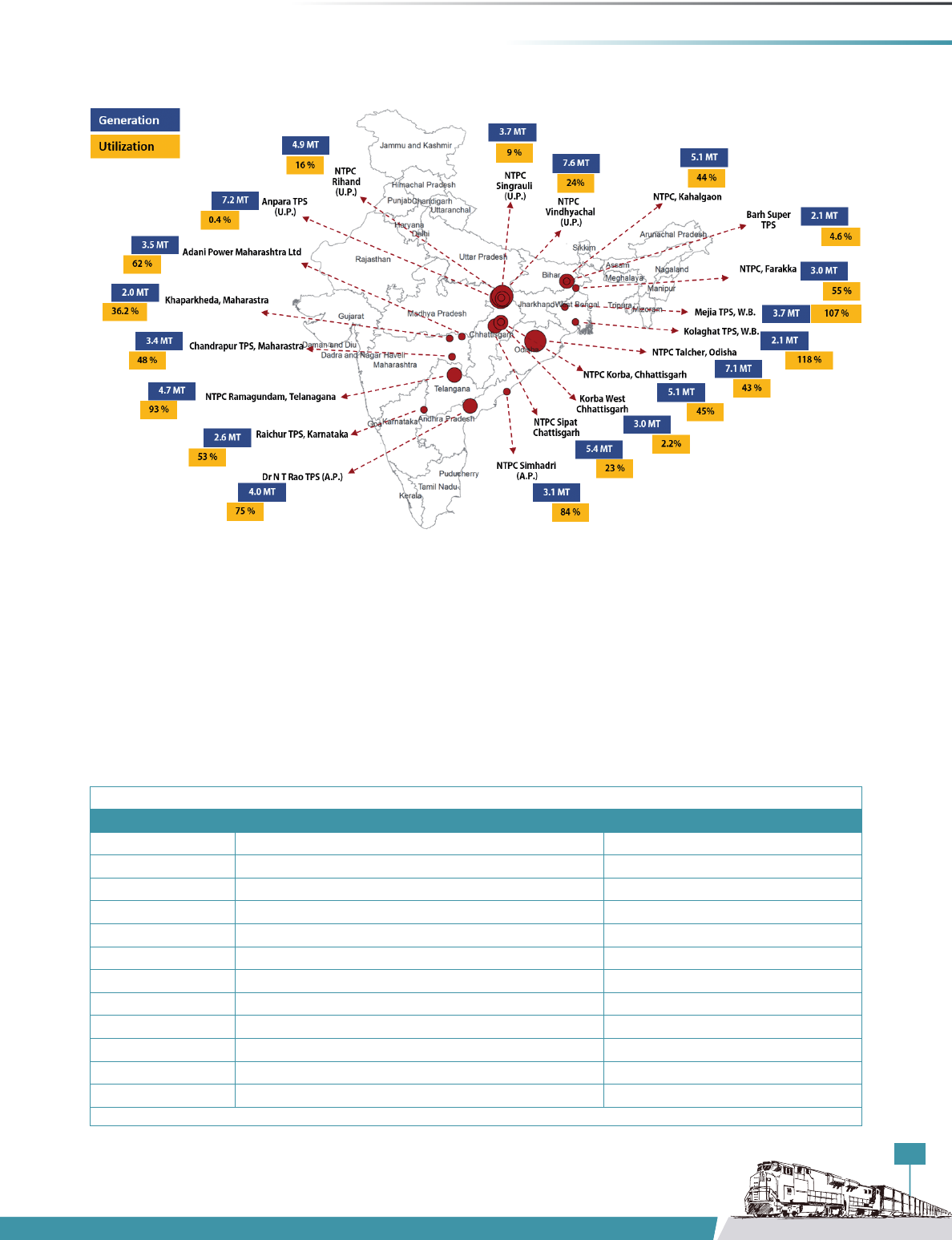

Figure7: LocationofCoal/LignitebasedThermalPowerStationsinIndia 17

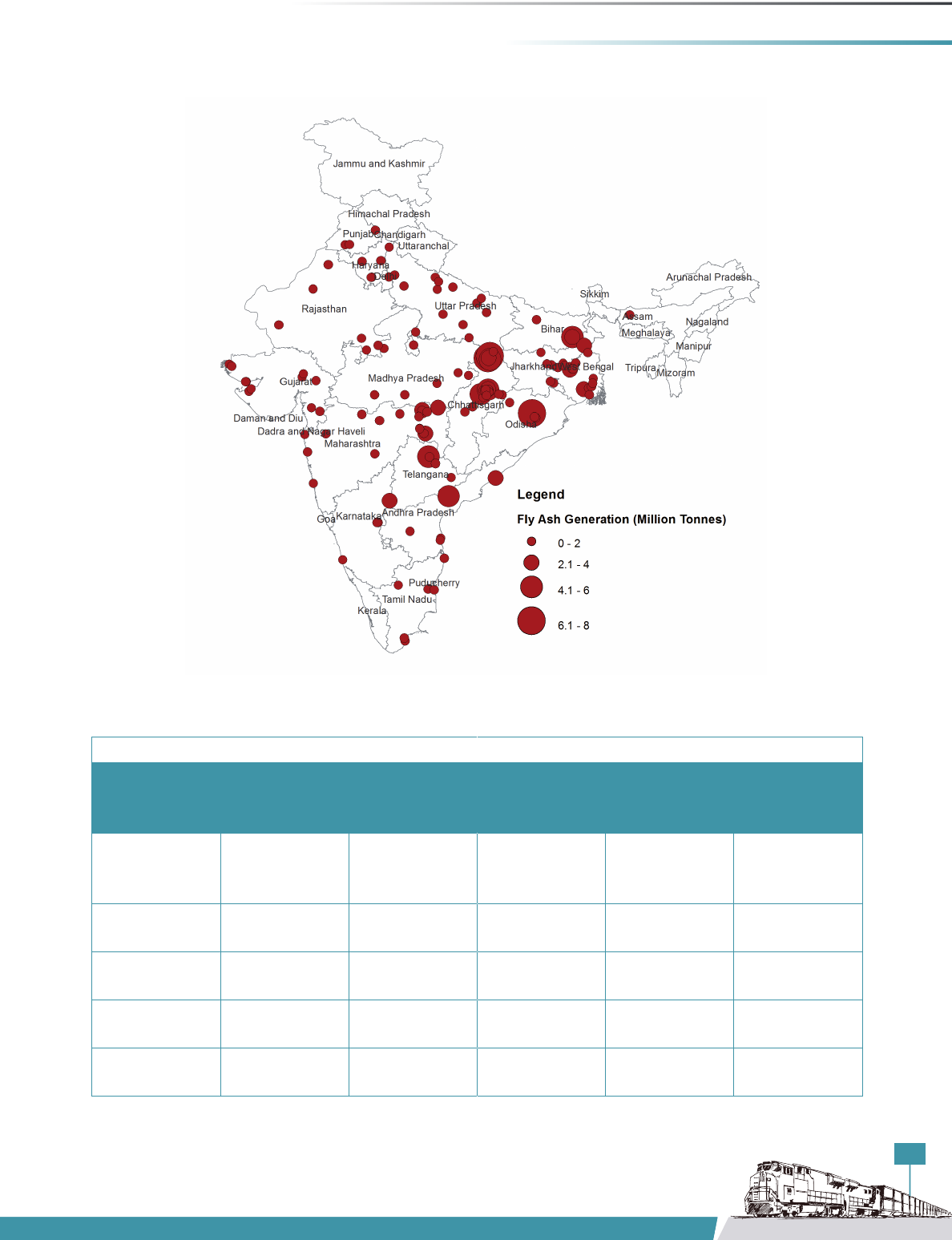

Figure8: Top20TPSinIndiaalongwithProductionFigures(2016-17) 19

Figure 9: Major Modes of Fly Ash Utilization 20

Figure 10: Fly Ash Tonnage Carried by Railways 20

Figure 11: Fly Ash Movement Trends in Indian Railways 21

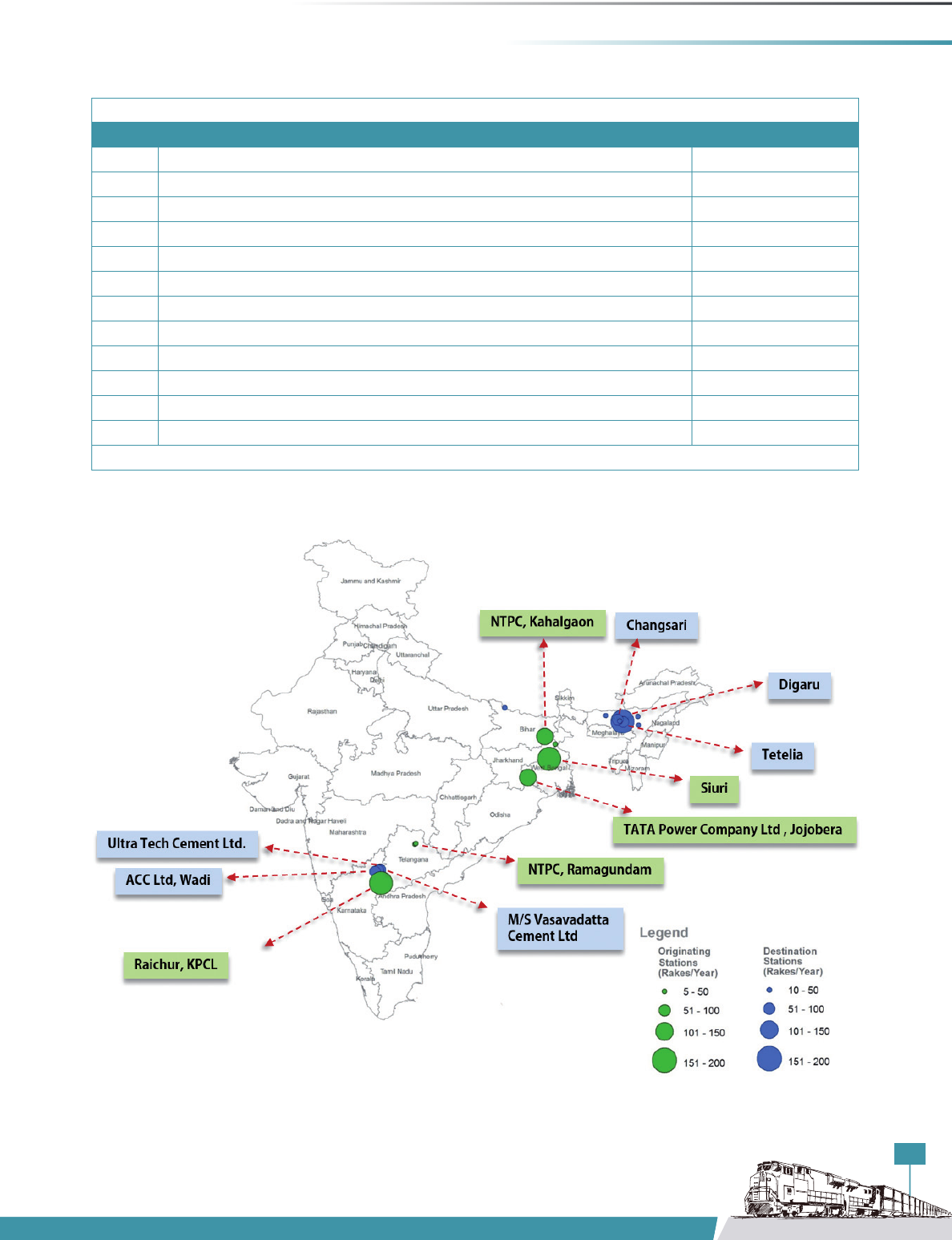

Figure 12: Major Origin and Destination Nodes for Transporting Fly Ash through Railways 23

Figure 13: Various type of Wagons used in transporting fly ash via Rail 24

Figure 14: Covered Car “BCCW’’ wagon for bulk transport of Cement/Fly Ash 24

Figure 15: BCCW wagons for bulk transport of Cement/Fly Ash 24

Figure 16: BTAP Wagon 24

Figure17: ShareofPPCcementandOPCcementintotalcementproduction 25

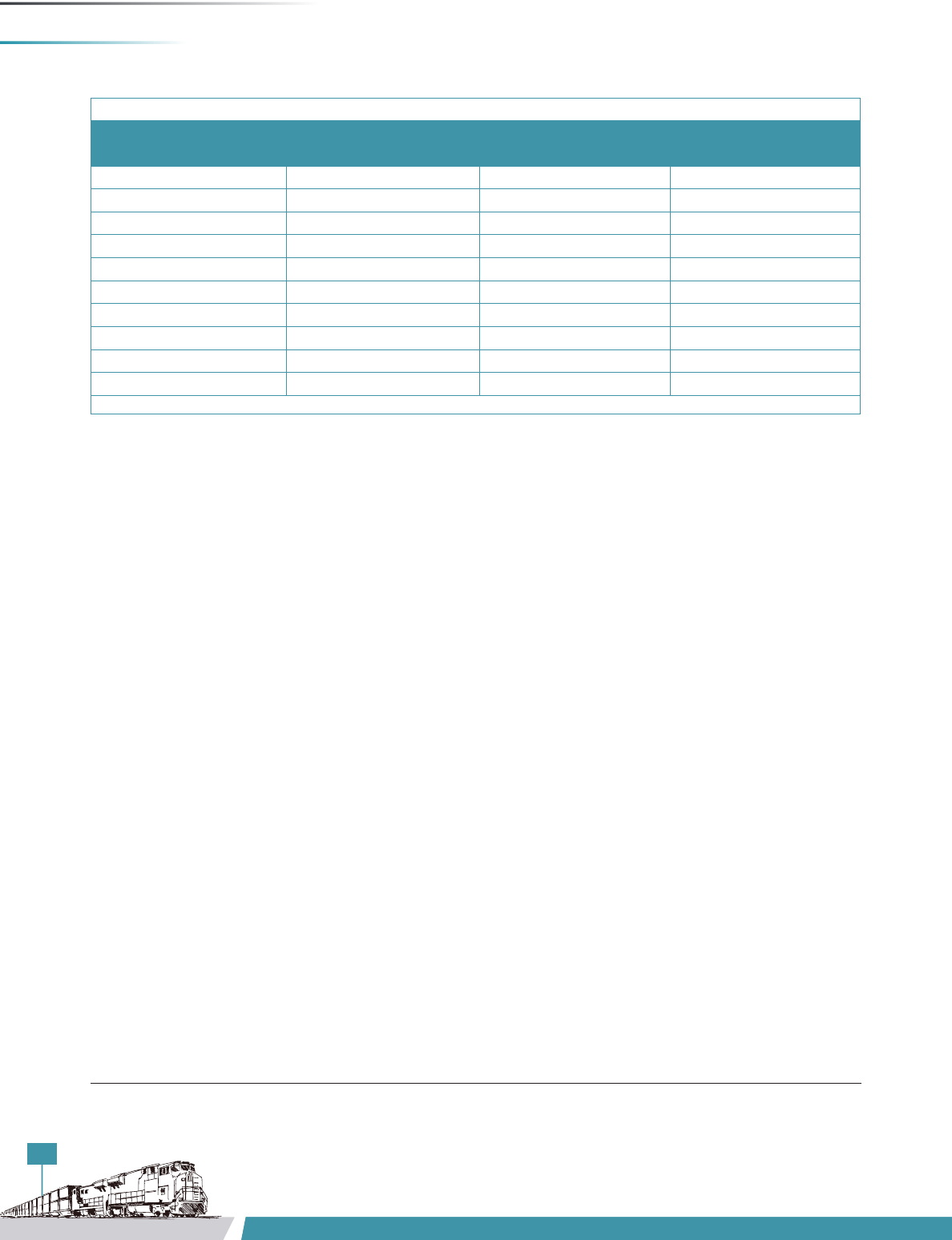

Figure18: SpatialdistributionofCementplantsinIndiaalongwiththeThermalPowerPlants(BufferRange–100km) 26

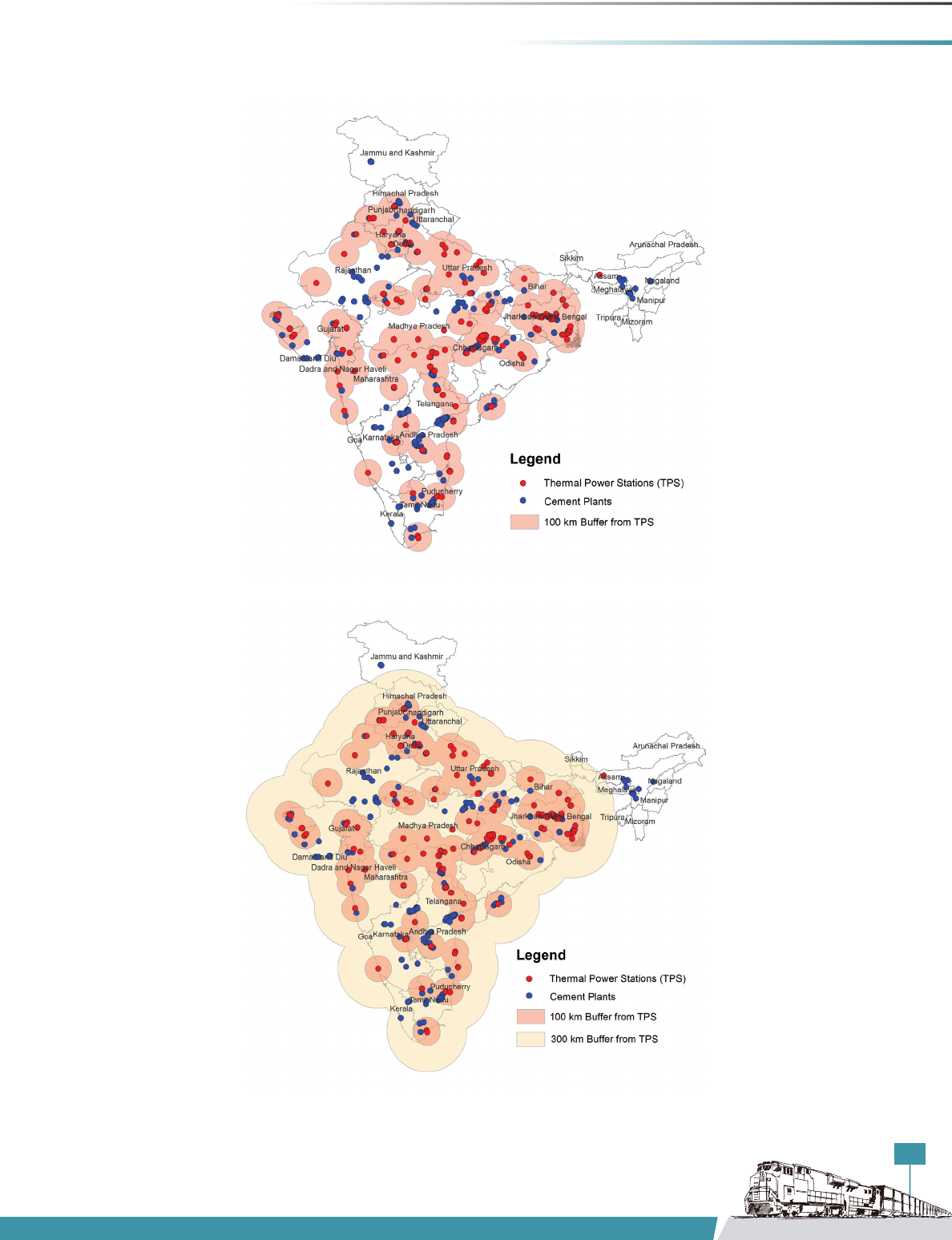

Figure19: SpatialdistributionofCementplantsinIndiaalongwiththeThermalPowerPlants(BufferRange–300km) 27

Figure 20: Pneumatic Unloading Facility for Bulker Trucks at Prism Cement, Satna 29

Figure 21: Mechanized fly ash unloading through Truck Tippler at Prism Cement, Satna 29

Figure 22: Map showing location of Cement Plants in Rewa-Satna region & Thermal Power Plants in Singrauli region 30

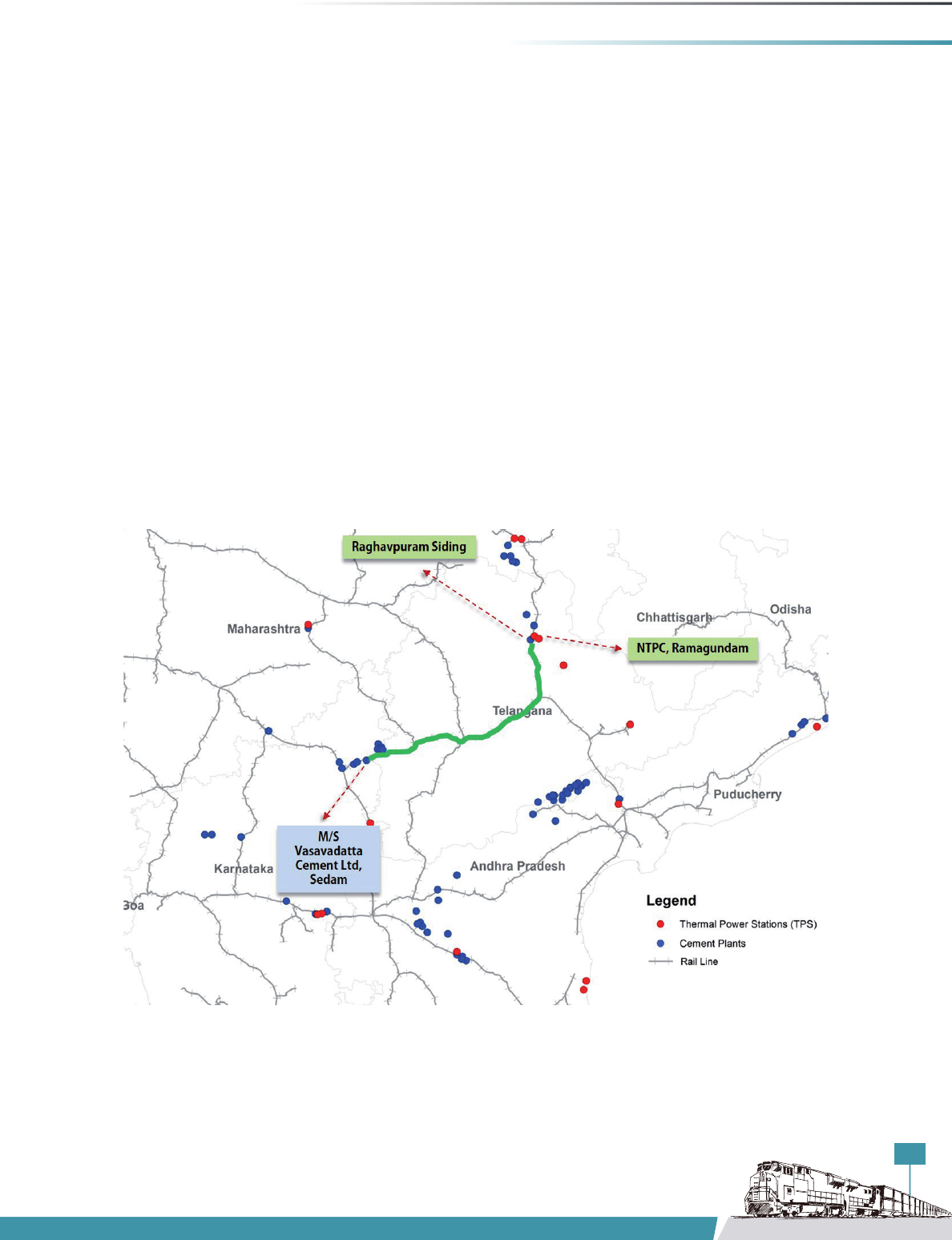

Figure 23: Map showing rail connectivity of transporting fly ash from Raghavpuram siding to Vasavadatta

Cement Ltd, Sedam 31

Figure 24: Railway Wagons before and after modification 32

Figure 25: Fly Ash loading at NTPC, Ramagundam 32

Figure 26: Map showing rail connectivity of transporting fly ash from Raichur Thermal Power Station to Vasavadatta Cement

Ltd, Sedam 33

Figure27: MapshowinglocationofSingrauliRegion 35

Figure 28: Map showing location of Thermal Power Stations in Singrauli Region and Cement Plants in Rewa-Satna Region 36

Figure 29: Annual Rail and Road Cost Comparisons for Cement Plants 38

Figure 30: Comparison of Annual

CO

2

Emissions 40

7

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

LIST OF TABLES

Table 1: Annual Backlog of Fly Ash along with Percent of Utilization 14

Table 2: State wise scenario of fly ash production in India 15

Table3: ListofTop20ThermalPowerStations(TPS)inIndiaintermsofGenerationofFlyAsh 17

Table 4: Mode of Fly ash Utilization 19

Table 5: Scenario of Fly Ash Transport by Indian Railways 21

Table6: Origin-DestinationTableshowingrakemovementofyashbyIndianRailwaysbetween2011and2017

(Numberofrakes) 22

Table7: MajorOriginNodesintermsofFlyAshTransportthroughIndianRailways 22

Table 8: Major Destination Nodes in terms of Fly Ash Transport through Indian Railways 23

Table 9: Share of PPC in Total Cement Production 25

Table 10: Thermal Power Stations in Singrauli Region [6] 29

Table12: CostofmovingyashfromRaichurtoSedambyRail(2007-08) 34

Table 13: List of Cement Plants selected to estimate Annual Fly Ash Demand 35

Table 14: Fly Ash availability in major Thermal Power Stations in Singrauli Region 36

Table15: AnnualestimatedcostsfortransportingyashfromSingrauliregiontoCementPlantsbyRoad 37

Table16: AnnualestimatedcostsfortransportingyashfromSingrauliregiontoCementPlantsbyRail 37

Table17: ComparisonofRoadandRailcostsaswellasrespectiveSavings 38

Table 18: Assumptions taken for calculating savings in

CO

2

emissions 39

Table 19 : Savings in

CO

2

Emissions 40

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

9

ACKNOWLEDGMENT

TheEnergyandResourcesInstitute(TERI)wouldliketoexpressdeepgratitudetotheMemberTrafcandRailway

Boarddirectorates(Trafc,Commercial,FreightMarketing,andCoaching)fortheirsupportandguidancethroughout

the study. TERI also thanks the officers at different zonal railways in sharing valuable inputs for the study. This report

wouldnothavebeenpossiblewithoutthesupportandguidanceoftheIndianRailways(IR).

TERI extends sincere thanks to various stakeholders and industry representatives from power sector (NTPC) and

cementsector(ACCCementandUltraTechCement)whosharedtheirinsightsandideastowardsincreasingtheshare

of IR’s freight loading.

We also extend sincere gratitude to Shakti Sustainable Energy Foundation in supporting TERI to undertake this study.

The project team also acknowledges the contribution of Mr Shri Prakash, Distinguished Fellow, TERI, and Mr Deepak

Nath, Independent Consultant and Ex-Railway Personnel towards reviewing and enriching the study with their

valuable suggestions and experience of the railways sector. We take this opportunity to thank the editorial and design

team at TERI for their contribution.

Project Team

Team Lead

Mr Shri Prakash

Project Investigator

Mr Sharif Qamar

Advisor

Mr Deepak Nath

Team

Mr Narendra Verma

Mr Sharif Qamar

Secretarial Assistance

Ms Sonia Khanduri

11

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

FLY ASH

With a share of over 60% in total electricity generation,

the volume of fly ash generated by the thermal power

plants in India is significantly high. Fly ash, which is a

by-product of coal-based power generation, is a fine

hazardous powder. It is produced by the combustion

of powdered coal and collected in electrostatic

precipitators(ESPs).

Over the past decade, the generation of fly ash by the

Indian thermal power plants has increased significantly.

Indian coal, which is used in power plants, has a low

caloric value and high ash content (30–45%), which

generates huge quantities of fly ash. Country’s track

record of utilizing fly ash has also been poor. Fly ash finds

several applications in areas such as agriculture, cement

manufacturing, brick industry, construction of road and

rail embankments, reclamation of low-lying areas, mine

fillings, etc. The pozzolanic property of fly ash/lime

reactivity makes it suitable for use in manufacturing of

cement and concrete.

Any thermal power station, generally, has four kinds of fly

ash, which are:

Hopper ash: This kind of ash comes out of the boiler

along with flue gases. It is collected by ESPs in a dry form.

This dry fly ash is collected from different ESP fields and

is of varying fineness. The fly ash collected from the ESP

fields nearer to the boiler is coarser than that collected

fromtheESPeldsawayfromtheboiler(thatis,nearer

tothechimney).

Bottom ash: This kind of ash gets collected at the bottom

of the boiler furnace and is, thus, referred to as bottom

ash. It is coarser than dry fly ash/hopper ash.

Pond ash: When dry fly ash and bottom ash, or both

mixed together, is carried in the form of water slurry and

deposited in ponds where water gets drained away, the

deposited ash is termed as pond ash.

Mound ash: When fly ash and bottom ash, or both mixed

in any proportion, gets deposited in a dry form in the

shape of a mound, it is termed as mound ash.

Aim of the Study

The study aims to examine the existing scenario of fly-

ash transport in India, with a specific emphasis on the

movement of fly ash through the Indian railways, as well

as to come up with strategies to increase the share of

railways in transporting fly ash.

Objectives

In order to fulfil the aim of the study, the following

objectives have been formulated:

¾ To understand the existing scenario of fly-ash

generation and utilization in India

¾ To understand the existing transportation scenario of

fly ash in railways

¾ To identify the potential supply-and-demand clusters

of fly ash

¾ To identify the factors responsible for the low modal

share of fly ash in railways

¾ To develop fly-ash-specific strategies to increase the

modal share of railways in transportation of fly ash

While the study team aimed at following above, lack of

data and information regarding transport demand flows

related to fly ash were areas of limitations in certain

instances.

Guidelines and Policies for

Fly-Ash Transportation in India

There are a two major guidelines issued by government

agencies, which have been listed in this section. These

guidelines are issued by the Central Pollution Control

Board (CPCB) andthe Ministry of Environment, Forests

andClimateChange(MoEF&CC).Itistobenotedatthe

outset that since these are guidelines, the parties involved

12

WORKING REPORT – FLY ASH

in the generation, transportation, and utilization aspects

of fly ash are not bound to adhere/follow. Interactions

with the stakeholders indicate that specialized wagons

or trucks are not deployed to transport fly ash from

production point to consumption point.

CPCB Guidelines for Fly-Ash

Transportation

The CPCB has framed guidelines for loading, unloading,

utilization, and nuisance-free transportation of all types

of fly ash, including dry fly ash and bottom ash generated

bythermalpowerstations(TPS).Consideringthevarious

aspects of handling and transportation of fly ash, the

CPCB suggests the following modes of transportation for

different end users of fly ash so as to avoid dust emission

(CPCB,2013).

Cement/Asbestos Manufacturing

¾ Only specially designed road tankers/bulkers or

mechanically designed, covered trucks provided with

automatic loading and unloading system should be

used.

¾ Specially designed railway wagons should be used

for transport by rail.

Manufacturing of Fly-Ash-based Brick, Tiles and

Blocks

¾ Tankers/ bulkers or mechanically designed, covered

trucks shall be used.

¾ In case of tractors, trolleys which have the provision

of a box-type cover on top with a hydraulic unloading

system should be deployed for transporting dry or

wet fly ash.

Mine/Abandoned Quarry Backfilling

¾ Tankers/bulkers or mechanically designed, covered

trucks shall be used.

¾ Based on topography considerations and feasibility

of the system, pipe conveyors can also be used.

¾ Ash slurry pipeline systems can be used to transport

ash slurry directly from thermal power plants to

abandoned mines, if permitted.

Road Construction and Filling of Low-Lying Area

¾ Tankers/bulkers or mechanically designed, covered

trucks shall be used.

MoEF&CC Guidelines for Fly-Ash

Utilization

To address the issue of fly-ash disposal in ash ponds and

to reduce the problem of pollution caused by fly ash,

the MoEF&CC has issued various notifications on fly-

ash utilization. The first notification was issued on 14th

September, 1999, which was subsequently amended

in 2003, 2009, and 2016 vide notications dated 27th

August 2003, 3rd November 2009, and 25th January

2016, respectively.

To enhance the efforts for gainful utilization of fly ash,

the latest MoEF&CC’s notification of 25th January 2016

mandates(MoEF&CC,2016):

¾ Every agency engaged in construction within

a 300-km range of any coal- or lignite- based

thermal power plant must use only fly-ash-based

materials for construction. This shall be applicable

to all construction agencies whether government or

private.

¾ No agency, person, or organization is allowed to

construct or approve the design of road or flyover

embankments with top soil within a 300-km range of

any coal- or lignite- based thermal power plant. Also,

the fly ash used for such embankment construction

shall strictly adhere to the guidelines specified in IRC

SP:58 of 2001, as amended from time to time.

¾ No agency, person, or organization shall undertake

or approve or allow reclamation and compaction of

low-lying areas with soil within a 300-km radius of

any coal- or lignite-based thermal power plant. Only

fly ash shall be used for compaction and reclamation.

¾ The cost of transportation of fly ash for road-

construction projects, or manufacturing of ash-based

projects, or any agricultural activity where ash is

being used as soil conditioner within a 100-km radius

of any coal-based thermal power plant has to be

borne entirely by TPS and equally divided between

the user and the thermal power station for distances

more than 100 km and up to 300 km. In case of road-

13

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

construction projects under the Pradhan Mantri Gram

Sadak Yojana and asset-creation programmes of the

government, involving construction of buildings,

roads, dams, and embankments, power plants shall

bear the entire cost of ash transportation to the site

within a 300-km radius.

¾ Pond ash should be made available free of cost

on an ‘as is where is’ basis to the manufacturers of

bricks, tiles, or blocks, including manufacturing units

that make clay based fly ash products; farmers, the

central and state road-construction agencies, the

Public Works Department, and agencies engaged in

backfilling or stowing of mines.

¾ It is also mandatory to use fly-ash-based products in

all government schemes or programmes, for example,

Pradhan Mantri Gram Sadak Yojana, Mahatma Gandhi

National Rural Employment Guarantee Scheme, and

Swachh Bharat Abhiyan.

¾ No person or agency shall undertake or approve

stowing of mines without using at least 25% of fly

ash on weight-to-weight basis of the total stowing

materials used within a 50-km radius of a coal- or

lignite-based thermal power plant.

Fly-Ash Transportation

Fly-ash transportation has many challenges as fly-ash

particles are lightweight and can potentially get airborne

easily and pollute the environment. Furthermore, its

airborne character requires it to be transported in

an enclosed container. As fly ash is used for a variety

of purposes discussed earlier, proper and adequate

measures should be undertaken while handling and

transporting it.

Handling and Disposal of Fly Ash within

the Power Plant

Fly ash collected from ESPs can be disposed of either in

dry form or wet-slurry form. Dry ash is typically conveyed

pneumatically from ESPs to storage silos, where it is kept

dry till further processing, while bottom ash, which is

collected from the bottom of the boiler, is disposed of

into ash ponds in the form of wet slurry.

The following technologies are conventionally used for

handling and disposal of fly ash and bottom ash from

ESPswithintheplantoruptotheash-pondarea(CPCB,

2013):

Fly Ash Silo

Ash Pond

Ulisaon

Ulisaon

Boiler

Electrostac

Precipitator

Coal/Lignite

Coal Pulveriser

Transfer

System

(Dry) (Wet)

Figure 1: Process showing Handling and Storage of Fly Ash

Source: CPCB Guidelines for Transporting Fly ash, 2013

14

WORKING REPORT – FLY ASH

¾ Pneumatic conveying

¾ Lean slurry disposal system

¾ Medium concentration slurry disposal system

¾ High concentration slurry disposal system

¾ Dry(moist)conveyingsystemthroughbeltconveyor/

tube-belt conveyor

Handling and Disposal of Fly Ash

outside the Power Plant

Fly ash is generally transported either from fly-ash silo

or ash pond. The modes of fly-ash transportation are

discussed ahead.

¾ Fly ash is generally transported by tractor trollies or

trucks by brick manufacturers, cement manufacturers,

and construction agencies based upon the

requirementanddistance(CPCB,2013).

¾ Thermal power plants generally construct silos for

intermediate storage of dry fly ash. After fly ash is

loaded into these silos, it is transported to cement

plants either by bulkers or trucks covered with

tarpaulins(seeFigure2).

¾ Fly ash is also transported to abandoned mines by

trucks covered suitably with tarpaulins. However, due

to the non-availability of abandoned mines, mine

backfilling using fly ash is carried out in very few

thermalpowerplants(CPCB,2013).Asperthe2009

notification, fly-ash disposal in abandoned mines or

quarries should be carried out under the guidance of

theDirectorateGeneralofMine Safety (DGMS) and

the power plant authorities shall regularly monitor

the groundwater in the surrounding area to assess

groundwater contamination.

Figure 2:Photograph showing Fly Ash Loading Silos and Road Bulkers

Source: TERI

Fly-Ash Generation and

Utilization in India

Indian coal is low-grade with an ash content of 30–45%,

in comparison to imported coal which has low ash

content, that is, 10–15%. (CEA, 2016-17) This results in

the generation of large quantities of ash by coal-/lignite-

based TPS in the country.

Fly-Ash Production

The Central Electricity Authority (CEA) has been

monitoring the status of fly-ash generation and its

utilization in the country since 1996. As per the CEA

report,(CEA,2016-17)datacollatedfrom155TPSacross

the country has been presented here to arrive at the

present status of fly-ash generation and utilization in

India.

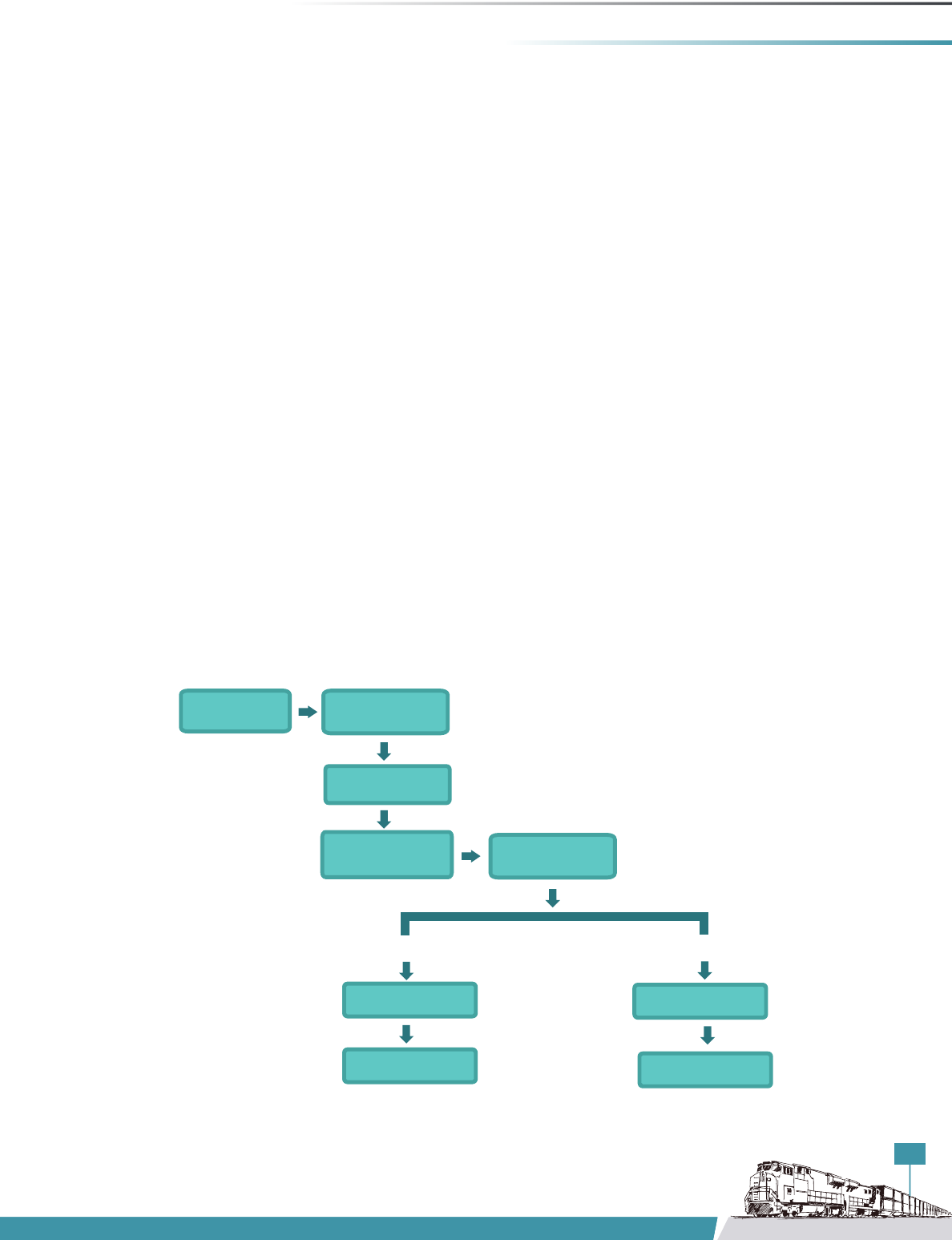

Fly-ash generation has increased from 68.9 million

tonnes in 1996–97 to 169.3 million tonnes in 2016–17

(CEA, 2016-17). Figure 3 shows the progressing y-ash

generationfrom1996–97to2016–17.

Similarly, the utilization of fly ash has increased from

6.6milliontonnesin1996–97to107.1milliontonnesin

2016–17(CEA,2016-17).Figure4showstheprogressing

y-ashutilizationfrom1996–97to2016–17.

A large number of technologies have been developed

for the gainful utilization and safe management of fly

ash. As a result, both the generation and utilization of fly

ash have increased significantly over the past decade.

Figure 5 represents the total annual production of fly

ash along with its corresponding utilization figures. The

percentage of fly-ash utilization has increased from 9.6%

in1996–97to63.3%in2016–17.

Although it appears from the Figure 5 that the utilization

of fly ash has increased significantly in recent years, it

does not entirely reflect the reality of the situation. It is

important to note that the annual backlog tonnage of

fly ash has been neglected in this analysis to arrive at the

exact utilization level; hence, it is necessary to include

the same to arrive at more realistic figures, and if we were

to do so, the utilization level will go down significantly.

15

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 5: An Overall Scenario of Fly Ash Production in India

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

0

10

20

30

40

50

60

70

0

20

40

60

80

100

120

140

160

180

200

1996-97

1997-98

1998-99

1999-2000

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

Fly Ash Ulizaon (%)

Million Tonnes

Year

Fly Ash Scenario in India: Producon vs Ulizaon

Fly Ash Producon (million-tonne) Fly Ash Ulizaon (million-tonne)

68.9

78.1

79.0

74.0

86.3

82.8

91.7

96.3

98.6

99.0

108.2

116.9

116.7

123.5

131.1

145.4

163.6

172.9

184.1

176.7

169.3

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

160.0

180.0

200.0

1996-97

1997-98

1998-99

1999-2000

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

Million Tonnes

Year

Fly Ash Generaon (million-tonne)

Figure 3: Scenario of Fly Ash Generation in India

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

6.6

8.4

9.2

8.9

13.5

15.6

20.8

28.3

37.5

45.2

55.0

62.0

66.6

77.3

73.1

85.1

100.4

99.6

102.5

107.8

107.1

0.0

20.0

40.0

60.0

80.0

100.0

120.0

1996-97

1997-98

1998-99

1999-2000

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

Million Tonnes

Year

Fly Ash Ulizaon (million-tonne)

Figure 4: Scenario of Fly Ash Utilization in India

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

16

WORKING REPORT – FLY ASH

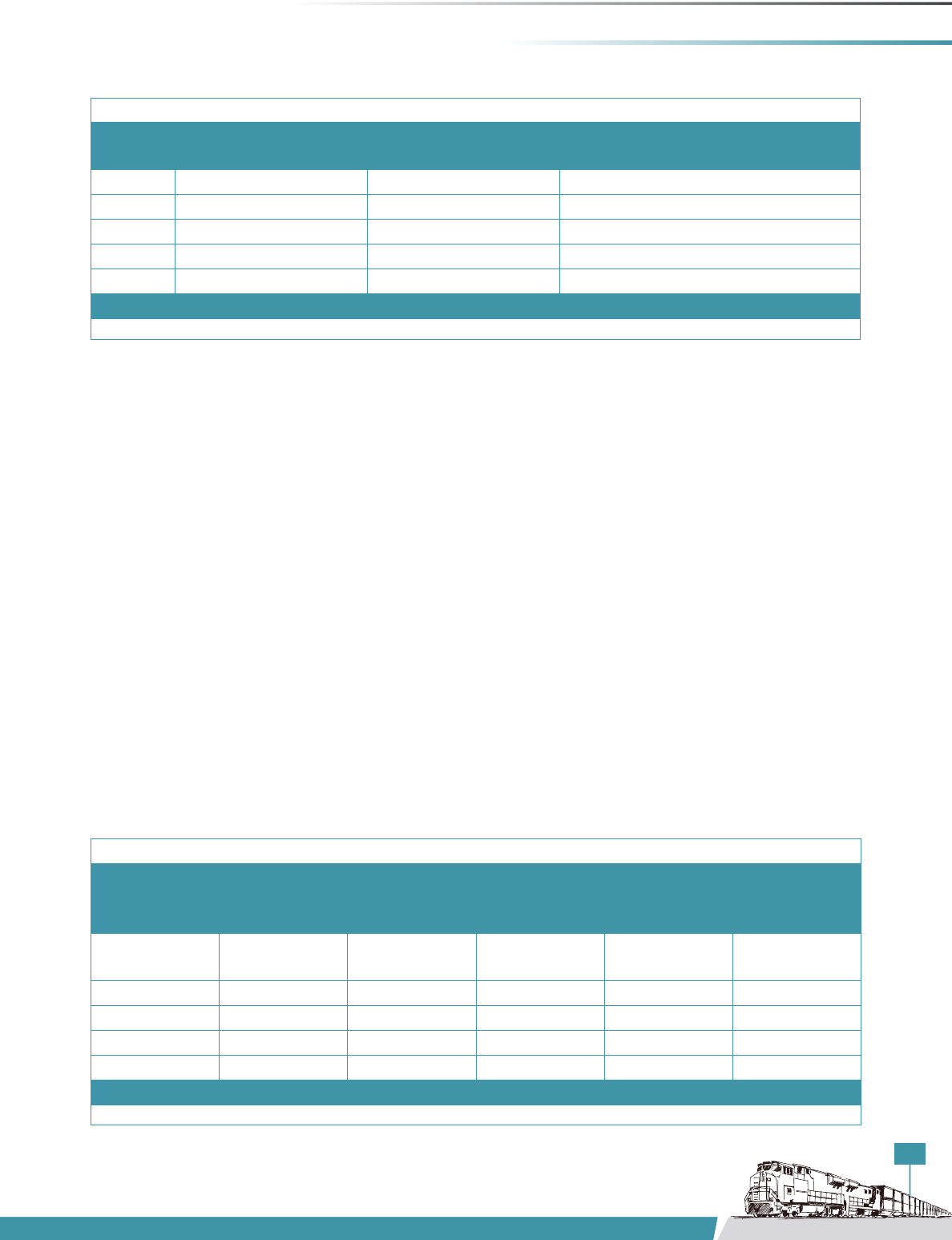

Table 1: Annual Backlog of Fly Ash along with Percent of Utilization

S. No. Year Fly Ash

Production

(Million-

Tonnes)

Fly Ash

Utilization

(Million-

Tonnes)

Fly Ash

Utilization

Cumulative

Backlog of

Fly Ash

( Million

Tonnes)

Fly Ash

Utilization

in % (After

Including

Backlog

Tonnage)

1 1996-97 68.9 6.6 9.6% 62.2 -

2 1997-98 78.1 8.4 10.8% 131.9 6%

3 1998-99 79.0 9.2 11.7% 201.6 5%

4 1999-2000 74.0 8.9 12.0% 266.8 3%

5 2000-01 86.3 13.5 15.7% 339.5 4%

6 2001-02 82.8 15.6 18.8% 406.8 4%

7 2002-03 91.7 20.8 22.7% 477.6 4%

8 2003-04 96.3 28.3 29.4% 545.6 5%

9 2004-05 98.6 37.5 38.0% 606.7 6%

10 2005-06 99.0 45.2 45.7% 660.4 7%

11 2006-07 108.2 55.0 50.9% 713.6 8%

12 2007-08 116.9 62.0 53.0% 768.5 8%

13 2008-09 116.7 66.6 57.1% 818.6 8%

14 2009-10 123.5 77.3 62.6% 864.8 9%

15 2010-11 131.1 73.1 55.8% 922.8 8%

16 2011-12 145.4 85.1 58.5% 983.1 9%

17 2012-13 163.6 100.4 61.4% 1,046.3 10%

18 2013-14 172.9 99.6 57.6% 1,119.6 9%

19 2014-15 184.1 102.5 55.7% 1,201.2 9%

20 2015-16 176.7 107.8 61.0% 1,270.1 8%

21 2016-17 169.3 107.1 63.3% 1,332.3 8%

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

Table 1 represents the details of fly-ash backlog along

with the utilization percentage. Lower utilization of

fly ash over the years has led to the piling up of huge

stocks of fly ash. The table makes it evident that a total

of 1,332 million tonnes of fly ash has been stocked on

groundasof2016–17,ofwhichonly107milliontonnes

were utilized, that is, only 8% of the total fly ash available

on ground. The table also highlights the significant

difference between percentages of utilization before

and after, including the backlog stocks of fly ash. It is to

be noted that the utility of fly ash diminishes with time

due to contamination.

17

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 6:StatewiseScenarioofFlyAshProductioninIndia(2016-17)

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

State-Wise Scenario of Fly-Ash

Production

State-wise generation trends for 2016–17 suggest

that Andhra Pradesh, Chhattisgarh, Madhya Pradesh,

Maharashtra, Uttar Pradesh, and West Bengal are the

most significant states contributing to more than 50%

of the total fly-ash generation in the country. Figure 6

shows the state-wise production of fly ash in the country.

It is evident from the map that Uttar Pradesh and

Chhattisgarh produce the maximum fly ash, whereas

Punjab, Haryana, Karnataka, and Telangana are the states

with least production.

The reason these states have higher production is

the number of power plants installed within their

boundaries. These states have the highest number of

thermalpowerplantsinstalledinthecountry(seeTable

2).AlthoughGujaratisanexception,asdespitethetotal

installed capacity of 15,472 MW, it has generated only

3.5 million tonnes of fly ash. Most of these power plants

useimportedcoalwithashcontentaslowas6–7%, as

compared to Indian coal with ash content of 30–45%.

Hence, the amount of ash produced is also comparatively

less. Table 2 shows the generation and utilization figures

of all the states.

18

WORKING REPORT – FLY ASH

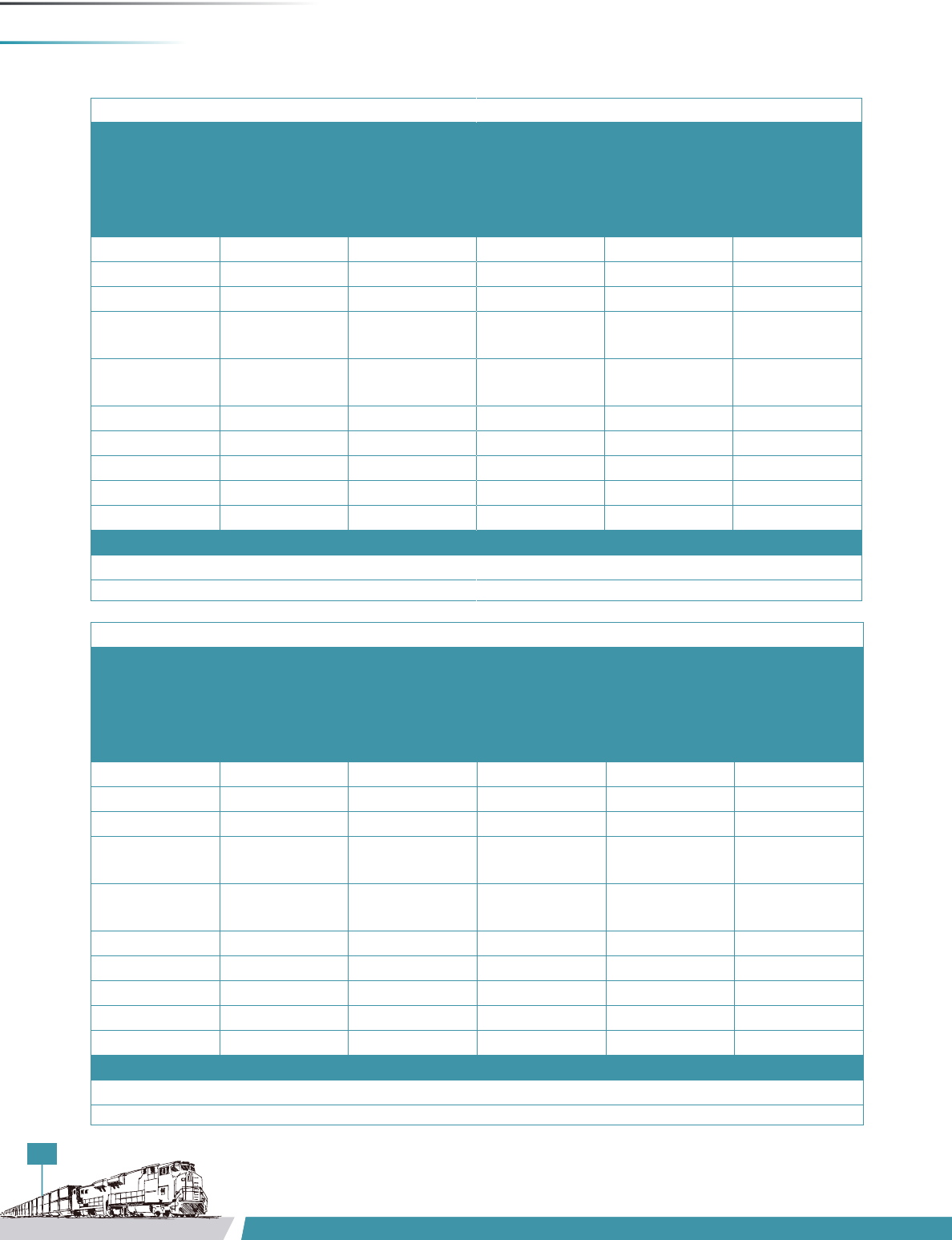

Table 2 : State wise scenario of fly ash production in India

S.No. State No. of

Thermal

Power

Stations

Installed

Capacity

(MW)

Fly Ash

Generation

(Million-

Tonnes)

Fly Ash

Utilization

(Million-

Tonnes)

Fly Ash

Utilization

in %

1 Uttar Pradesh 18 19,104 28.3 13.2 47%

2 Chhattisgarh 20 17,740 25.2 10.8 43%

3 Andhra Pradesh 10 10,973 17.8 12.7 71%

4 West Bengal 17 14,142 16.7 13.8 83%

5 Maharashtra 20 21,556 16.5 11.8 71%

6 Odisha 5 5,188 11.5 6.4 56%

7 Madhya Pradesh 7 10,640 11.4 4.1 36%

8 Bihar 4 4,100 7.4 2.4 32%

9 Rajasthan 8 7,840 6.8 6.4 95%

10 Jharkhand 7 5,613 6.7 7.3 108%

11 Tamil Nadu 10 8,430 6.2 4.6 75%

12 Haryana 5 5,550 4.1 5.3 128%

13 Gujarat 11 15,472 3.5 3.5 102%

14 Karnataka 4 5,480 3.1 1.7 56%

15 Telangana 3 1,820 2.7 1.0 36%

16 Punjab 3 2,640 0.9 1.4 162%

17 Delhi 2 840 0.4 0.6 157%

18 Assam 1 250 0.2 0.0 0%

Grand Total 155 1,57,377 169.3 107.1 63%

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

As evident from Table 2, states generating more fly

ash do not necessarily have a higher percentage of

utilization when compared to other states. States like

Jharkhand, Haryana, Gujarat, Punjab, and Delhi are

utilizing more than what they are generating, hence

acting as consumption centres of fly ash. On the contrary,

the utilization figures of states like Bihar, Chhattisgarh,

Madhya Pradesh, and Telangana hover around 30–40%,

which is the lowest amongst all the states.

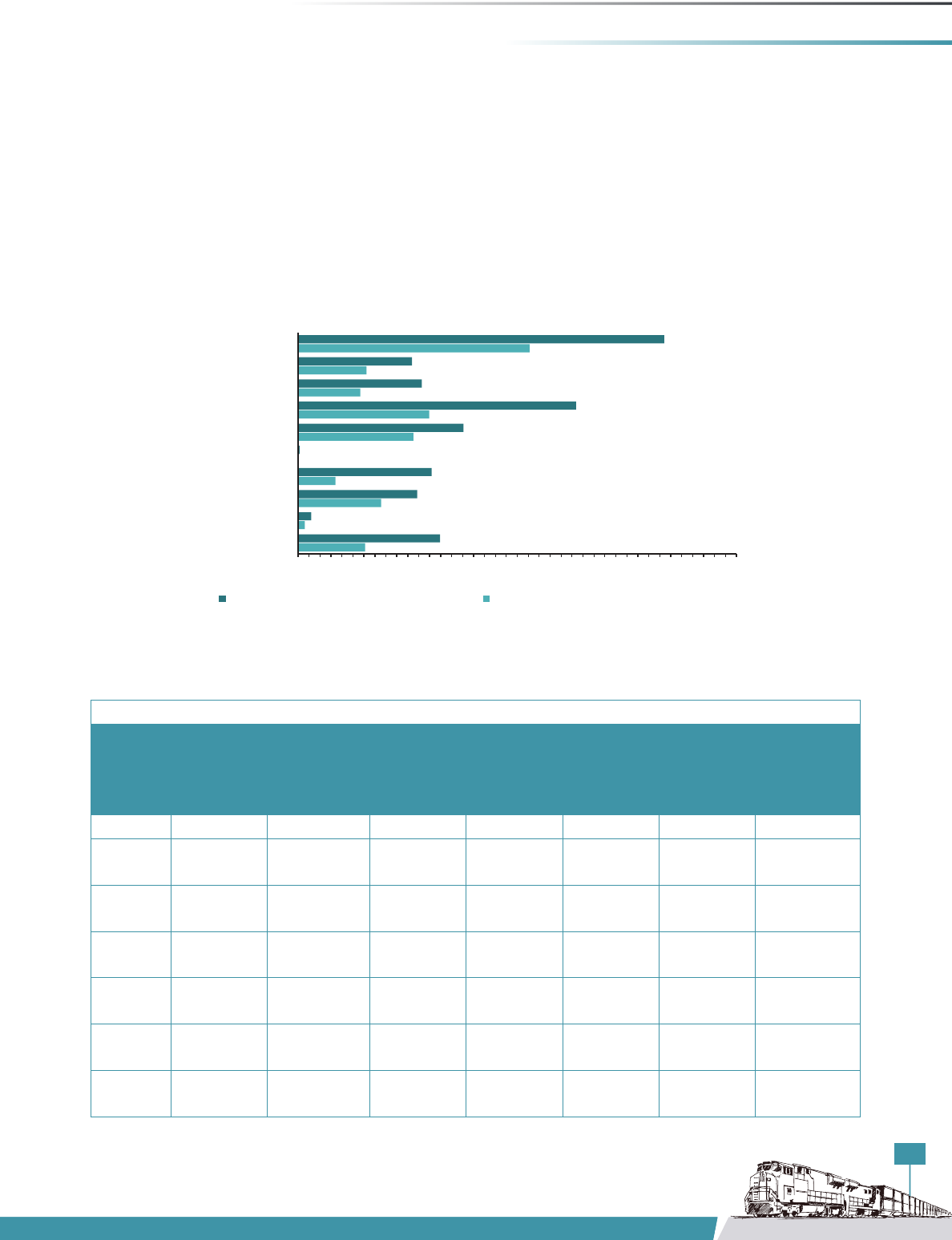

Plant-Wise Scenario of Fly-Ash

Production

Most of the fly-ash generation can be attributed to TPS

located in the states of Uttar Pradesh, Madhya Pradesh,

Chhattisgarh, West Bengal, and Andhra Pradesh. Figure

7showsthelocationofthesepowerplants.Itisevident

from the map that most of the fly-ash production

clusters are located in the middle-eastern part of the

country. The size of the circles in the map represents the

corresponding generation values of each power plant in

million tonnes.

Table 3 lists the top 20 power plants in the country in terms

of fly-ash generation. NTPC Vindhyachal tops the list with

anannualproductionof7.6million tonnesin2016–17

followed by Anpara, NTPC Talcher in Odisha, and NTPC

Sipat and Korba in Chhattisgarh. As mentioned earlier

also, these thermal power stations may not necessarily

be the ones with the highest installed capacity, but since

they use coal with comparatively higher ash content, the

fly-ash generation values are higher irrespective of their

installed capacity.

19

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 7: Location of Coal/Lignite based Thermal Power Stations in India

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17) & TERI Analysis

Table 3:ListofTop20ThermalPowerStations(TPS)inIndiaintermsofGenerationofFlyAsh

Name of TPS Power Utility &

State

Installed

Capacity (MW)

Fly Ash

Generation

(Million Tonnes)

Fly Ash

Utilization

(Million Tonnes)

Percentage

Utilization (%)

Vindhyachal

(Madhya

Pradesh)

NTPC Ltd.

(Madhya

Pradesh)

4,760 7.6 1.8 23.5%

Anpara

(UttarPradesh)

UPRVYNL

(UttarPradesh)

2,630 7.2 0.0 0.4%

Talcher(Odisha) NTPC Ltd.

(Odisha)

3,000 7.1 3.1 43.2%

Sipat

(Chhattisgarh)

NTPC Ltd.

(Chhattisgarh)

2,980 5.4 1.2 22.8%

Korba

(Chhattisgarh)

NTPC Ltd.

(Chhattisgarh)

2,600 5.1 2.3 45.0%

20

WORKING REPORT – FLY ASH

Table 3:ListofTop20ThermalPowerStations(TPS)inIndiaintermsofGenerationofFlyAsh

Name of TPS Power Utility &

State

Installed

Capacity (MW)

Fly Ash

Generation

(Million Tonnes)

Fly Ash

Utilization

(Million Tonnes)

Percentage

Utilization (%)

Kahalgaon

(Bihar)

NTPCLtd.(Bihar) 2,340 5.1 2.2 44.0%

Rihand

(UttarPradesh)

NTPC Ltd.

(UttarPradesh)

3,000 4.9 0.8 15.5%

Ramagundam

(Andhra

Pradesh)

NTPC Ltd.

(Andhra

Pradesh)

2,600 4.7 4.4 93.1%

Dr. Narla Tata

RaoTPS(Andhra

Pradesh)

APGENCO

(Andhra

Pradesh)

1,760 4.0 3.0 75.4%

Mejia

(WestBengal)

DVC

(WestBengal)

2,340 3.7 4.0 107.0%

Singrauli

(UttarPradesh)

NTPCLtd.(U.P.) 2,000 3.7 0.3 9.1%

Adani Power Ltd.

(Maharashtra)

Adani Power Ltd.

(Maharashtra)

3,300 3.5 2.2 62.2%

Chandrapur

(Maharashtra)

MSPGCL

(Maharashtra)

2,340 3.4 1.6 47.6%

Simhadri

(Andhra

Pradesh)

NTPC Ltd.

(Andhra

Pradesh)

2,000 3.1 206 83.7%

NTPC Farakka

(WestBengal)

NTPC Ltd.

(WestBengal)

2,100 3.0 1.7 55.3%

Korba(West)

(Chhattisgarh)

CSPGCL

(Chhattisgarh)

1,340 3.0 0.1 2.2%

Raichur

(Karnataka)

KPCL(Karnataka) 1,720 2.6 1.4 52.8%

Barh Super TPS

(Bihar)

NTPCLtd.(Bihar) 1,320 2.1 0.1 4.6%

Kolaghat(West

Bengal)

WBPDCL

(WestBengal)

1,260 2.1 2.4 117.6%

Khaparkheda

(Maharashtra)

MSPGCL

(Maharashtra)

1,340 2.0 0.7 36.2%

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

21

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 8: Top20TPSinIndiaalongwithProductionFigures(2016-17)

Source : Report on Fly Ash Generation , Central Electricity Authority (2016-17) & TERI Analysis

Table 4 : Mode of Fly ash Utilization

S. No. Mode of Utilization Million-Tonnes

1 Cement manufacturing 40.6

2 Mine filling 11.8

3 Bricks & tiles manufacturing 14.9

4 Reclamation of low lying areas 11.0

5 Ash dyke raising 11.9

6 Roads & flyovers 6.2

7 Agriculture 1.9

8 Concrete 0.8

9 Hydro power sector 0.0

10 Others 8.0

11 Unutilized fly ash 62.2

Total 169.3

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

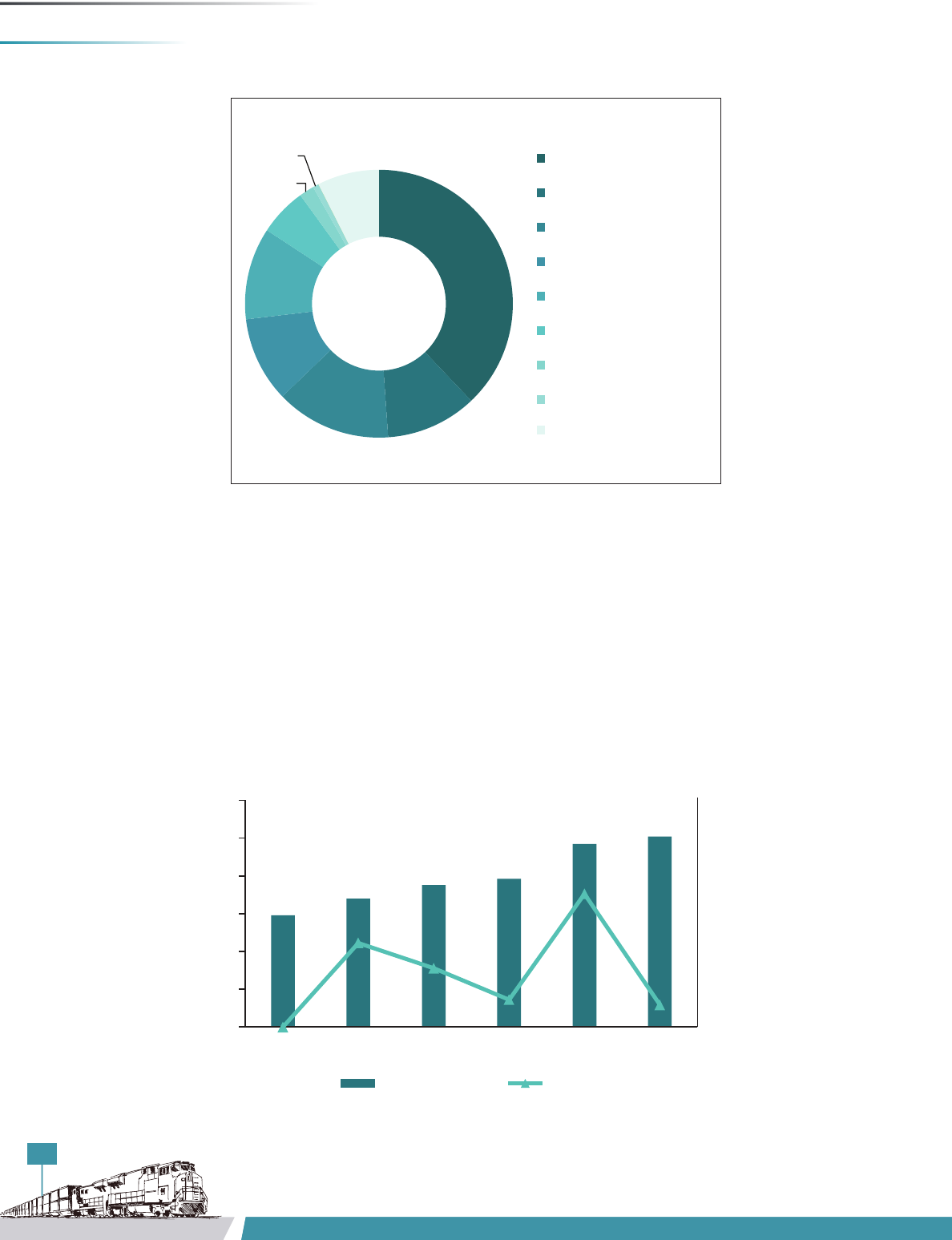

Mode of Fly-Ash Utilization

Fly ash, which was once considered to be ‘hazardous

industrial waste’, has now acquired the status of a

resourceful commodity. The current major modes of fly-

ash utilization in the country as per the CEA are shown

in Table 4.

Table 4 shows that cement manufacturing has the

largest share of fly-ash consumption, followed by brick

manufacturing, reclamation of low-lying areas, and mine

filling. Also, a significant amount of fly ash is still not

utilized. Figure 9 shows the modes of fly ash utilization

during 2016–17. In this report, focus is on the use of

fly ash by cement plants, since bulk movement of the

product is possible by rail with consumption centres

concentrated in select regions.

22

WORKING REPORT – FLY ASH

Fly-Ash Transport in Indian

Railways

As per the data received from the Centre for Railway

Information Systems (CRIS), Ministry of Railways, the

tonnage of fly ash carried by railways increased from

1.5 million tonnes in 2011–12 to 2.5 million tonnes in

2016–17.Althoughwhencomparedtothetotalyash

transported, the share of Indian Railways is substantially

low. The modal share of railways in transporting fly ash,

which was 1.7% in 2011–12, has slightly increased to

2.3% in 2016–17. As per CRIS, Indian Railways carried

1.8 million tonnes of y ash during 2017-18. However,

calculations regarding modal share of railways could

not be done as data related to fly ash generation and

utilizationfor2017-18werenotreleasedbytheCEA(at

thetimeofpublishingthisreport).

1.48

1.7

1.88

1.96

2.42

2.52

0

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0

0.5

1

1.5

2

2.5

3

2011-2012 2012-2013 2013-2014 2014-2015 2015-2016 2016-2017

Growth (%)

Tonnage Carried (Million Tonnes)

Fly Ash Carried by Indian Railways

Tonnage Carried Growth(%)

Figure 10: Fly Ash Tonnage Carried by Railways

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

38%

11%

14%

10%

11%

6%

2%

1%

7%

Mode of Ulizaon of Fly Ash during Year 2016-17 (%)

Cement

Mine filling

Bricks & Tiles

Reclamaon of low lying

area

Ash Dyke Raising

Roads & flyovers

Agriculture

Concrete

Others

Figure 9: Major Modes of Fly Ash Utilization

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17)

23

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Table 5: Scenario of Fly Ash Transport by Indian Railways

Year Trips Originating Tonnage Carried

(Million Tonnes)

Net Tonne

Kilometres

(Million)

Average Lead (Km)

2011-2012 507 1.5 866 586

2012-2013 576 1.7 954 562

2013-2014 644 1.9 1107 590

2014-2015 660 2.0 1137 579

2015-2016 833 2.4 1443 595

2016-2017 856 2.5 1403 556

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

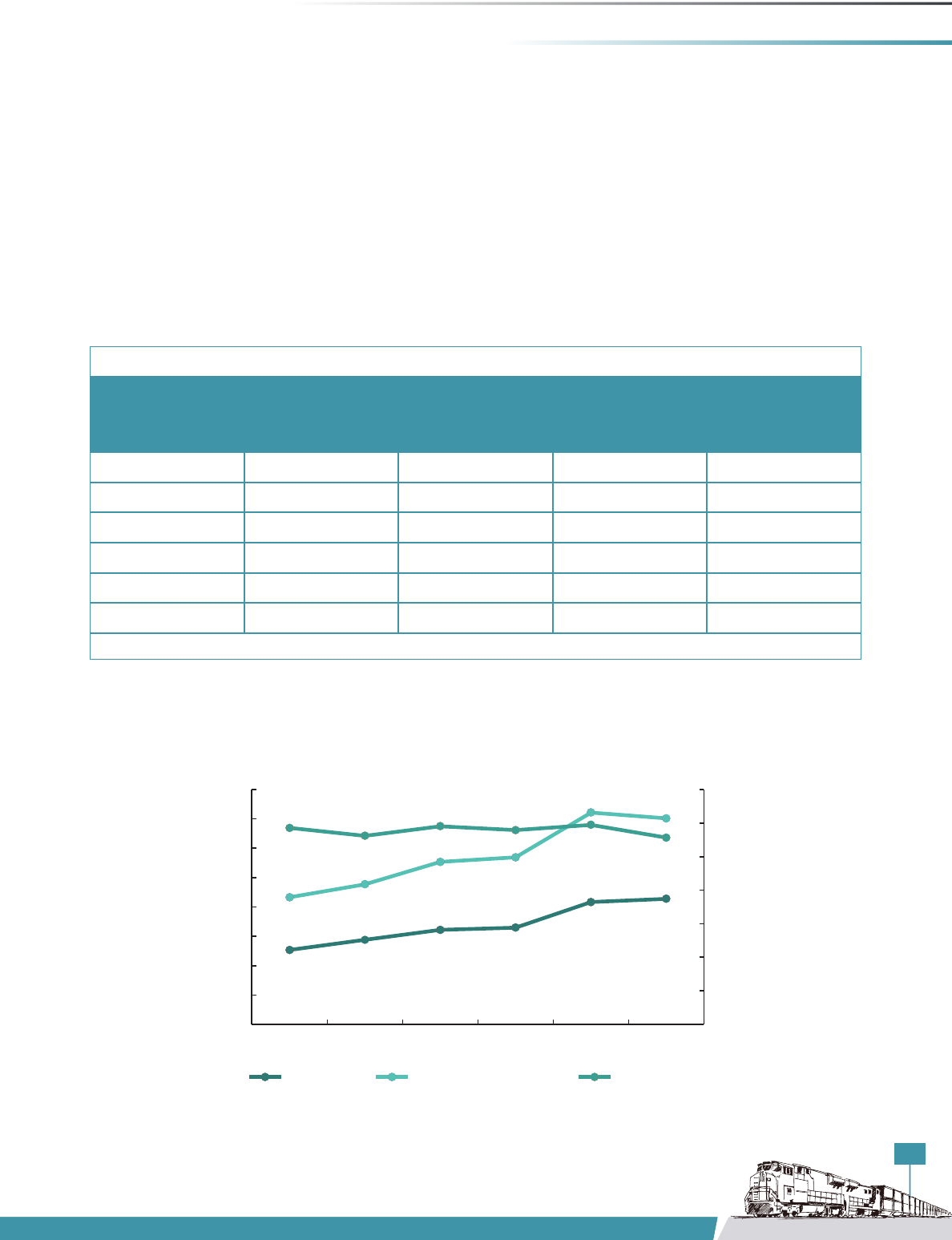

Figure 11: Fly Ash Movement Trends in Indian Railways

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

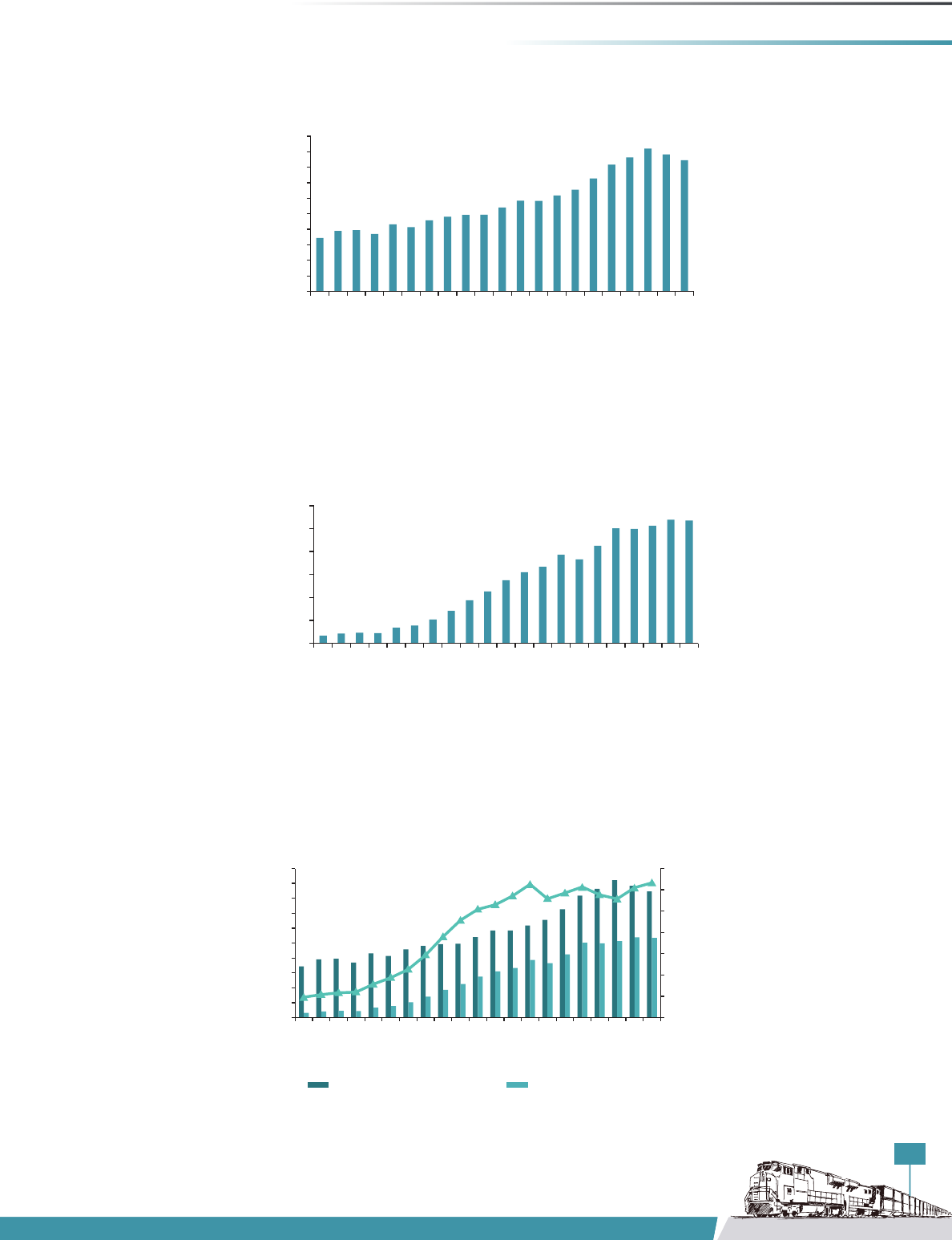

Figure 10 shows that although the tonnage of fly ash

carried by railways increased significantly, from 2011-12

to2016-17,thegrowthrateforthesamehas notbeen

smooth. There was a substantial spike in growth from 5%

in 2015 to 23% in 2016, but it has again declined to 4%

in2017,whichisthelowestmarkforrailwaysinthepast

six years. Table 5 shows the various parameters related to

fly-ash movement by rail.

0

100

200

300

400

500

600

700

0

200

400

600

800

1000

1200

1400

1600

2011-12 2012-13 2013-14 2014-15 2015-16 2016-17

Average Lead (Km)

NTKM's (Million Tonnes)

Fly Ash Movement Trends in Indian Railways

No of Trips NTKM's(million tonnes) Avg Lead(km's)

The number of rake movements containing fly ash

hasincreasedfrom507tripsin2011–12to856tripsin

2016–17(seeFigure11).Similarly,nettonnekmhasalso

increased from 866 million to 1,403 million. The average

lead over which Indian Railways has been transporting

fly ash has stayed more or less constant over the past few

years, ranging between 550 km and 600 km.

24

WORKING REPORT – FLY ASH

Table 6:Origin-DestinationTable showing rake movementof y ash byIndian Railwaysbetween 2011 and 2017

(Numberofrakes)

O/D Assam Bangladesh Bihar Jharkhand Kerala Karnataka MP Tripura UP West

Bengal

Production

Ends

Assam 2 2

Bihar 720 28 53 1 4 806

Jharkhand 499 18 121 1 1 2 642

Karnataka 1 1,066 1,067

Maharashtra 11 11

MP 3 3

Odisha 1 1

Telangana 243 243

UP 1 1 2

West Bengal 1,242 31 19 1 7 1,300

Attraction

Ends

2,464 77 193 1 1 1,320 1 1 5 14 4,076

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

Table 7 : Major Origin Nodes in terms of Fly Ash Transport through Indian Railways

S.No. Originating Stations Avg. Rakes/Year

1 Siuri, West Bengal 180

2 ARVCementSocietyandACCLtd.(RaichurKPCL),Karnataka 178

3 NTPC Private siding, Kahalgaon 134

4 Private siding of m/s TATA Power Company Ltd. at Jojobera 105

5 KesoramCementLtd.,Raghavapuram(NTPCRamagundam) 35

6 Dhulianganga(NTPCFarakka) 28

Grand Total 660

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

Origin-Destination Analysis

An origin-destination (O-D) analysis has also been

carried out to understand the spatial pattern of fly-ash

transportation in India by Indian Railways. As evident

from Table 6, Bihar, Jharkhand, Karnataka, and West

Bengal have the major share of originating trips for fly-

ash transport by railways, whereas Assam and Karnataka

serve as the major attraction/consumption zones where

fly ash is being transported by railways.

Further, the O-D data suggests that most of these

originating trips have been concentrated in only a few

origin stations rather than being distributed uniformly

across the country, which means transport by railways

has been restricted toselected stations.Table 7 shows

the details of such stations.

A total of 4,076 rakes of y ash have been moved by

IndianRailwaysbetween2011and2017,whichgivesan

averageof679rakesperyear.ItisevidentfromTable7

that a total of 660 rakes in a year are originating from

theabovesixstations,whichmeansthataround97%of

the total originating trips in a year are attributed to these

stations only.

Similarly, Table 8 gives us a peek into the destination

ends of the fly ash rakes carried by Indian Railways.

Again,consideringatotalaverageof679rakesperyear,

which are reaching various destinations, the destinations

of641rakesareconcentratedinonly11stations(shown

inTable8), which means that around 94% of the total

destined trips are attributed to these stations only.

25

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Table 8: Major Destination Nodes in terms of Fly Ash Transport through Indian Railways

S.No. Destination Stations Avg. Rakes/Year

1 Digaru, Assam 184

2 Vasavadatta Cement Ltd, Karnataka 94

3 UltraTechCementLimited(UnitofRajashreeCementWorks),Karnataka 69

4 Tetelia, Assam 59

5 ACCLtd.Siding(Wadi),Karnataka 56

6 Chang Sari, Assam 56

7 Lanka, Assam 38

8 New Guwahati Goodshed, Assam 30

9 Raxaul Junction, Bihar 30

10 Amoni, Assam 15

11 Barpeta Road, Assam 10

Grand Total 641

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17)

Figure 12 : Major Origin and Destination Nodes for Transporting Fly Ash through Railways

Source: Centre for Railway Information Systems, Ministry of Railways (2016-17) & TERI Analysis

Figure 12 shows the major origin and destination nodes

based on O-D analysis.

26

WORKING REPORT – FLY ASH

Rake Composition

As per the CPCB guidelines, specially designed railway

wagons should be used for transporting fly ash by rail,

but as of now, most of the fly ash is being transported

in BCN wagons (see Figure13), which are mainly used

fortransportingcement.Around67%ofthetotalyash

is transported in BCN wagons, where it is first bagged

and then loaded into the wagons. Specialized fly-ash

wagons are being used on only few circuits such as

Raichur and Ramagundam. Cement manufacturers in

these circuits have procured BCCW and BCFC wagons,

which are being used to transport fly ash from thermal

powerplantslocatedinRaichurandRamagundam(see

Figure 13: Various type of Wagons used in transporting fly ash via Rail

Source:CentreforRailwayInformationSystems,MinistryofRailways(2016-17)

Figure 14:

Covered Car “BCCW’’ wagon for bulk transport of Cement/Fly Ash

Source : Texmaco Rail & Engineering

1

Figure 16: BTAP Wagon

Source: Texmaco Rail & Engineering

3

Figure 15: BCCW wagons for bulk transport of Cement/Fly Ash

Source: Texmaco Rail & Engineering

2

1

https://www.texmaco.in/webfiles/product.php?product_cat_id=3

2

http://www.touaxtexmaco.com/content/bccw-cement-wagon

3

http://www.touaxtexmaco.com/type/tank-wagons

67.2%

31.0%

1.4%

0.4%

Share of various type of wagons used in

transporng fly ash via Rail

BCN

BCCW

BCFC

BOXN

Figures14and 15).Thesearetop-loadingandbottom-

discharge wagons. Around 31% of the total fly ash is

being transported in BCCW wagons, followed by BCFC

wagons which contribute to merely 1.4%.

Another type of wagon, which is still under the trial phase

fortransportingyash,istheBTAPwagon(seeFigure16).

This wagon is used to transport alumina powder. Trials

for bulk transportation of fly ash have been undertaken

by NTPC in BTAP wagons, but commercial operation

of such wagons is still awaited. These are top-loading

wagons and have the option for both bottom- and side-

discharge.

27

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

4

See https://www.downtoearth.org.in/news/cpwd-no-fly-ash-zone-11910

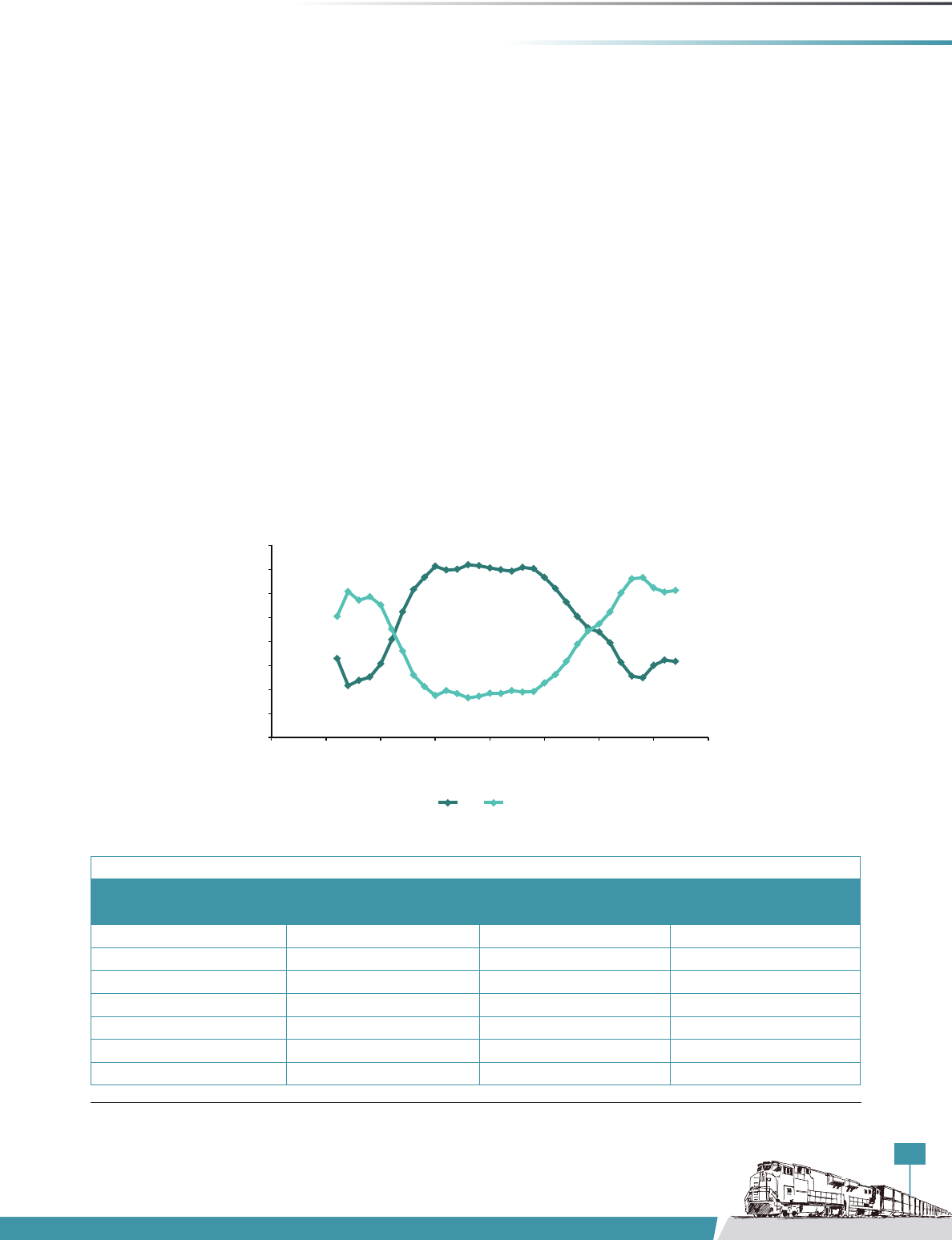

Figure 17: Share of PPC cement and OPC cement in total cement production

Source: Cement Manufacturers Association (CMA)

0

10

20

30

40

50

60

70

80

1975 1980 1985 1990 1995 2000 2005 2010 2015

Percentage

Year

Changing Shares of OPC & PPC

OPC PPC

Fly-Ash Transport in Cement

Industry

As mentioned earlier also, cement industry is the

largest consumer of y ash in the country (see Figure

9). Fly ash can either be blended with cement at the

time of production (Portland Pozzolana Cement [PPC])

or added as an admixture while mixing concrete. This

is done because of fly ash’s pozzolanic behaviour.

Pozzolanic materials are those substances which are

not cementitious in nature but contain certain chemical

constituents. These materials, once combined with

lime and water at ordinary temperature, can develop

cementitious properties. Pozzolana cement is obtained

by blending a mixture of clinkers, up to 35% of pozzolana

(forex-y ash), and the stipulated quantity of gypsum.

The strength of pozzolana is comparable to Ordinary

PortlandCement(OPC)andtheconcreteproducedusing

fly ash has shown a better performance and resistance

towards corrosion and chemical attack.

With nearly 280 million tonnes of cement production

in 2016–17 (Ministryof Commerceand Industry 2017),

the Indian cement industry is the second-largest in the

world. While cement production has increased steadily,

its composition in terms of OPC and PPC has changed

signicantly(seeFigure17).Intheperiodpriorto1986,

the use of PPC in cement production was significant,

for instance, in 1983, PPC constituted 80% of the total

cement produced. PPC production came down to less

than 20% in 1990 and remained at this level for almost a

decade. The downslide was a fallout of the Central Public

WorksDepartment’s(CPWD)circularbanningtheuseof

PPC

4

. The ban was subsequently rolled back in 2004 and

PPC production increased to more than 50% of the total

cement production in 2006.

Table 9 gives the breakup of the cement produced from

2000–01to2007–08,alongwithPPCproduction.

Table 9: PPC’s share in the total cement production

Year Cement Production

(Million Tonnes)

PPC Production

(Million Tonnes)

% of Total Production

2000-01 93.6 24.5 26.2

2001-02 102.4 32.3 31.5

2002-03 111.4 43.1 38.7

2003-04 117.5 52.1 44.4

2004-05 127.6 60.2 47.2

2005-06 141.8 74.0 52.2

2006-07 155.7 93.6 60.1

28

WORKING REPORT – FLY ASH

5

242 Cement Plants as provided by Cement Manufacturers Association

6

142 Thermal Power Plants as mentioned in CEA Report, 2016-17

Due to the unavailability of data, the updated figures

for PPC’s share in recent years have not been presented

here, but as per the discussion with stakeholders,

PPC’s share in cement production at present is likely

to be somewhere around 65%. Considering the 280

million tonnes of cement production in 2016–17, PPC

production can be pegged at around 182 million

tonnes. At a rough estimate of 20% of fly-ash blending

in producing PPC-grade cement, the total amount of fly

ashusedin2016–17bythecementindustrytoproduce

182 million tonnes of PPC would be about 36.4 million

tonnes, which is close to the total fly-ash consumption

bythe cement industry in thesame year (seeTable 4).

Hence,theshareofPPCproduction(65%)seemsmore

orlessaccuratefor2016-17.Inthecomingyears,withthe

Indian economy doing well, the per capita consumption

of cement is also likely to increase, putting more

pressure on cement production. Hence, there is a clear

possibility that PPC production will increase, and so will

the demand for fly ash. Therefore, the cement industry is

expected to remain the single-biggest consumer of fly

ash in the coming years.

Figure 18 shows the distribution of cement plants

5

as

well as thermal power plants

6

in India. Cement plants, the

largest consumers of fly ash, are generally located close

to limestone deposits, which is the basic raw material

for cement production. In India, there are several such

clusters of cement plants around large limestone

deposits.

Many cement manufacturers have established split-

grinding units close to the consumption centres, where

the clinker brought from the mother plant are passed

through the grinding stage, bagged, and dispatched to

the market. Some of the cement manufacturers have

established split-grinding units close to TPS, so that fly ash

can be utilized without entailing a high transportation

cost. The proximity of these cement plants has been

calculated by plotting a 100-km buffer from the TPS.

As Figure 18 shows, of the 242 cement plants plotted

onthemap(actualnumbersmightvaryslightlydueto

theunavailabilityofafewplantlocations),172cement

plants were located within a distance range of 100 km

from TPS. Further, if we increase this buffer up to 300 km

(seeFigure19),thisnumberincreasesfrom172to225,

which means that a total of 53 cement plants are located

within a distance range of 100–300 km from TPS. This

indicatesthataround71%ofthetotalcementplantsare

located within a 100-km buffer of thermal power plants,

and around 22% of cement plants are located within a

buffer of 100–300 km.

A few cement plants are also located in isolated places.

It is clear from Figure 19 that the spatial distribution

of cement-manufacturing units follows the spatial

patterns of fly-ash producers, i.e. TPSs, for example, the

cement plants located near the Singrauli, Anpara, and

Vindhyachal cluster of power plants and the cement

plants located near Kahalgaon, Farakka, Mejia, and

Kolaghat.

Table 9: PPC’s share in the total cement production

Year Cement Production

(Million Tonnes)

PPC Production

(Million Tonnes)

% of Total Production

2007-08 168.3 111.2 66.1

2008-09 181.6 120.8 66.5

2009-10 160.8 100.2 62.3

2010-11 216.3 102.4 60.5

2011-12 230.3 110.1 61.2

2012-13 235.1 - -

2013-14 256.0 - -

2014-15 276.9 - -

2015-16 283.5 - -

2016-17 280.0 - -

Source: Cement Manufacturers Association (CMA)

29

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 19:SpatialdistributionofCementplantsinIndiaalongwiththeThermalPowerPlants(BufferRange–300km)

Source: Report on Fly Ash Generation, CEA (2016–17), and CMA

Figure 18:SpatialdistributionofCementplantsinIndiaalongwiththeThermalPowerPlants(BufferRange–100km)

Source: Report on Fly Ash Generation, Central Electricity Authority (2016-17) & Cement Manufacturers Association

30

WORKING REPORT – FLY ASH

Opportunity of Fly-Ash Transport by

Rail

As discussed earlier also, the cement industry is likely

to be the main consumer of fly ash in the coming years.

Therefore, the report focusses on the possibilities of

transporting fly ash by rail from power plants to cement

plants. Presently, almost all fly-ash transportation

happens by road. The modal share of railways in

transportingyashwasonly2.3%in2016–17.Thermal

power plants generally construct silos for intermediate

storage of fly ash, from where it is transported to cement

plants either by bulkers or rail. Discussions with the

stakeholders from ACC Cement, NTPC, and the CMA

revealed that the major reasons for the use of road

transport are lower capital investment and complete

control over the transportation chain. These companies

have purchased road tankers and given them on labour

contract to agencies for provision of driver and other

manpower. They have also made capital investment at

both ends for the development of loading and unloading

facilities as well as the creation of silos for storage.

Some of these companies have entered into long-term

agreements with power plants for the supply of fly ash

(Nanduri, 2008). As the movement of y ash in road

tankers is expensive and unsuitable for large quantities,

several cement manufacturers have also located clinker-

grinding units close to the power plant.

To understand if it is feasible to transport fly ash by rail, it

is important to relate the patterns of fly-ash production

with the consumption centres, and also understand the

logistical requirements to move fly ash in bulk quantities.

Figure 7 shows that because coal-based power plants

are spread across the country, fly-ash generation is not

evenly distributed. Because of geographical advantage,

large coal-based plants are located in regions of Uttar

Pradesh, Jharkhand, Chhattisgarh, and West Bengal.

Other concentrations can be observed in Telangana and

the Telangana–Maharashtra border in the Wardha Valley

Coalfield. Some major power plants are also located

in Gujarat, Odisha, Bihar, and Andhra Pradesh. For a

better understanding these thermal power plants can

be divided into the following clusters throughout the

country:

Cluster 1: Five coal-based power plants with large

capacities are located in a cluster known as the Singrauli

region at the border of Uttar Pradesh and Madhya

Pradesh. These power plants are Obra, Rihand, Singrauli,

Anpara, and Vindhyachal. They have a combined fly-ash

generation of around 20 million tonnes per year. In the

same region, power plants with slightly lower capacities

are also located at Tanda, Panki, Unchahar, and Parichha.

Cluster 2: In Bihar and West Bengal, the major power

plants are Kahalgaon, Farakka, Mejia, and Kolaghat. The

power plants at Kahalgaon and Farakka alone produce

around 8 million tonnes of fly ash per year.

Cluster 3: In Chhattisgarh, the major power plants are

NTPC Sipat and Korba. Few other state-owned and

private sector plants like Jindal Thermal Power Plant and

others are also located in the same cluster. These power

plants produce around 15 million tonnes of fly ash per

year.

Cluster 4: In the Telangana, Andhra Pradesh, Karnataka,

and Maharashtra cluster, large coal-based power plants

are Ramagundam, Kothagudem, Vijayawada, Simhadri,

Rayalaseema, Raichur, Chandrapur, and Tirora. The

power plants at Ramagundam, Vijayawada, and Raichur

produce more than 10 million tonnes of fly ash per year.

Cluster 5: In the Gujarat and Rajasthan cluster,

Wanakbori, Ukai, Kota, JSW Barmer, and Suratgarh are the

major power plants which produce significant quantities

of fly ash in the western part of India.

Cluster 6: In the Delhi, Punjab, and Haryana cluster,

power plants located at Dadri, Jhajjar, and Hissar produce

significant quantities of fly ash.

Two case studies from the aforementioned clusters have

been selected and presented here to further understand

the various aspects involved in transporting fly ash by

rail and road.

Case Study I

Ramagundam Region

The southern region consisting of states like Telangana,

Andhra Pradesh, and Karnataka houses major power

plants like Ramagundam, Vijayawada, and Raichur, which

produce more than 10 million tonnes of fly ash per

year.In2007,aconcertedeffortwasmadebyRailways,

31

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Rs 1,225 per tonne, but after the introduction of rail

movement, this cost was reduced to Rs 363 per tonne in

thedistanceslabof377km(Nanduri,2008).Therailway

wagons were initially provided by the South Central

Railway by way of in-house modification of the existing

surplus tank wagons (see Figure 21) on the condition

that these wagons would be used only until the cement

plants procure their own specialized wagons. Also,

loading and unloading facilities were created at both

sidings. About 210 surplus four-wheeler tank wagons

were deployed by the South Central Railway for moving

fly ash between Raghavapuram siding and Sedam

(Nanduri, 2008). The wagons used to transport y ash

were only provided as a temporary solution, as Railways

did not have many surplus wagons for modification.

In the long term, Indian Railways/cement companies/

power corporations will have to consider the option of

investing in pneumatic hopper-type wagons.

NTPC, and cement plants to transport fly ash by rail

mode. Kesoram Cement Company, Raghavapuram, a

subsidiary of Vasavadatta Cements, Sedam, entered into

an agreement with NTPC, Ramagundam, to take away fly

ash from NTPC silos by road tankers to Raghavapuram

siding, and from there, to Vasavadatta siding at Sedam

byrailwaywagons,coveringadistanceof377km (see

Figure 20). A pilot study conducted by South Central

Railway for this arrangement showed benefits for all

the parties involved. While cement plants benefitted

from the cheaper transport cost, Indian Railways was

successful in capturing and generating revenue by

capturing the traffic, which would have otherwise been

transported by road.

Prior to this agreement, the entire quantity of fly ash was

transported by road though bulker trucks. Transporting

fly ash through road would cost cement plants around

Figure 20: Map showing the rail connectivity of fly-ash transportation from Raghavapuram siding to Vasavadatta Cements, Sedam

Source: Report on Fly Ash Generation, CEA (2016–17), CMA, and TERI analysis

32

WORKING REPORT – FLY ASH

Figure 21: Railway wagons before and after modification

Source: Report on fly-ash utilization by cement industry (Nanduri, 2008)

Figure 22: Fly-ash loading at NTPC, Ramagundam

Source: The Hindu

7

7

See https://www.thehindu.com/news/cities/Hyderabad/high-demand-for-ntpc-fly-ash/article23282313.ece.

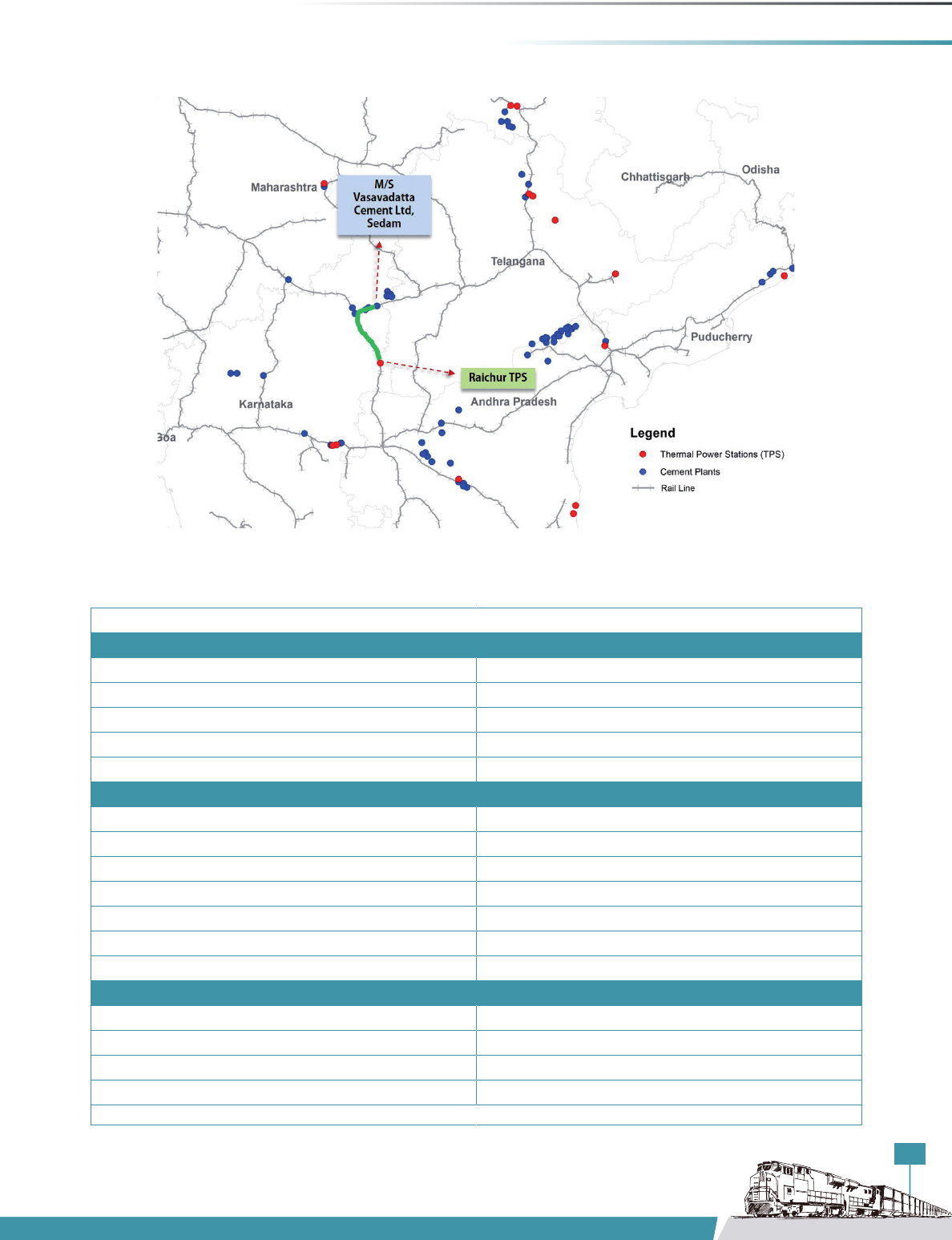

The pilot study has also pointed out the benefits,

specifically to railways, by fly-ash transportation from the

Raichur Thermal Power Station to Vasavadatta Cements,

Sedam(seeFigure23).

As mentioned in the pilot study report, benefits to

railways on both the aforementioned routes have been

listed in Tables 10 and 11 for a better understanding.

33

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Figure 23: Map showing rail connectivity of fly-ash transportation from the Raichur Thermal Power

Station to Vasavadatta Cements, Sedam

Source: Report on Fly Ash Generation, CEA (2016–17), CMA, and TERI analysis

Table10:CostofmovingyashfromRaghavapuramtoSedambyrail(2007–08)

Particulars Details

No. of wagons per rake 40

No. of rakes to be loaded 180

Averagequantityperrake(metrictonnes) 2,400

Totalquantitytobemoved(metrictonnes) 4,32,000

Wagon days per year 14,600

Cost of moving fly ash

Distance 377km

NTKM per year 23,40,49,140

Tare tonne km per year 5,23,03,140

Total GTKM 28,63,52,280

Line-haul cost in 2005–06 per 1000 GTKM in Rs 195

Operational cost in Rs 5,58,38,695

Total distributed costs as derived ratio in Rs 8,93,41,911

Benefit to Railways

Revenue per tonne km in Rs 363

Total revenue in Rs 15,68,16,000

Surplus per year in Rs 6,74,74,089

Surplus after 15% freight concession 43,951,689

Source: Report on fly-ash utilization by cement industry (Nanduri, 2008)

34

WORKING REPORT – FLY ASH

Table11:CostofmovingyashfromRaichurtoSedambyrail(2007–08)

Particulars Details

No. of wagons used 200

No of wagons per rake 40

No. of rakes to be loaded 365

Average quantity per rake 2,400

Total quantity to be moved 8,76,000

Wagon days per year 73,000

Cost of moving fly ash

Distance 150 km

GTKM per year 18,88,32,750

Tare tonne km per year 0

Total GTKM 18,88,32,750

Line-haul cost in 2005–06 per 1000 GTKM 195

Operational cost in Rs 3,68,22,386

Total distributed costs as derived ratio in Rs 5,89,15,818

Benefit to Railways

Revenue per tonne km 140

Total revenue in Rs 15,68,16,000

Surplus per year in Rs 9,79,00,182

Surplus after 15% freight concession 74,377,782

Source: Report on fly-ash utilization by cement industry (Nanduri, 2008)

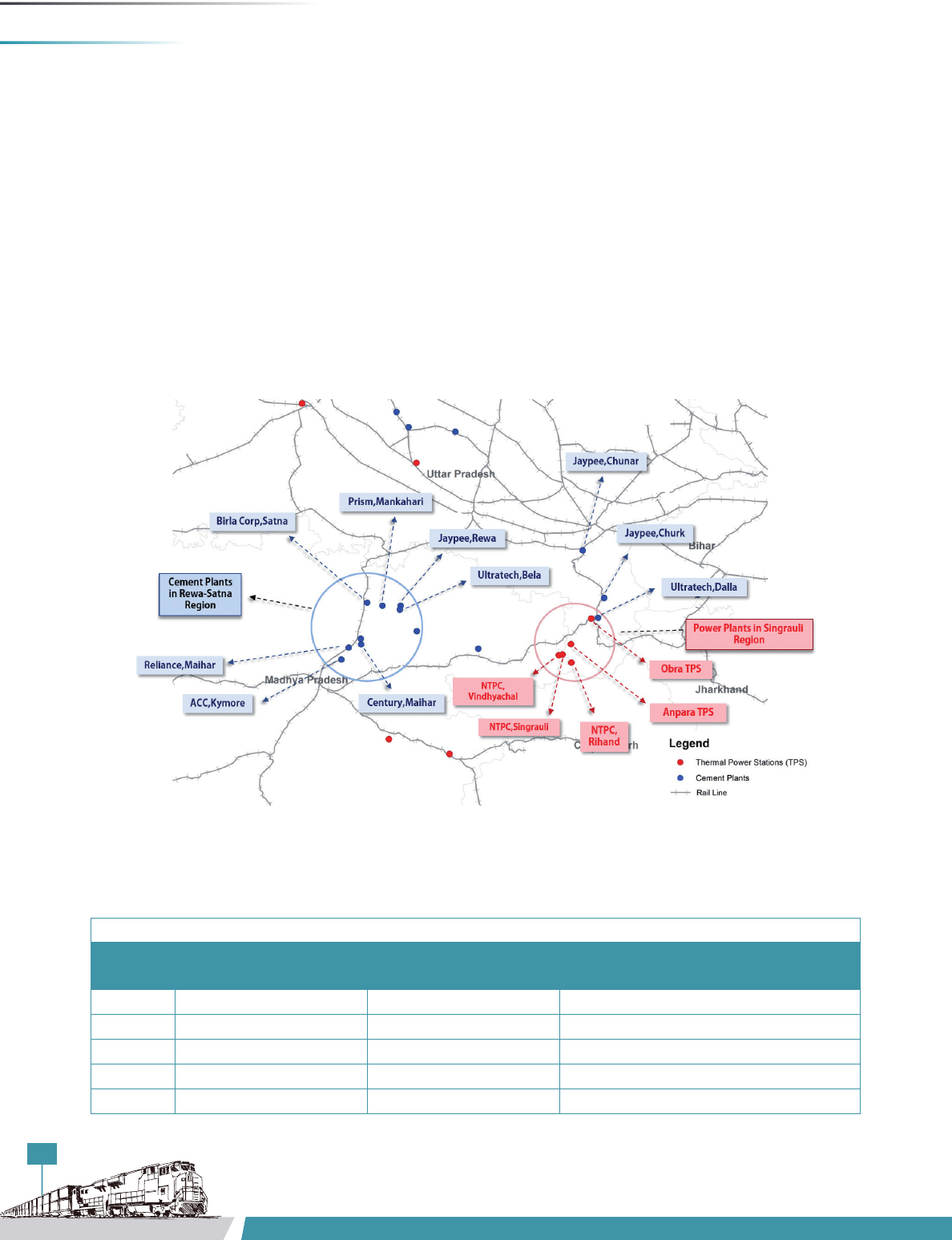

Case Study II

Singrauli Region

Geographically spread across the Singrauli district

of Madhya Pradesh and Sonebhadra district of Uttar

Pradesh, the Singrauli region is known as the power

capital of India. Several coal-based thermal power plants

are located in this region with the installed capacity of

more than 20,000 MW of power generation. Table 12

shows the details of the power plants in this region.

Table 12: TPS in Singrauli Region

S. no. Name of TPS Capacity (MW)

1 NTPC Vindhyachal 4,760

2 NTPC Singrauli 2,000

3 Hindalco Renusagar 750

4 Sasan Ultra Mega Power Project 3,960

5 Anpara 2,630

6 Hindalco Mahan 1,200

7 Essar Power 1,200

8 NTPC Rihand 3,000

9 Obra 1,194

Total 20,694

Source: Report on Fly Ash Generation, CEA (2016–17)

35

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Power plants in the Singrauli region generate around

25 to 30 million tonnes of fly ash per year. However, the

ash-utilization levels of these power plants have been

considerably low over the years. As per the CEA report

(2016–17), NTPC Vindhyachal, Obra, and Rihand had

utilizationlevelsof23.5%,27.6%,and15.5%,respectively,

whereas NTPC Singrauli and Anpara had utilization levels

of only 9.2% and 0.4%, respectively.

The location of fly-ash generation contributes

significantly to its gainful utilization. Although there

are many coal-based thermal power plants in the

Singrauli region, the remote location of these plants

from the ash-consumption belt restricts the utilization

of ash generated in the region. The nearest cities from

the Singrauli region are Rewa and Varanasi, which are

located at a distance of 225 km and 250 km, respectively.

Providing fly ash to the cement industries of the Rewa–

Satna–Katni region is a major way of ash utilization for

the power plants of the Singrauli region. The total peak

demand of fly ash from these cement plants is around

25,000 tonnes per day, whereas the Singrauli region

generatesmorethan70,000tonnesofyasheveryday

(Narayan&Mangla,2016).Therefore,alargequantityof

fly ash remains unutilized and is being disposed of in ash

dykes.

Fly ash is being provided to the cement industries of the

Rewa–Satna–Katni region through closed bulkers and

trucks. Although power plants and cement plants have

the facility of pneumatic loading and unloading through

road bulkers and trucks (see Figures 24 and 25), some

modifications are required in order to develop loading

and unloading facilities for the rail mode.

As far as specialized wagons are concerned, trials of

modified BTAP wagons for transporting fly ash are

going on. Once approved, it will help in transporting fly

ash by rail in an environmentally safe manner. Railway

freight charges are less than 50% of the cost of fly-ash

transportationbyroad(Narayan&Mangla,2016).Hence,

fly-ash transportation by rail will not only encourage the

cement plants of Rewa–Satna–Katni to take more fly ash

from TPS, but will also encourage the bulk movement of

fly ash to distant consumers in an economic manner.

Estimation of Costs and Benefits of Fly-Ash

Transportation

The transportation cost of any commodity plays a

significant role in the marketability of the product. The

transportation cost usually varies according to the type

of mode used and distance travelled. At present, freight

charges for transporting fly ash through bulkers and

trucks range between Rs 800 per tonne and Rs 1,200 per

tonne, (Narayan & Mangla, 2016), which is signicantly

Figure 24: Pneumatic unloading facility for bulker trucks at Prism

Cement, Satna

Source: Fly Ash Utilization 2018 – Conference

8

Figure 25: Mechanized fly-ash unloading by truck tippler at Prism

Cement, Satna

Source: Fly Ash Utilization 2018—Conference

9

8

See http://flyash2018.missionenergy.org/presentations/Prism%20Cement.pdf.

9

See http://flyash2018.missionenergy.org/presentations/Prism%20Cement.pdf.

36

WORKING REPORT – FLY ASH

high when compared to transportation charges through

the rail mode. Indian Railways has classified fly ash as

Class-120 material for full rake load, and as per the current

rates, railway freight charges for transporting fly ash to a

distanceof301–350km(sincemostofthecementplants

of the Rewa–Satna–Katni region are within 250–350 km

ofpowerplants)shallbeintherangeofRs393pertonne

to Rs 419 per tonne. High freight charges, which at present

are borne by users, can limit the substantial utilization of

fly ash. The analysis presented in this section is restricted

to fly-ash movement between the cement plants located

in the Rewa–Satna region and the thermal power plants

locatedintheSingrauliregion(seeFigure26).

Demand Assessment

Only cement plants with rail connectivity have been

selected to estimate the fly-ash demand since these are

the potential buyers to whom fly ash can be transported

by rail, provided they have the required infrastructure

in place for unloading the fly ash from rail. Table 13 lists

selected cement plants. The average annual capacity

utilization for previous years has been used to project

the current PPC production in these plants. It is assumed

that on an average, the quantity of fly ash required to

produce PPC is 30% of the total PPC production.

Figure 26: Map showing the location of TPS in the Singrauli region and cement plants in the Rewa–Satna region

Source: Report on Fly Ash Generation, CEA (2016–17), CMA, and TERI analysis

Table 13: Cement plants selected to estimate the annual fly-ash demand

Cement plant Location Estimated annual fly-ash demand

(in million tonnes)

1 ACC, Kymore Katni, MP 0.518

2 UltraTech, Dalla Sonebhadra, UP 0.117

3 UltraTech, Bela Rewa,MP 0.434

4 Jaypee, Chunar GU Mirzapur 0.487

5 Jaypee, Churk GU Mirzapur 0.012

37

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

Table 13: Cement plants selected to estimate the annual fly-ash demand

Cement plant Location Estimated annual fly-ash demand

(in million tonnes)

6 Jaypee, Rewa Rewa,MP 0.603

7 Reliance, Maihar Satna, MP 1.015

8 Century, Maihar Satna, MP 0.451

9 Birla Corp, Satna Satna, MP 0.416

10 Prism, Mankahari Satna, MP 1.337

Total 5.39

Source: TERI analysis

Fly-Ash Availability

As discussed earlier also, cement plants located in the

Rewa–Satna region are the major consumers of fly

ash available at power plants in the Singrauli region.

Assuming that all the fly-ash demand has to be met

through the fly ash available in the Singrauli region,

fly-ash availability has been calculated by selecting

major fly-ash-producing plants in the region. Table 14

represents the availability of fly ash in major TPS in the

Singrauli region.

Estimation of Transport Cost

Transportation costs for moving fly ash from the Singrauli

region to cement plants in the Rewa–Satna region by

both rail and road modes have been estimated. The

cost for road transport has been estimated based on

literature review as well as through primary survey with

trucking companies operating in the region. Similarly,

the rail transport cost has been taken from the Freight

OperationsInformationSystem(FOIS).TheFOISprovides

per tonne line-haul costs based on different distance

slabs. In addition to this cost, Railways also charge a

development fee of 5% and busy-season surcharge of

15% on the base fare.

At present, rail transport is not being used because of

the lack of appropriate wagons and loading/unloading

infrastructure. The loading infrastructure available

at these power plants is suitable for loading fly ash

into trucks but not into trains. The cost of loading and

unloading has not been considered separately for cost

estimations, as fly ash is loaded directly into bulker

trucks from silos and unloaded in a similar manner at

cement plants. The estimated costs for both road and rail

have been shown in Table 15 and Table 16, respectively.

Based on the tariff rates discussed earlier, estimated

annual transport cost incurred on account of rail-based

movement of fly ash has been arrived at in Table 16.

Table 14: Fly-ash availability in major TPS in the Singrauli region

S. no. Name of TPS Capacity (MW) Fly-ash

generation

(million tonnes)

Fly-ash

utilization

(million tonnes)

Total unutilized

fly ash (million

tonnes)

1 NTPC

Vindhyachal

4,760 7.63 1.79 5.84

2 NTPC Singrauli 2,000 3.67 0.33 3.34

3 Anpara 2,630 7.17 0.03 7.14

4 NTPC Rihand 3,000 4.85 0.75 4.1

5 Obra 1,194 1.38 0.38 1

Total 24.7 3.28 21.42

Source: Report on Fly Ash Generation, CEA (2016–17)

38

WORKING REPORT – FLY ASH

Table 15: Annual estimated costs for transporting fly ash from the Singrauli region to cement plants by road

S. no. Cement plant Location Distance by

road (km)

Estimated

annual fly-ash

demand

(in million

tonnes)

Estimated

annual

transport cost

by road

(Rs million)

1 ACC, Kymore Katni, MP 324 0.52 517.70

2 UltraTech, Dalla Sonebhadra, UP 109 0.12 46.92

3 UltraTech, Bela Rewa, MP 216 0.43 434.20

4 Jaypee, Chunar

GU*

Mirzapur, UP 186 0.49 487.20

5 Jaypee, Churk

GU*

Mirzapur, UP 123 0.01 4.68

6 Jaypee, Rewa Rewa, MP 213 0.60 603.20

7 Reliance, Maihar Satna, MP 285 1.02 1,015.00

8 Century, Maihar Satna, MP 285 0.45 451.25

9 Birla Corp, Satna Satna, MP 260 0.42 416.00

10 Prism, Mankahari Satna, MP 255 1.34 1,336.50

Total 5.39 5,312.65

*Grinding unit

Source: TERI analysis

Table 16: Annual estimated costs for transporting fly ash from the Singrauli region to cement plants by rail

S. no. Cement plant Location Distance by rail

(km)

Estimated

annual fly-ash

demand (in

million tonnes)

Estimated

annual

transport cost

by rail (Rs

million)

1 ACC, Kymore Katni, MP 308 0.52 244.02

2 UltraTech, Dalla Sonebhadra, UP 75 0.12 23.96

3 UltraTech, Bela Rewa, MP 480 0.43 302.88

4 Jaypee, Chunar

GU*

Mirzapur, UP 175 0.49 135.99

5 Jaypee, Churk

GU*

Mirzapur, UP 91 0.01 2.39

6 Jaypee, Rewa Rewa, MP 480 0.60 420.77

7 Reliance, Maihar Satna, MP 313 1.02 478.43

8 Century, Maihar Satna, MP 330 0.45 227.05

9 Birla Corp, Satna Satna, MP 415 0.42 249.60

10 Prism, Mankahari Satna, MP 437 1.34 845.20

Total 5.39 2,930.29

*Grinding unit

Source: TERI analysis

39

INCREASING RAIL SHARE IN FREIGHT TRANSPORT IN INDIA

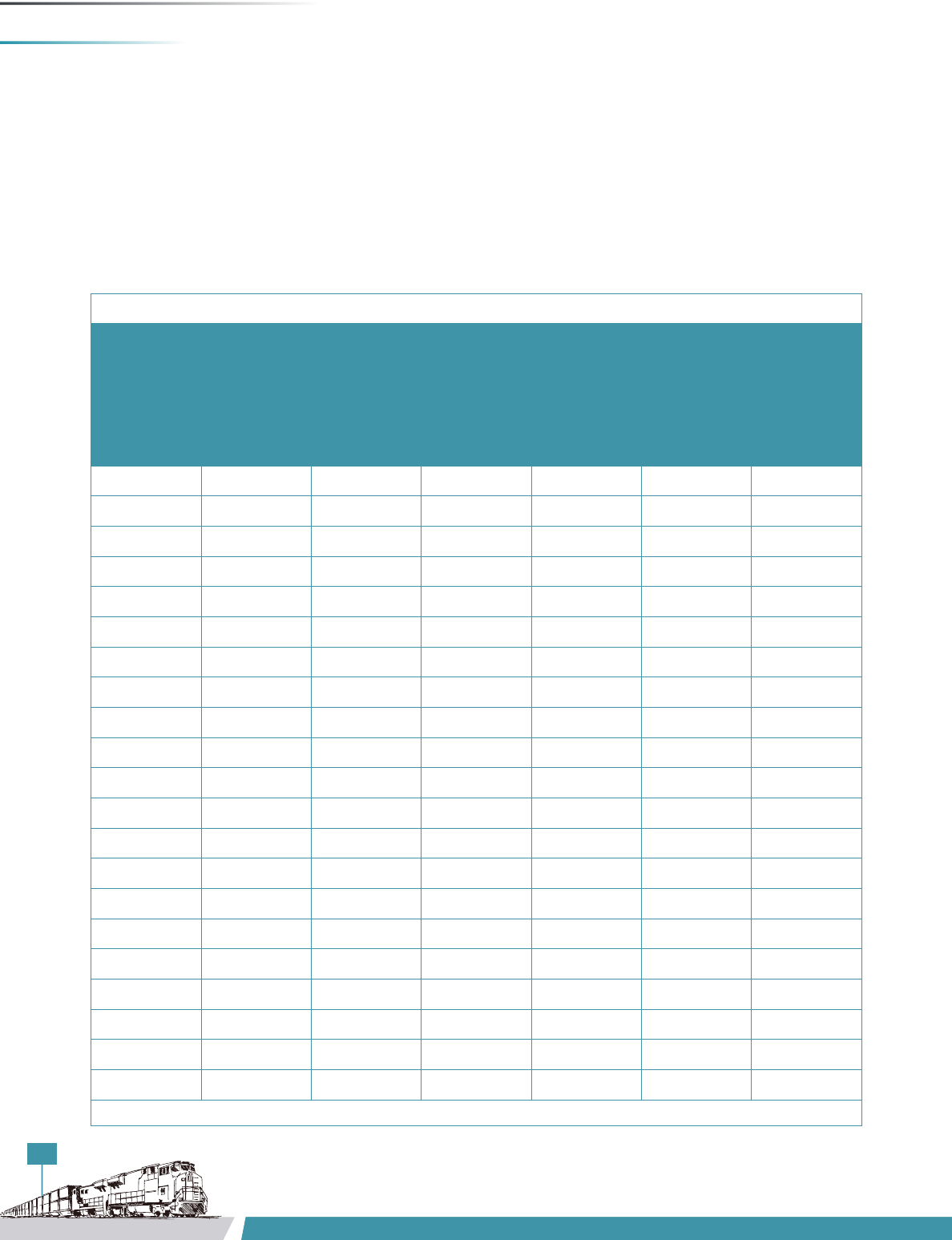

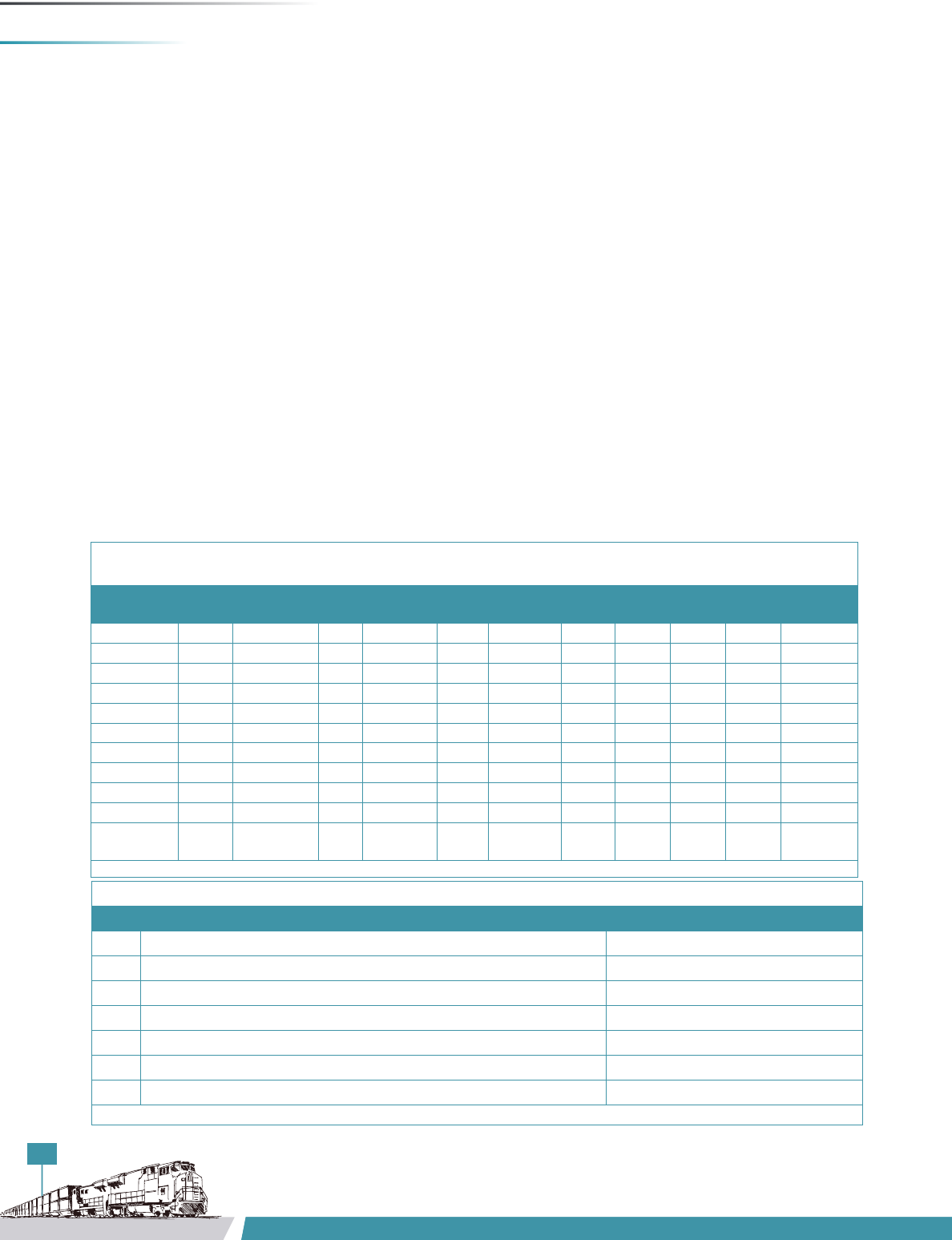

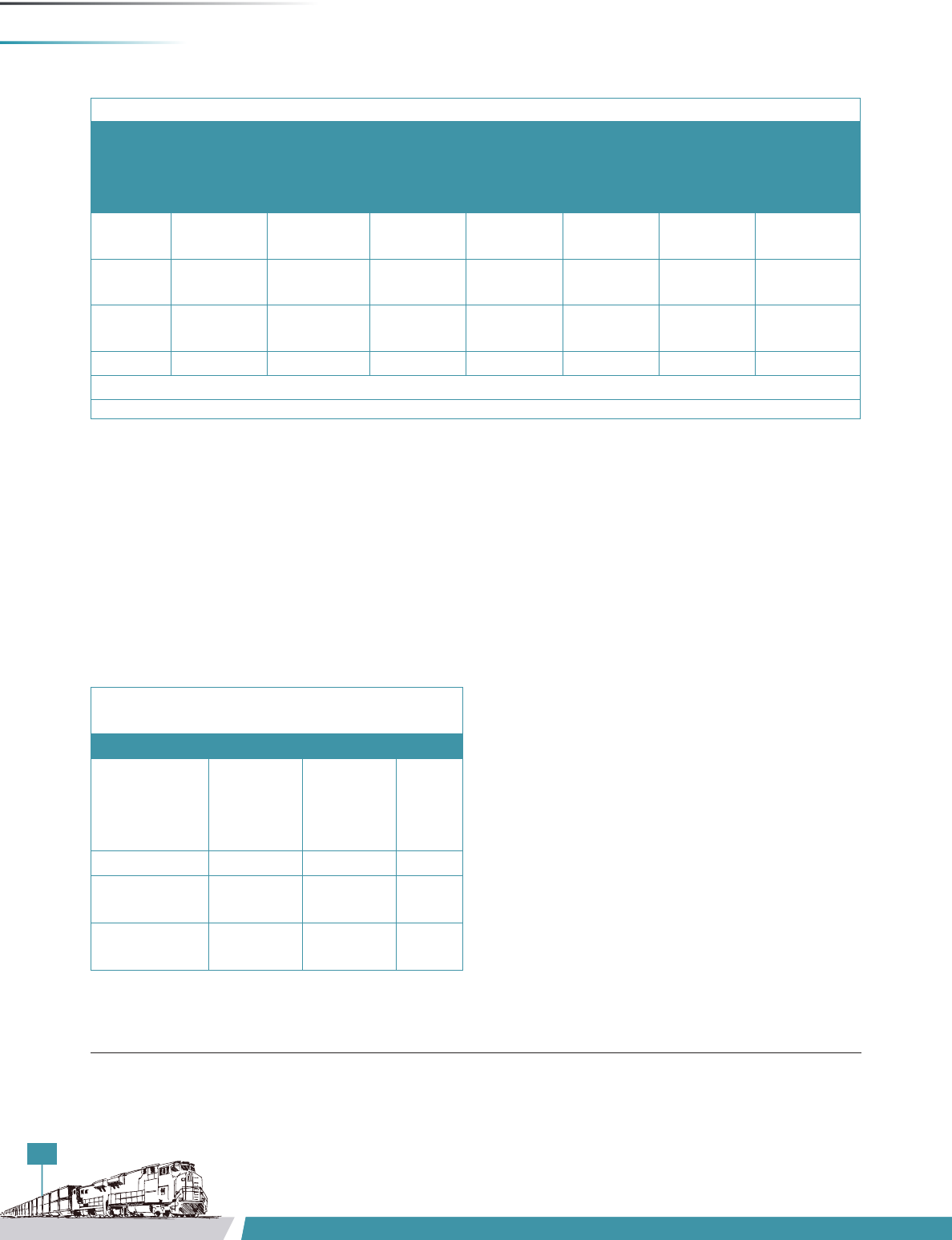

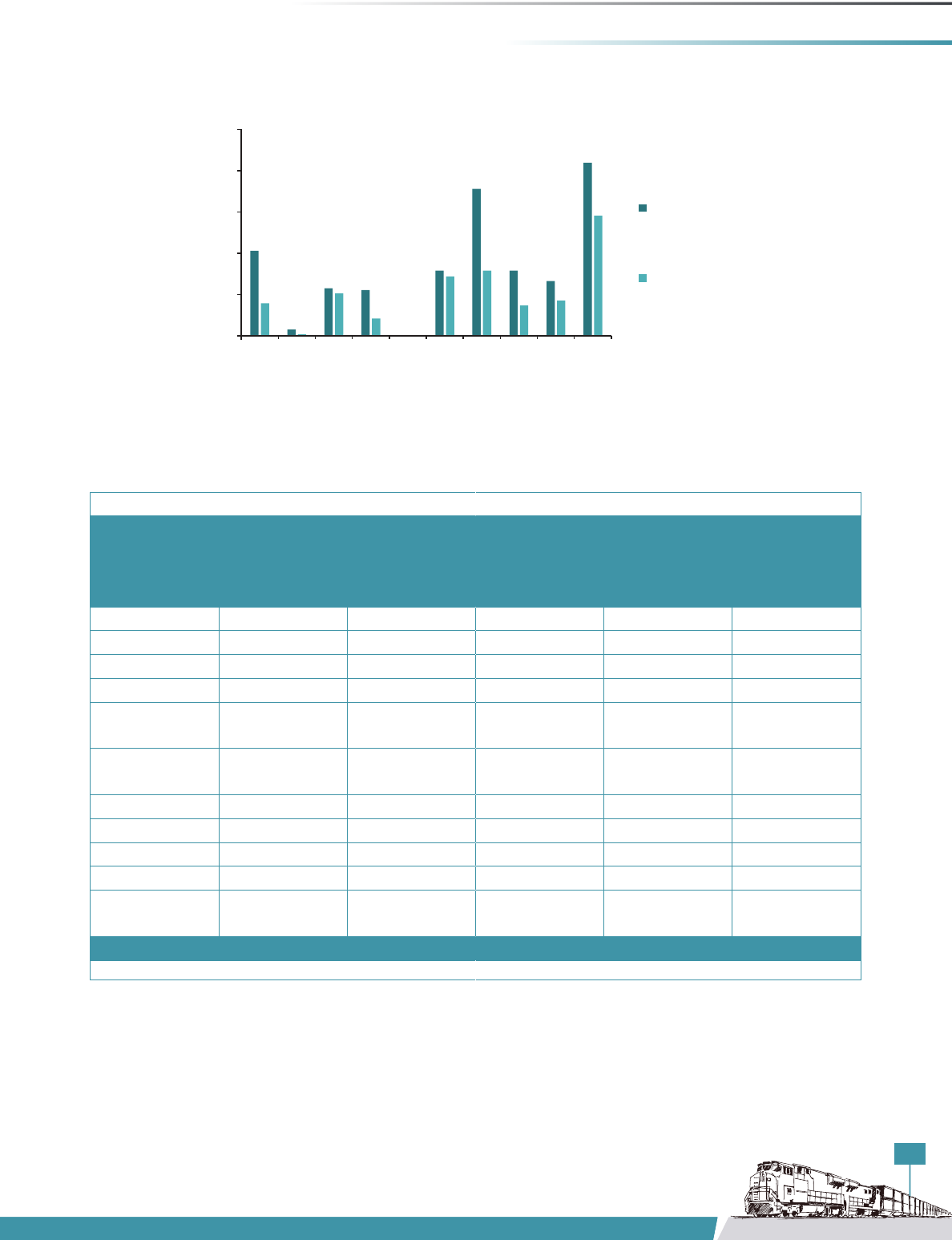

Figure 27: Annual Rail and Road Cost Comparisons for Cement Plants

Source: TERI Analysis

244.02

23.96

302.88

135.99

2.39

420.77

478.43

227.05

249.60

845.20

517.70

46.92

434.20

487.20

4.68

603.20

1015.00

451.25

416.00

1336.50

0 200 400 600 800 1000 1200 1400 1600

ACC - Kymore

UltraTech - Dalla

UltraTech - Bela

Jaypee, Chunar GU

Jaypee, Churk GU

Jaypee, Rewa

Reliance - Maihar

Century - Maihar

Birla Corp - Satna

Prism - Mankahari

Annual Road and Rail Cost Comparison for Cement Plants

(in Million INR)

Annual Esmated Cost by Road (in million INR) Annual Esmated Cost by Rail (in Million INR)

Comparison of Transport Cost and Estimated Savings

The analysis presented in this section tries to estimate

the cost savings cement companies will make if

suitable infrastructure for loading and unloading of fly

ash for railway rakes is available at supplier and user

ends respectively. Considering the availability of such

infrastructure, the relative costs for transporting fly ash

by both rail and road modes have been estimated and

compared(seeFigure27).

ItisevidentfromFigure27thatroadfreightchargesare

much higher than the rail freight cost for moving fly ash

betweentheSingrauliandRewa–Satnaregions.Table17

shows the estimation of savings for cement companies,

if the mode of transport is shifted to rail.

Table 17: Comparison of road and rail costs as well as respective savings

S. no. Cement

plant

Location Distance by

road (km)

Distance by

rail (km)

Annual cost

by road (Rs

million)

Annual

estimated

rail cost (Rs

million)

Cost savings

if shifted

to rail (Rs

million)

1 ACC, Kymore Katni, MP 324 308 517.70 244.02 273.68

2 UltraTech,

Dalla

Sonebhadra,

UP

109 75 46.92 23.96 22.96

3 UltraTech,

Bela

Rewa, MP 216 480 434.20 302.88 131.32

4 Jaypee,

Chunar GU*

Mirzapur 186 175 487.20 135.99 351.21

5 Jaypee,

Churk GU*

Mirzapur 123 91 4.68 2.39 2.29

6 Jaypee,

Rewa

Rewa, MP 213 480 603.20 420.77 182.43

7 Reliance,

Maihar

Satna, MP 285 313 1,015.00 478.43 536.57

40

WORKING REPORT – FLY ASH

Table 17: Comparison of road and rail costs as well as respective savings

S. no. Cement

plant

Location Distance by

road (km)

Distance by

rail (km)

Annual cost

by road (Rs

million)

Annual

estimated

rail cost (Rs

million)

Cost savings

if shifted

to rail (Rs

million)

8 Century,

Maihar

Satna, MP 285 330 451.25 227.05 224.20

9 Birla Corp,

Satna

Satna, MP 260 415 416.00 249.60 166.40

10 Prism,

Mankahari

Satna, MP 255 437 1,336.50 845.20 491.30

Total 5,312.65 2,930.29 2,382.36

*Grinding unit

Source: TERI analysis

Estimation of Transport Emissions

For the same estimated distances between the two

regions, CO

2

emissions from both the modes have been

estimated. Table 18 shows assumptions made regarding

the same.

Based on the aforementioned assumptions, CO

2

emissions caused by transporting fly ash from the

Singrauli region to each of the selected cement plants

have been calculated for both rail and road. Figure 28

shows that fly-ash transportation by road causes a much

higher amount of CO

2

emissions when compared to rail

transport for the same distance.

Savings in CO

2